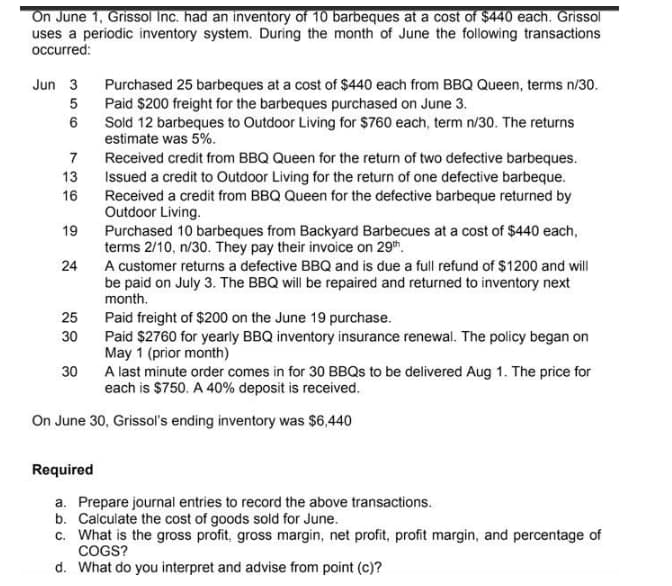

On June 1, Grissol Inc. had an inventory of 10 barbeques at a cost of $440 each. Grissol uses a periodic inventory system. During the month of June the following transactions occurred: Jun 3 Purchased 25 barbeques at a cost of $440 each from BBQ Queen, terms n/30. 5 Paid $200 freight for the barbeques purchased on June 3. 6 Sold 12 barbeques to Outdoor Living for $760 each, term n/30. The returns estimate was 5%. Received credit from BBQ Queen for the return of two defective barbeques. Issued a credit to Outdoor Living for the return of one defective barbeque. Received a credit from BBQ Queen for the defective barbeque returned by Outdoor Living. Purchased 10 barbeques from Backyard Barbecues at a cost of $440 each, 7 13 16 19

On June 1, Grissol Inc. had an inventory of 10 barbeques at a cost of $440 each. Grissol uses a periodic inventory system. During the month of June the following transactions occurred: Jun 3 Purchased 25 barbeques at a cost of $440 each from BBQ Queen, terms n/30. 5 Paid $200 freight for the barbeques purchased on June 3. 6 Sold 12 barbeques to Outdoor Living for $760 each, term n/30. The returns estimate was 5%. Received credit from BBQ Queen for the return of two defective barbeques. Issued a credit to Outdoor Living for the return of one defective barbeque. Received a credit from BBQ Queen for the defective barbeque returned by Outdoor Living. Purchased 10 barbeques from Backyard Barbecues at a cost of $440 each, 7 13 16 19

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PB: Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following...

Related questions

Question

answer quickly

Transcribed Image Text:On June 1, Grissol Inc. had an inventory of 10 barbeques at a cost of $440 each. Grissol

uses a periodic inventory system. During the month of June the following transactions

occurred:

Jun 3

Purchased 25 barbeques at a cost of $440 each from BBQ Queen, terms n/30.

5 Paid $200 freight for the barbeques purchased on June 3.

Sold 12 barbeques to Outdoor Living for $760 each, term n/30. The returns

estimate was 5%.

7

Received credit from BBQ Queen for the return of two defective barbeques.

Issued a credit to Outdoor Living for the return of one defective barbeque.

Received a credit from BBQ Queen for the defective barbeque returned by

Outdoor Living.

13

16

19

Purchased 10 barbeques from Backyard Barbecues at a cost of $440 each,

terms 2/10, n/30. They pay their invoice on 29th.

A customer returns a defective BBQ and is due a full refund of $1200 and will

be paid on July 3. The BBQ will be repaired and returned to inventory next

month.

24

25

Paid freight of $200 on the June 19 purchase.

Paid $2760 for yearly BBQ inventory insurance renewal. The policy began on

May 1 (prior month)

A last minute order comes in for 30 BBQS to be delivered Aug 1. The price for

each is $750. A 40% deposit is received.

30

30

On June 30, Grissol's ending inventory was $6,440

Required

a. Prepare journal entries to record the above transactions.

b. Calculate the cost of goods sold for June.

c. What is the gross profit, gross margin, net profit, profit margin, and percentage of

COGS?

d. What do you interpret and advise from point (c)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT