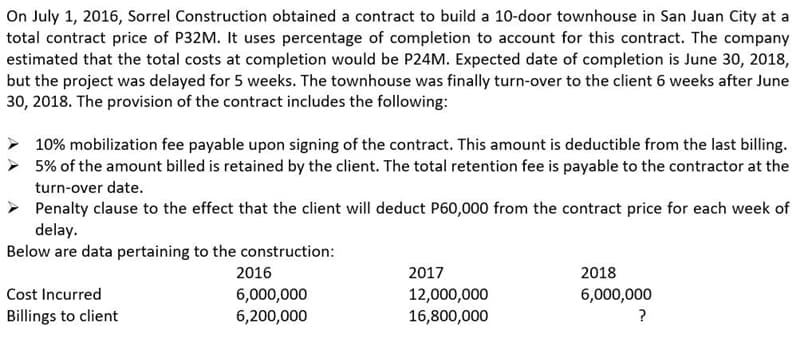

On July 1, 2016, Sorrel Construction obtained a contract to build a 10-door townhouse in San Juan City at a total contract price of P32M. It uses percentage of completion to account for this contract. The company estimated that the total costs at completion would be P24M. Expected date of completion is June 30, 2018, but the project was delayed for 5 weeks. The townhouse was finally turn-over to the client 6 weeks after June 30, 2018. The provision of the contract includes the following: > 10% mobilization fee payable upon signing of the contract. This amount is deductible from the last billing. > 5% of the amount billed is retained by the client. The total retention fee is payable to the contractor at the turn-over date. > Penalty clause to the effect that the client will deduct P60,000 from the contract price for each week of delay. Below are data pertaining to the construction: 2016 2017 2018 12,000,000 16,800,000 Cost Incurred 6,000,000 6,200,000 6,000,000 Billings to client ?

On July 1, 2016, Sorrel Construction obtained a contract to build a 10-door townhouse in San Juan City at a total contract price of P32M. It uses percentage of completion to account for this contract. The company estimated that the total costs at completion would be P24M. Expected date of completion is June 30, 2018, but the project was delayed for 5 weeks. The townhouse was finally turn-over to the client 6 weeks after June 30, 2018. The provision of the contract includes the following: > 10% mobilization fee payable upon signing of the contract. This amount is deductible from the last billing. > 5% of the amount billed is retained by the client. The total retention fee is payable to the contractor at the turn-over date. > Penalty clause to the effect that the client will deduct P60,000 from the contract price for each week of delay. Below are data pertaining to the construction: 2016 2017 2018 12,000,000 16,800,000 Cost Incurred 6,000,000 6,200,000 6,000,000 Billings to client ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 10C

Related questions

Question

100%

The amount collected from the client in 2018 amounted to:

Transcribed Image Text:On July 1, 2016, Sorrel Construction obtained a contract to build a 10-door townhouse in San Juan City at a

total contract price of P32M. It uses percentage of completion to account for this contract. The company

estimated that the total costs at completion would be P24M. Expected date of completion is June 30, 2018,

but the project was delayed for 5 weeks. The townhouse was finally turn-over to the client 6 weeks after June

30, 2018. The provision of the contract includes the following:

10% mobilization fee payable upon signing of the contract. This amount is deductible from the last billing.

5% of the amount billed is retained by the client. The total retention fee is payable to the contractor at the

turn-over date.

Penalty clause to the effect that the client will deduct P60,000 from the contract price for each week of

delay.

Below are data pertaining to the construction:

2016

2017

2018

6,000,000

6,200,000

Cost Incurred

6,000,000

12,000,000

16,800,000

Billings to client

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT