On nov 1 Noman started his Repair service. Listed below are the transactions for the month of nov 2019. On nov 1 Invested Rs450,000 cash and equipment 50,000 with a building book value of Rs50,000 in new business On nov 2 Received Rs1,000 for Repair service On nov 5 Purchased Insurance poliey paid 3 months advance payment 6,000 On nov 13 Purchased equipment for Rs7,000, paying Rs2,000 cash and giving a note for remaining On nov 14 purchased office supplies 500 On nov 15 Paid telephone bill expenses Rs2,000 On nov 18 Withdrew Rs2,000 cash for personal use On nov 20 Purchased supplies for Rs3,000 on account On nov 21 Paid Rs 5,000 on outstanding note On nov 24 Withdrew supplies 500 for personal use On nov 27 Received Rs 3,250 for lawn care service Question -1 REQUIRED : A. GENERAL JOURNAL b. LEDGER POSTING C. TRIAL BALANCE

On nov 1 Noman started his Repair service. Listed below are the transactions for the month of nov 2019. On nov 1 Invested Rs450,000 cash and equipment 50,000 with a building book value of Rs50,000 in new business On nov 2 Received Rs1,000 for Repair service On nov 5 Purchased Insurance poliey paid 3 months advance payment 6,000 On nov 13 Purchased equipment for Rs7,000, paying Rs2,000 cash and giving a note for remaining On nov 14 purchased office supplies 500 On nov 15 Paid telephone bill expenses Rs2,000 On nov 18 Withdrew Rs2,000 cash for personal use On nov 20 Purchased supplies for Rs3,000 on account On nov 21 Paid Rs 5,000 on outstanding note On nov 24 Withdrew supplies 500 for personal use On nov 27 Received Rs 3,250 for lawn care service Question -1 REQUIRED : A. GENERAL JOURNAL b. LEDGER POSTING C. TRIAL BALANCE

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 10DQ

Related questions

Topic Video

Question

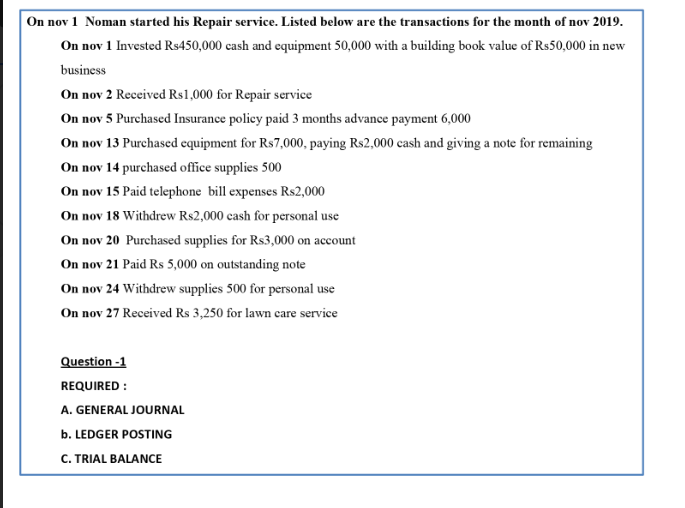

Transcribed Image Text:On nov 1 Noman started his Repair service. Listed below are the transactions for the month of nov 2019.

On nov 1 Invested Rs450,000 cash and equipment 50,000 with a building book value of Rs50,000 in new

business

On nov 2 Received Rs1,000 for Repair service

On nov 5 Purchased Insurance policy paid 3 months advance payment 6,000

On nov 13 Purchased equipment for Rs7,000, paying Rs2,000 cash and giving a note for remaining

On nov 14 purchased office supplies 500

On nov 15 Paid telephone bill expenses Rs2,000

On nov 18 Withdrew Rs2,000 cash for personal use

On nov 20 Purchased supplies for Rs3,000 on account

On nov 21 Paid Rs 5,000 on outstanding note

On nov 24 Withdrew supplies 500 for personal use

On nov 27 Received Rs 3,250 for lawn care service

Question -1

REQUIRED :

A. GENERAL JOURNAL

b. LEDGER POSTING

C. TRIAL BALANCE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College