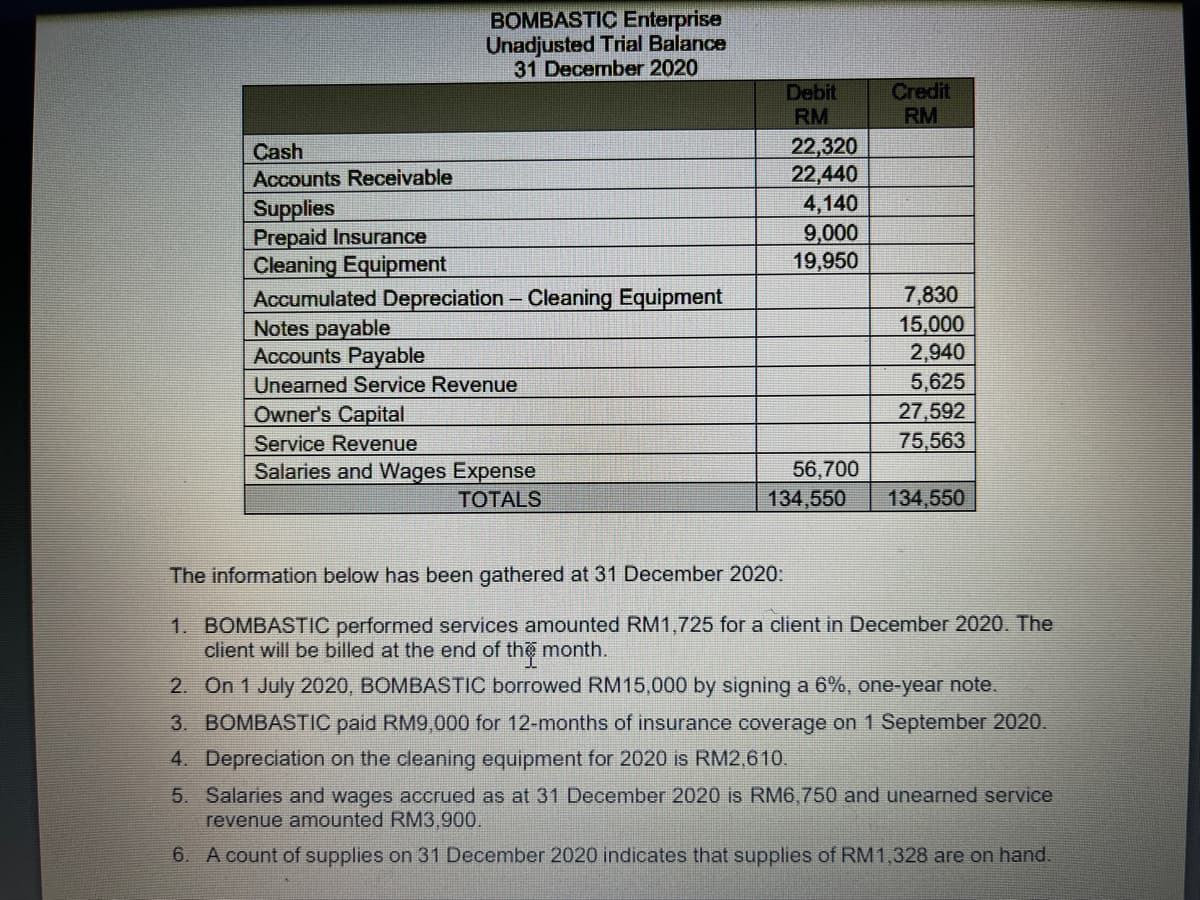

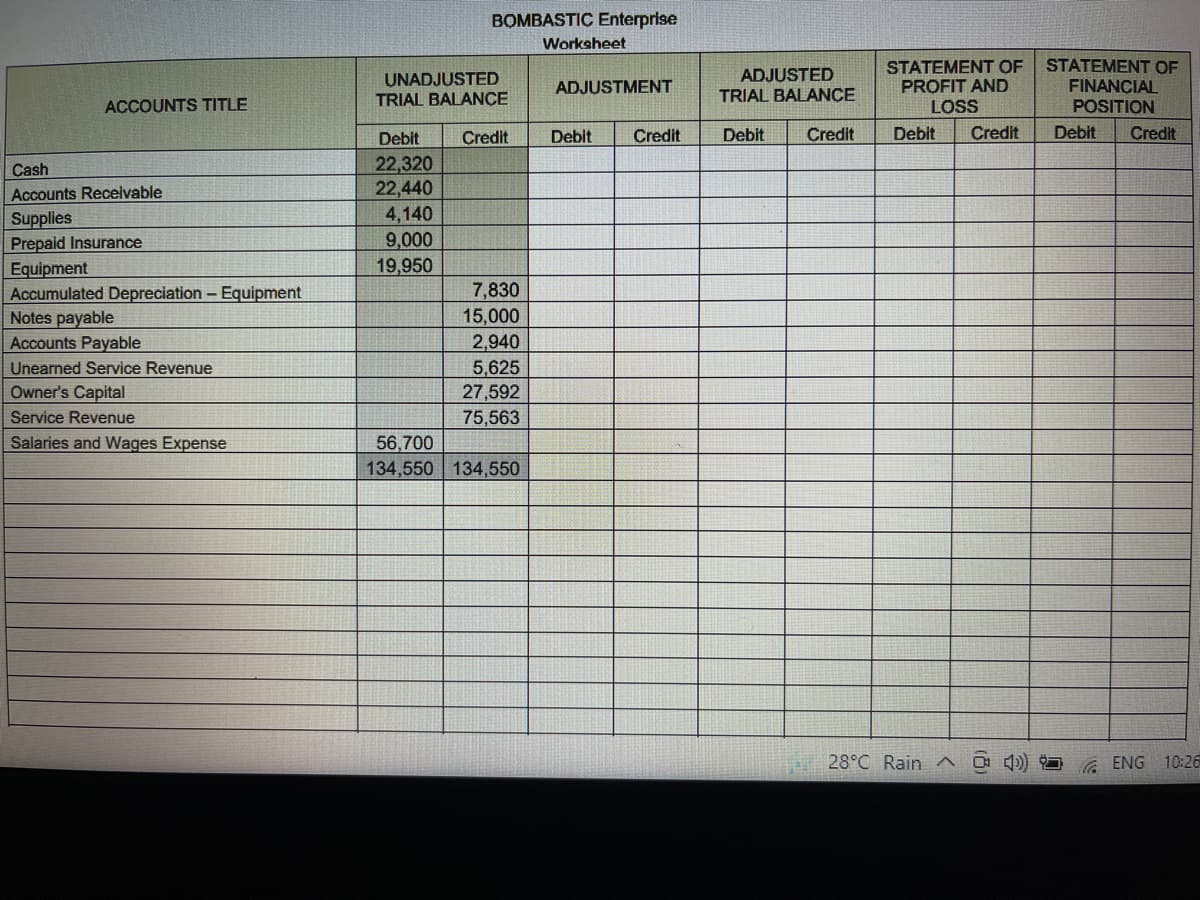

BOMBAS prise Unadjusted Trial Balance 31 December 2020 Debit RM Credit RM 22,320 22,440 Cash Accounts Receivable 4,140 Supplies Prepaid Insurance Cleaning Equipment Accumulated Depreciation – Cleaning Equipment Notes payable Accounts Payable 9,000 19,950 7,830 15,000 2,940 Unearned Service Revenue 5,625 27,592 75,563 Owner's Capital Service Revenue Salaries and Wages Expense 56,700 134,550 TOTALS 134,550 The information below has been gathered at 31 December 2020: 1. BOMBASTIC performed services amounted RM1,725 for a client in December 2020. The client will be billed at the end of the month. 2. On 1 July 2020, BOMBASTIC borrowed RM15,000 by signing a 6%, one-year note. 3. BOMBASTIC paid RM9,000 for 12-months of insurance coverage on 1 September 2020. 4. Depreciation on the cleaning equipment for 2020 is RM2,610. 5. Salaries and wages accrued as at 31 December 2020 is RM6,750 and unearned service revenue amounted RM3,900. 6. A count of supplies on 31 December 2020 indicates that supplies of RM1,328 are on hand.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 2 steps