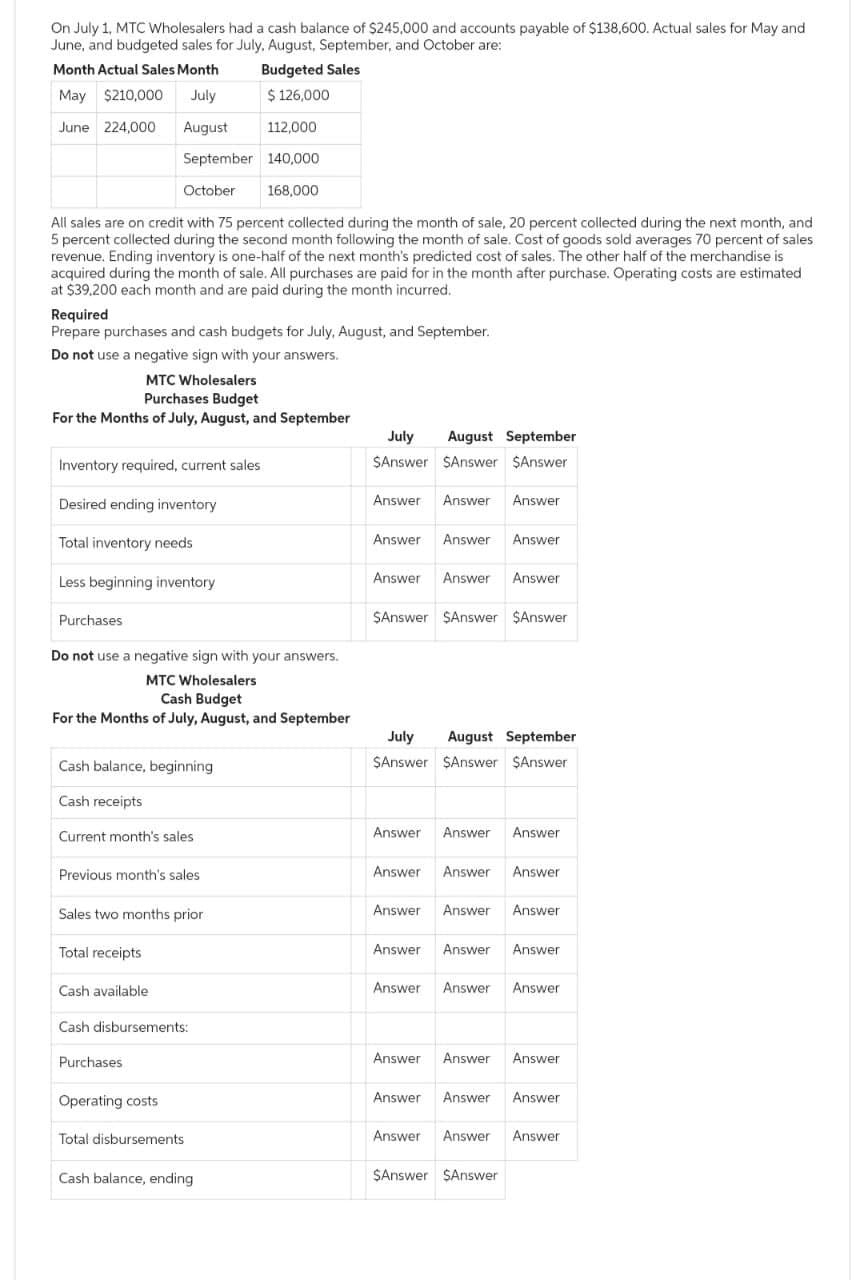

On July 1, MTC Wholesalers had a cash balance of $245,000 and accounts payable of $138,600. Actual sales for May and June, and budgeted sales for July, August, September, and October are: Month Actual Sales Month Budgeted Sales May $210,000 July $ 126,000 June 224,000 August 112,000 September 140,000 October All sales are on credit with 75 percent collected during the month of sale, 20 percent collected during the next month, and 5 percent collected during the second month following the month of sale. Cost of goods sold averages 70 percent of sales revenue. Ending inventory is one-half of the next month's predicted cost of sales. The other half of the merchandise is acquired during the month of sale. All purchases are paid for in the month after purchase. Operating costs are estimated at $39,200 each month and are paid during the month incurred. Required Prepare purchases and cash budgets for July, August, and September. Do not use a negative sign with your answers. MTC Wholesalers Purchases Budget For the Months of July, August, and September Inventory required, current sales Desired ending inventory Total inventory needs Less beginning inventory Purchases Do not use a negative sign with your answers. MTC Wholesalers Cash Budget For the Months of July, August, and September Cash balance, beginning Cash receipts Current month's sales Previous month's sales Sales two months prior Total receipts Cash available 168,000 Cash disbursements: Purchases. Operating costs Total disbursements Cash balance, ending July August September $Answer $Answer $Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer $Answer $Answer $Answer July August September $Answer $Answer $Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer $Answer $Answer Answer Answer Answer

On July 1, MTC Wholesalers had a cash balance of $245,000 and accounts payable of $138,600. Actual sales for May and June, and budgeted sales for July, August, September, and October are: Month Actual Sales Month Budgeted Sales May $210,000 July $ 126,000 June 224,000 August 112,000 September 140,000 October All sales are on credit with 75 percent collected during the month of sale, 20 percent collected during the next month, and 5 percent collected during the second month following the month of sale. Cost of goods sold averages 70 percent of sales revenue. Ending inventory is one-half of the next month's predicted cost of sales. The other half of the merchandise is acquired during the month of sale. All purchases are paid for in the month after purchase. Operating costs are estimated at $39,200 each month and are paid during the month incurred. Required Prepare purchases and cash budgets for July, August, and September. Do not use a negative sign with your answers. MTC Wholesalers Purchases Budget