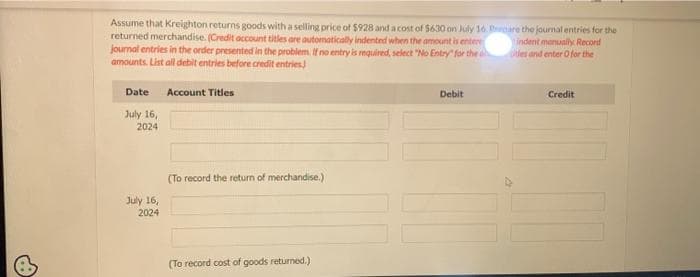

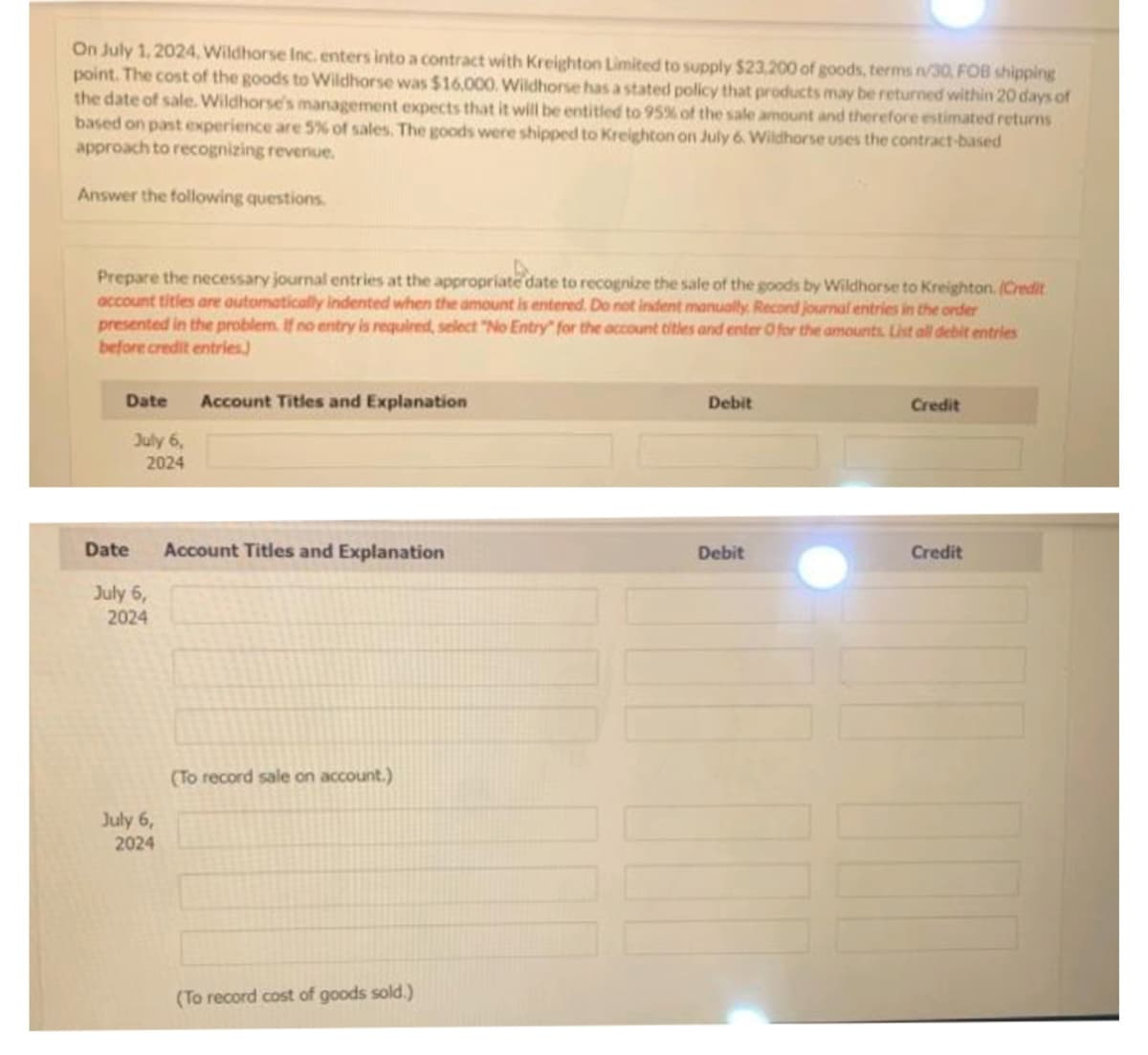

On July 1, 2024, Wildhorse Inc. enters into a contract with Kreighton Limited to supply $23,200 of goods, terms n/30, FOB shipping point. The cost of the goods to Wildhorse was $16,000. Wildhorse has a stated policy that products may be returned within 20 days of the date of sale. Wildhorse's management expects that it will be entitled to 95% of the sale amount and therefore estimated returns based on past experience are 5% of sales. The goods were shipped to Kreighton on July 6. Wildhorse uses the contract-based approach to recognizing revenue. Answer the following questions. Prepare the necessary journal entries at the appropriate date to recognize the sale of the goods by Wildhorse to Kreighton. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry for the account titles and enter O for the amounts List all debit entries before credit entries) Account Titles and Explanation Date Date July 6, 2024 July 6, 2024 July 6, 2024 Account Titles and Explanation (To record sale on account.) (To record cost of goods sold.) Debit Debit Credit Credit

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps