On July 1, 2013, Tremen Corporation acquired 40% of the shares of Delany Company. Tremen paid $3,000,000 for the investment, and that amount is exactly equal to 40% of the fair value of identifiable net assets on Delany's balance sheet. Delany recognized net income of $1,000,000 for 2013, and paid $150,000 quarterly dividends to its shareholders. After all closing entries are made, Tremen's "Investment in Delany Company" account would have a balance of: A. $3,200,000. B. $3,160,000. C. $3,000,000.| D. $3,080,000.

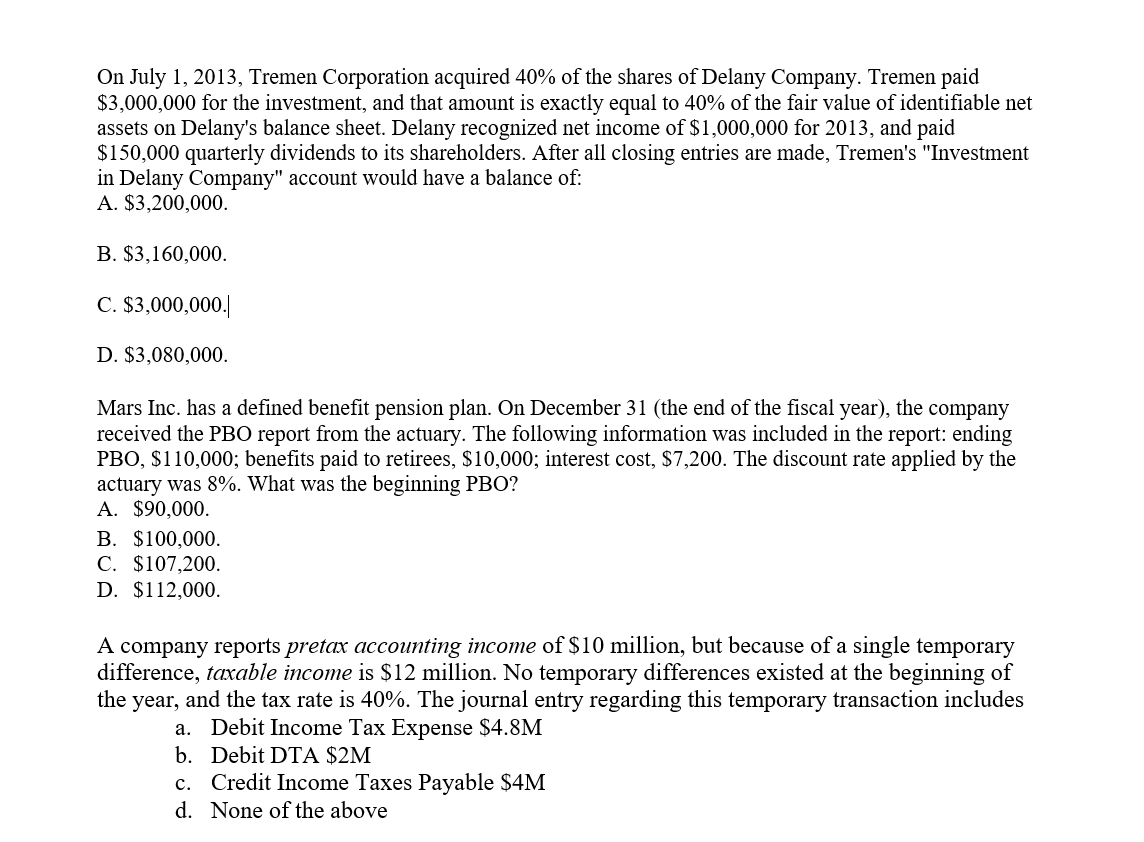

On July 1, 2013, Tremen Corporation acquired 40% of the shares of Delany Company. Tremen paid $3,000,000 for the investment, and that amount is exactly equal to 40% of the fair value of identifiable net assets on Delany's balance sheet. Delany recognized net income of $1,000,000 for 2013, and paid $150,000 quarterly dividends to its shareholders. After all closing entries are made, Tremen's "Investment in Delany Company" account would have a balance of: A. $3,200,000. B. $3,160,000. C. $3,000,000.| D. $3,080,000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On July 1, 2013, Tremen Corporation acquired 40% of the shares of Delany Company. Tremen paid

$3,000,000 for the investment, and that amount is exactly equal to 40% of the fair value of identifiable net

assets on Delany's balance sheet. Delany recognized net income of $1,000,000 for 2013, and paid

$150,000 quarterly dividends to its shareholders. After all closing entries are made, Tremen's "Investment

in Delany Company" account would have a balance of:

A. $3,200,000.

B. $3,160,000.

C. $3,000,000.|

D. $3,080,000.

Mars Inc. has a defined benefit pension plan. On December 31 (the end of the fiscal year), the company

received the PB0 report from the actuary. The following information was included in the report: ending

PBO, $110,000; benefits paid to retirees, $10,000; interest cost, $7,200. The discount rate applied by the

actuary was 8%. What was the beginning PBO?

A. $90,000.

B. $100,000.

C. $107,200.

D. $112,000.

A company reports pretax accounting income of $10 million, but because of a single temporary

difference, taxable income is $12 million. No temporary differences existed at the beginning of

the year, and the tax rate is 40%. The journal entry regarding this temporary transaction includes

a. Debit Income Tax Expense $4.8M

b. Debit DTA $2M

c. Credit Income Taxes Payable $4M

d. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning