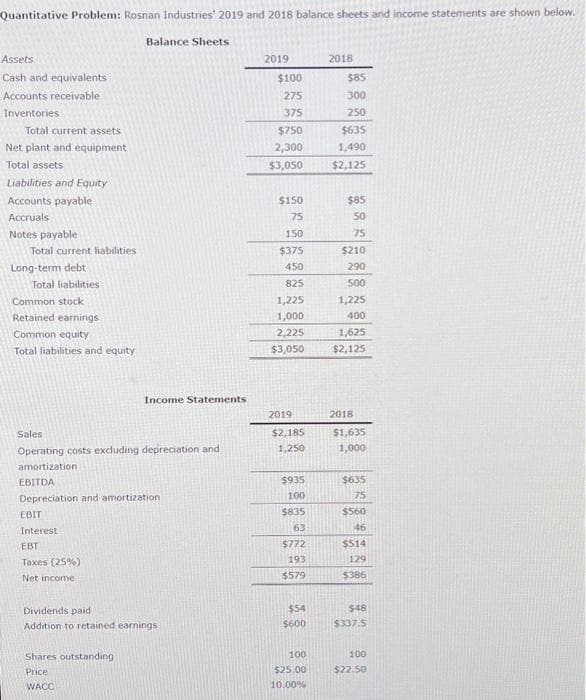

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Common equity Total liabilities and equity EBIT Interest EBT Taxes (25%) Net income Balance Sheets Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization Income Statements Shares outstanding Price WACC) Dividends paid Addition to retained earnings 2019 $100 275 375 $750 2,300 $3,050 $150 75 150 $375 450 825 1,225 1,000 2,225 $3,050 2019 $2,185 1,250 $935 100 $835 63 $772 193 $579 $54 $600 100 $25.00 10.00% 2018 $85 300 250 $635 1,490 $2,125 $85 50 75 $210 290 500 1,225 400 1,625 $2,125 2018 $1,635 1,000 $635 75 $560 46 $514 129 $386 $48 $337.5 100 $22.50

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Common equity Total liabilities and equity EBIT Interest EBT Taxes (25%) Net income Balance Sheets Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization Income Statements Shares outstanding Price WACC) Dividends paid Addition to retained earnings 2019 $100 275 375 $750 2,300 $3,050 $150 75 150 $375 450 825 1,225 1,000 2,225 $3,050 2019 $2,185 1,250 $935 100 $835 63 $772 193 $579 $54 $600 100 $25.00 10.00% 2018 $85 300 250 $635 1,490 $2,125 $85 50 75 $210 290 500 1,225 400 1,625 $2,125 2018 $1,635 1,000 $635 75 $560 46 $514 129 $386 $48 $337.5 100 $22.50

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14E: Interest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below.

Assets

Cash and equivalents

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

Liabilities and Equity

Accounts payable

Accruals

Notes payable

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

Common equity

Total liabilities and equity

EBIT

Interest

EBT

Taxes (25%)

Net income

Balance Sheets

Sales

Operating costs excluding depreciation and

amortization

EBITDA

Depreciation and amortization

Income Statements

Shares outstanding

Price

WACC)

Dividends paid

Addition to retained earnings

2019

$100

275

375

$750

2,300

$3,050

$150

75

150

$375

450

825

1,225

1,000

2,225

$3,050

2019

$2,185

1,250

$935

100

$835

63

$772

193

$579

$54

$600

100

$25.00

10.00%

2018

$85

300

250

$635

1,490

$2,125

$85

50

75

$210

290

500

1,225

400

1,625

$2,125

2018

$1,635

1,000

$635

75

$560

46

$514

129

$386

$48

$337:5

100

$22.50

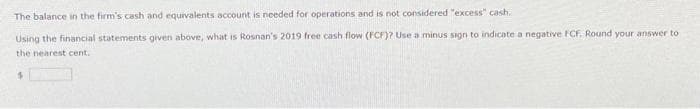

Transcribed Image Text:The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash.

Using the financial statements given above, what is Rosnan's 2019 free cash flow (FCF)? Use a minus sign to indicate a negative FCF. Round your answer to

the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning