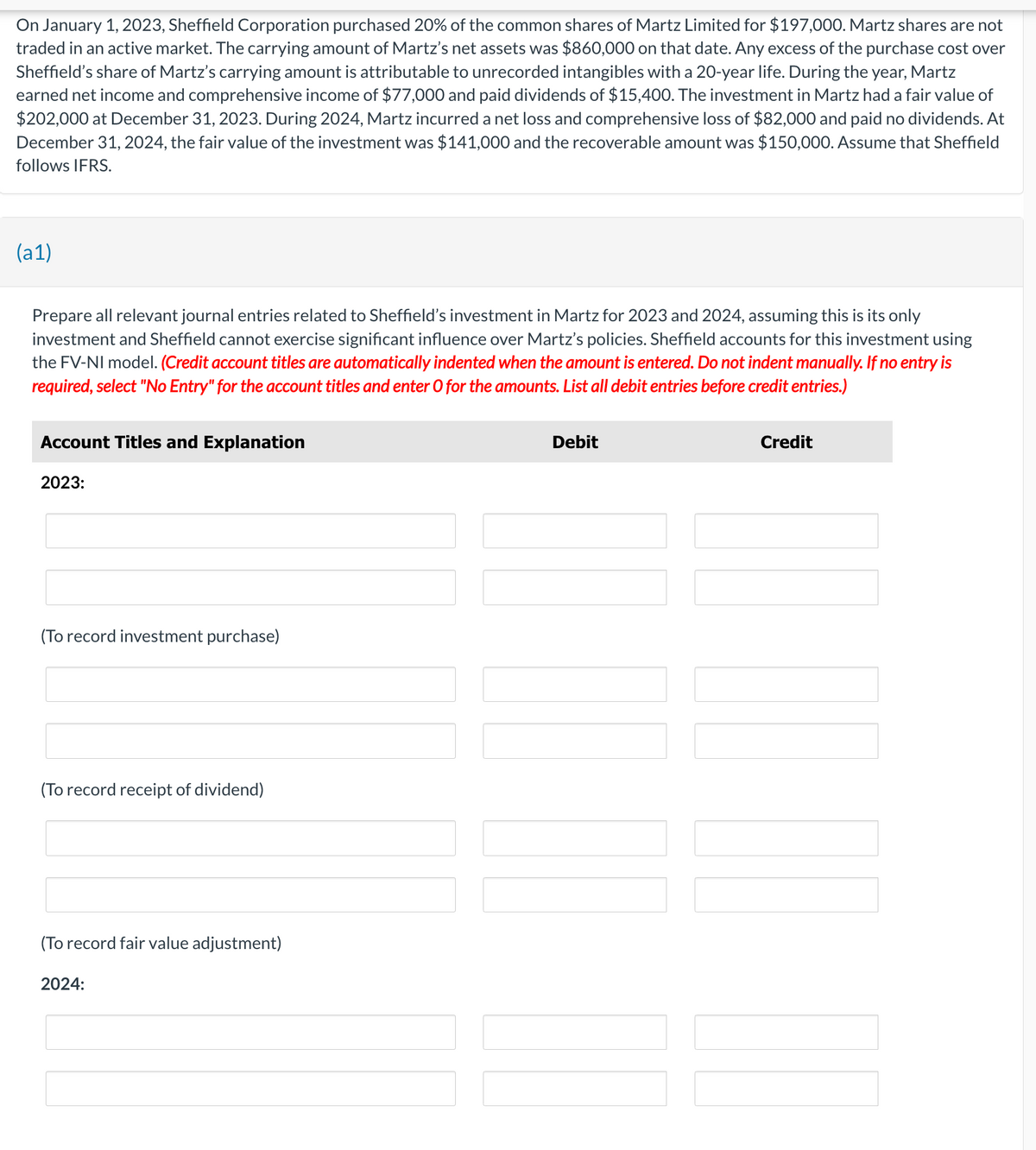

On January 1, 2023, Sheffield Corporation purchased 20% of the common shares of Martz Limited for $197,000. Martz shares are not traded in an active market. The carrying amount of Martz's net assets was $860,000 on that date. Any excess of the purchase cost over Sheffield's share of Martz's carrying amount is attributable to unrecorded intangibles with a 20-year life. During the year, Martz earned net income and comprehensive income of $77,000 and paid dividends of $15,400. The investment in Martz had a fair value of $202,000 at December 31, 2023. During 2024, Martz incurred a net loss and comprehensive loss of $82,000 and paid no dividends. At December 31, 2024, the fair value of the investment was $141,000 and the recoverable amount was $150,000. Assume that Sheffield follows IFRS. (a1)

choose from the following accounts:

Accumulated Other Comprehensive Income

Allowance for Investment Impairment

Bond Investment at Amortized Cost

Cash

Commission Expense

Dividends Receivable

Dividend Revenue

FV-NI Investments

FV-OC|Investments

Gain on Disposal of Investments - FV-NI

Gain on Disposal of Investments - FV-OCI

Gain on Sale of Investments

GST Receivable

Interest Expense

Interest Income

Interest Payable

Interest Receivable

Investment in Associate

Investment Income or Loss

Loss on Discontinued Operations

Loss on Disposal of Investments FV-NI

Loss on Disposal of Investments FV-OCI

Loss on Impairment

Loss on Sale of Investments

No Entry

Note Investment at Amortized Cost

Other Investments

Recovery of Loss from Impairment

Unrealized Gain or Loss

Unrealized Gain or Loss - OCI

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images