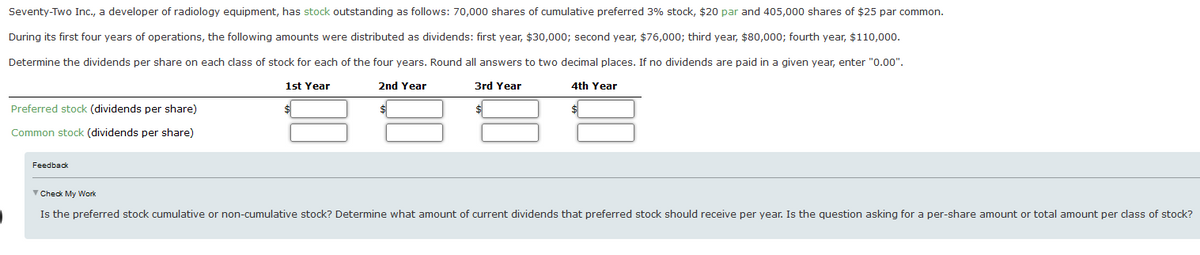

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 70,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $30,000; second year, $76,000; third year, $80,000; fourth year, $110,000. Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividends per share) Common stock (dividends per share)

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 70,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $30,000; second year, $76,000; third year, $80,000; fourth year, $110,000. Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividends per share) Common stock (dividends per share)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 3SEA

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 70,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common.

During its first four years of operations, the following amounts were distributed as dividends: first year, $30,000; second year, $76,000; third year, $80,000; fourth year, $110,000.

Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00".

1st Year

2nd Year

3rd Year

4th Year

Preferred stock (dividends per share)

Common stock (dividends per share)

Feedback

✓ Check My Work

Is the preferred stock cumulative or non-cumulative stock? Determine what amount of current dividends that preferred stock should receive per year. Is the question asking for a per-share amount or total amount per class of stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning