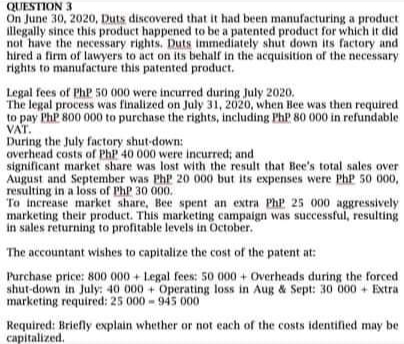

On June 30, 2020, Duts discovered that it had been manufacturing a product illegally since this product happened to be a patented product for which it did not have the necessary rights. Duts immediately shut down its factory and hired a firm of lawyers to act on its behalf in the acquisition of the necessary rights to manufacture this patented product. Legal fees of PhP 50 000 were incurred during July 2020. The legal process was finalized on July 31, 2020, when Bee was then required to pay PhP 800 000 to purchase the rights, including PhP 80 000 in refundable VAT. During the July factory shut-down: averhead costs of PhP 40 000 were incurred; and significant market share was lost with the result that Bee's total sales over August and September was PhP 20 000 but its expenses were PhP 50 000, resulting in a loss of PhP 30 000. To increase market share, Bee spent an extra PhP 25 000 aggressively marketing their product. This marketing campaign was successful, resulting in sales returning to profitable levels in October. The accountant wishes to capitalize the cost of the patent at: Purchase price: 800 000 + Legal fees: 50 000 + Overheads during the forced shut-down in July: 40 000 + Operating loss in Aug & Sept: 30 000 + Extra marketing required: 25 000-945 o00 Required: Briefly explain whether or not each of the costs identified may be capitalized.

On June 30, 2020, Duts discovered that it had been manufacturing a product illegally since this product happened to be a patented product for which it did not have the necessary rights. Duts immediately shut down its factory and hired a firm of lawyers to act on its behalf in the acquisition of the necessary rights to manufacture this patented product. Legal fees of PhP 50 000 were incurred during July 2020. The legal process was finalized on July 31, 2020, when Bee was then required to pay PhP 800 000 to purchase the rights, including PhP 80 000 in refundable VAT. During the July factory shut-down: averhead costs of PhP 40 000 were incurred; and significant market share was lost with the result that Bee's total sales over August and September was PhP 20 000 but its expenses were PhP 50 000, resulting in a loss of PhP 30 000. To increase market share, Bee spent an extra PhP 25 000 aggressively marketing their product. This marketing campaign was successful, resulting in sales returning to profitable levels in October. The accountant wishes to capitalize the cost of the patent at: Purchase price: 800 000 + Legal fees: 50 000 + Overheads during the forced shut-down in July: 40 000 + Operating loss in Aug & Sept: 30 000 + Extra marketing required: 25 000-945 o00 Required: Briefly explain whether or not each of the costs identified may be capitalized.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:QUESTION 3

On June 30, 2020, Duts discovered that it had been manufacturing a product

illegally since this product happened to be a patented product for which it did

not have the necessary rights., Duts immediately shut down its factory and

hired a firm of lawyers to act on its behalf in the acquisition of the necessary

rights to manufacture this patented product.

Legal fees of PhP 50 000 were incurred during July 2020.

The legal process was finalized on July 31, 2020, when Bee was then required

to pay PhP 800 000 to purchase the rights, including PhP 80 000 in refundable

VAT.

During the July factory shut-down:

averhead costs of PhP 40 000 were incurred; and

significant market share was lost with the result that Bee's total sales over

August and September was PhP 20 000 but its expenses were PhP 50 000,

resulting in a loss of PhP 30 000.

To increase market share, Bee spent an extra PhP 25 000 aggressively

marketing their product. This marketing campaign was successful, resulting

in sales returning to profitable levels in October.

The accountant wishes to capitalize the cost of the patent at:

Purchase price: 800 000 + Legal fees: 5o 000 + Overheads during the forced

shut-down in July: 40 000 + Operating loss in Aug & Sept: 30 000 + Extra

marketing required: 25 000-94s 000

Required: Briefly explain whether or not each of the costs identified may be

capitalized.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning