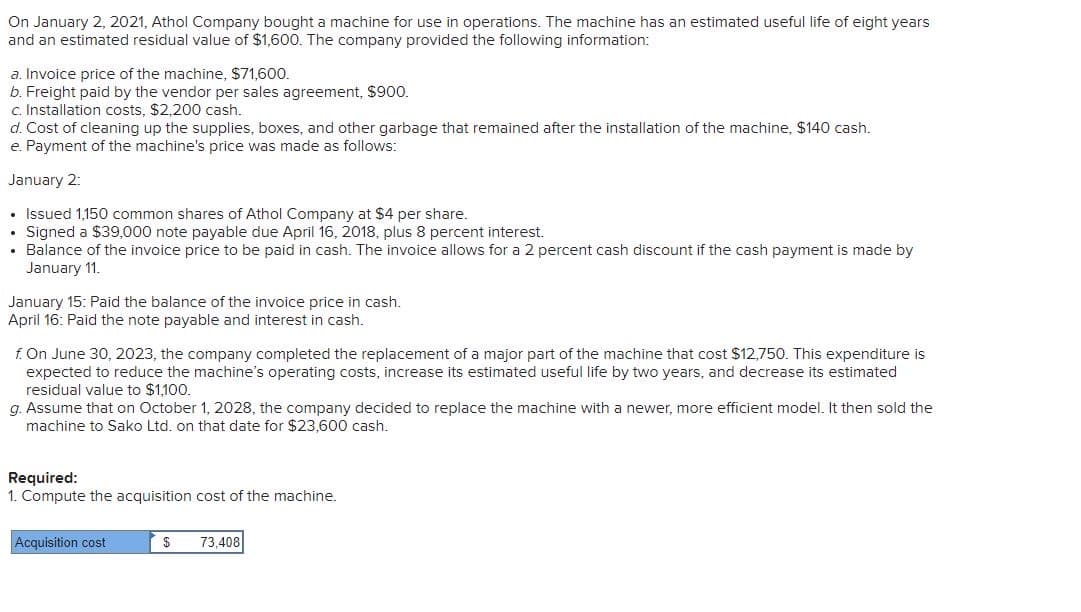

On January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years and an estimated residual value of $1,600. The company provided the following information: a. Invoice price of the machine, $71,600. b. Freight paid by the vendor per sales agreement, $900. c. Installation costs, $2,200 cash. d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $140 cash. e. Payment of the machine's price was made as follows: January 2: • Issued 1,150 common shares of Athol Company at $4 per share. • Signed a $39,000 note payable due April 16, 2018, plus 8 percent interest. • Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by January 11. January 15: Paid the balance of the invoice price in cash. April 16: Paid the note payable and interest in cash. f. On June 30, 2023, the company completed the replacement of a major part of the machine that cost $12,750. This expenditure is expected to reduce the machine's operating costs, increase its estimated useful life by two years, and decrease its estimated residual value to $1,100. g. Assume that on October 1, 2028, the company decided to replace the machine with a newer, more efficient model. It then sold the machine to Sako Ltd. on that date for $23,600 cash. Required: 1. Compute the acquisition cost of the machine. Acquisition cost $ 73,408

On January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years and an estimated residual value of $1,600. The company provided the following information: a. Invoice price of the machine, $71,600. b. Freight paid by the vendor per sales agreement, $900. c. Installation costs, $2,200 cash. d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $140 cash. e. Payment of the machine's price was made as follows: January 2: • Issued 1,150 common shares of Athol Company at $4 per share. • Signed a $39,000 note payable due April 16, 2018, plus 8 percent interest. • Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by January 11. January 15: Paid the balance of the invoice price in cash. April 16: Paid the note payable and interest in cash. f. On June 30, 2023, the company completed the replacement of a major part of the machine that cost $12,750. This expenditure is expected to reduce the machine's operating costs, increase its estimated useful life by two years, and decrease its estimated residual value to $1,100. g. Assume that on October 1, 2028, the company decided to replace the machine with a newer, more efficient model. It then sold the machine to Sako Ltd. on that date for $23,600 cash. Required: 1. Compute the acquisition cost of the machine. Acquisition cost $ 73,408

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Question

Transcribed Image Text:On January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years

and an estimated residual value of $1,600. The company provided the following information:

a. Invoice price of the machine, $71,600.

b. Freight paid by the vendor per sales agreement, $900.

c. Installation costs, $2,200 cash.

d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $140 cash.

e. Payment of the machine's price was made as follows:

January 2:

• Issued 1,150 common shares of Athol Company at $4 per share.

• Signed a $39,000 note payable due April 16, 2018, plus 8 percent interest.

• Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by

January 11.

January 15: Paid the balance of the invoice price in cash.

April 16: Paid the note payable and interest in cash.

f. On June 30, 2023, the company completed the replacement of a major part of the machine that cost $12,750. This expenditure is

expected to reduce the machine's operating costs, increase its estimated useful life by two years, and decrease its estimated

residual value to $1,100.

g. Assume that on October 1, 2028, the company decided to replace the machine with a newer, more efficient model. It then sold the

machine to Sako Ltd. on that date for $23,600 cash.

Required:

1. Compute the acquisition cost of the machine.

Acquisition cost

$ 73,408

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning