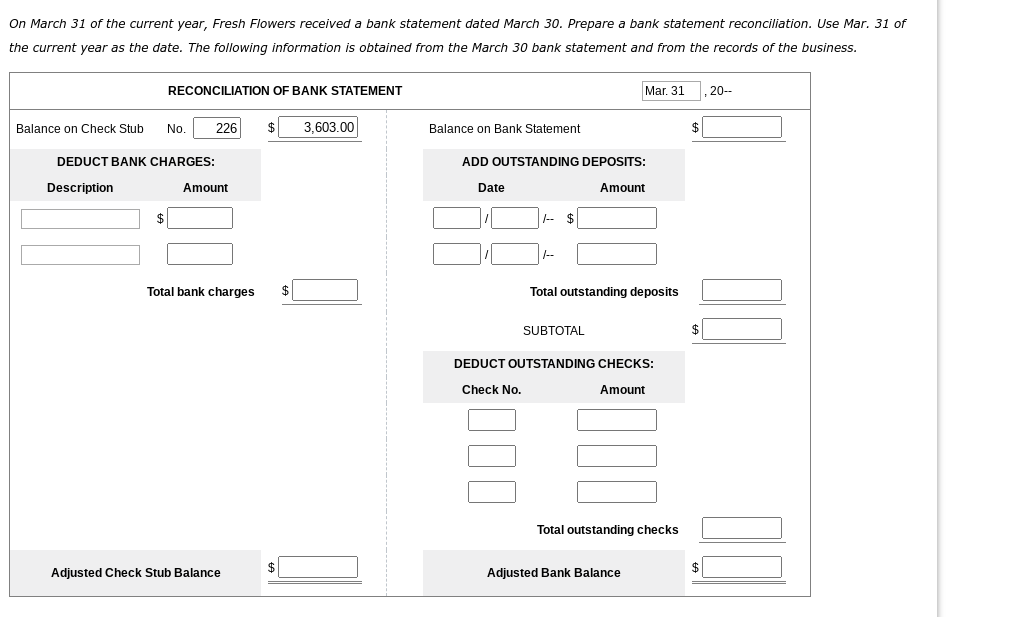

On March 31 of the current year, Fresh Flowers received a bank statement dated March 30. Prepare a bank statement reconciliation. Use Mar. 31 of the current year as the date. The following information is obtained from the March 30 bank statement and from the records of the business.

On March 31 of the current year, Fresh Flowers received a bank statement dated March 30. Prepare a bank statement reconciliation. Use Mar. 31 of the current year as the date. The following information is obtained from the March 30 bank statement and from the records of the business.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5EB: The bank reconciliation shows the following adjustments. Deposits in transit: $526 Outstanding...

Related questions

Question

On March 31 of the current year, Fresh Flowers received a bank statement dated March 30. Prepare a

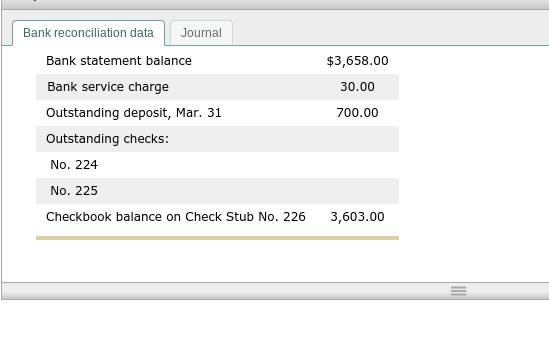

Transcribed Image Text:Bank reconciliation data

Journal

Bank statement balance

$3,658.00

Bank service charge

30.00

Outstanding deposit, Mar. 31

700.00

Outstanding checks:

No. 224

No. 225

Checkbook balance on Check Stub No. 226

3,603.00

Transcribed Image Text:On March 31 of the current year, Fresh Flowers received a bank statement dated March 30. Prepare a bank statement reconciliation. Use Mar. 31 of

the current year as the date. The following information is obtained from the March 30 bank statement and from the records of the business.

RECONCILIATION OF BANK STATEMENT

Mar, 31

,20--

Balance on Check Stub

No.

226

$

3,603.00

Balance on Bank Statement

$

DEDUCT BANK CHARGES:

ADD OUTSTANDING DEPOSITS:

Description

Amount

Date

Amount

|- $

--

Total bank charges

Total outstanding deposits

SUBTOTAL

DEDUCT OUTSTANDING CHECKS:

Check No.

Amount

Total outstanding checks

$

Adjusted Check Stub Balance

Adjusted Bank Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning