On July 1, 2017, Sandhill Company received $1,012,000 cash as compensation for the forced sale (condemnation) of the company’s land and building. The state planned to use the property to build a new on-ramp for a nearby highway. The land and building cost $460,000 and $782,000, respectively, when they were acquired. At July 1, 2017, the accumulated depreciation relating to the building amounted to $345,000. On December 1, 2017, Sandhill purchased a piece of replacement property for cash. The new land cost $331,200, and the new building cost $984,400. Prepare the journal entries to record the transactions on July 1 and December 1, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

On July 1, 2017, Sandhill Company received $1,012,000 cash as compensation for the forced sale (condemnation) of the company’s land and building. The state planned to use the property to build a new on-ramp for a nearby highway. The land and building cost $460,000 and $782,000, respectively, when they were acquired. At July 1, 2017, the

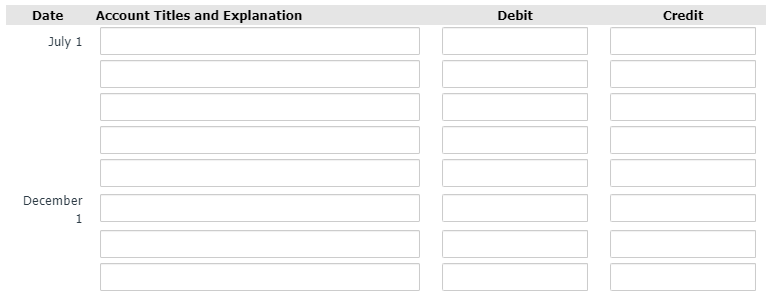

Prepare the journal entries to record the transactions on July 1 and December 1, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images