For the Months of July, August, and September Inventory required, current sales Desired ending inventory Total inventory needs Less beginning inventory Purchases Do not use a negative sign with your answers. MTC Wholesalers Cash Budget For the Months of July, August, and September Cash balance, beginning Cash receipts Current month's sales Previous month's sales Sales two months prior Total receipts Cash available 168,000 Cash disbursements: Purchases. Operating costs Total disbursements Cash balance, ending July August September $Answer $Answer $Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer $Answer $Answer $Answer July August September $Answer $Answer $Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer Answer $Answer $Answer Answer Answer Answer

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:On July 1, MTC Wholesalers had a cash balance of $245,000 and accounts payable of $138,600. Actual sales for May and

June, and budgeted sales for July, August, September, and October are:

Month Actual Sales Month

Budgeted Sales

May $210,000 July

$ 126,000

June 224,000

August

112,000.

September 140,000

October

All sales are on credit with 75 percent collected during the month of sale, 20 percent collected during the next month, and

5 percent collected during the second month following the month of sale. Cost of goods sold averages 70 percent of sales

revenue. Ending inventory is one-half of the next month's predicted cost of sales. The other half of the merchandise is

acquired during the month of sale. All purchases are paid for in the month after purchase. Operating costs are estimated

at $39,200 each month and are paid during the month incurred.

Required

Prepare purchases and cash budgets for July, August, and September.

Do not use a negative sign with your answers.

MTC Wholesalers

Purchases Budget

For the Months of July, August, and September

Inventory required, current sales

Desired ending inventory

Total inventory needs

Less beginning inventory

Purchases

Do not use a negative sign with your answers.

MTC Wholesalers

Cash Budget

For the Months of July, August, and September

Cash balance, beginning

Cash receipts

Current month's sales

Previous month's sales

Sales two months prior

Total receipts

Cash available

168,000

Cash disbursements:

Purchases.

Operating costs

Total disbursements

Cash balance, ending

July August September

$Answer $Answer $Answer

Answer Answer Answer

Answer Answer Answer

Answer Answer Answer

$Answer $Answer $Answer

July August September

$Answer $Answer $Answer

Answer Answer Answer

Answer Answer Answer

Answer

Answer

Answer Answer Answer

Answer

Answer Answer Answer

Answer

Answer

Answer

Answer Answer Answer

$Answer $Answer

Answer Answer Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning