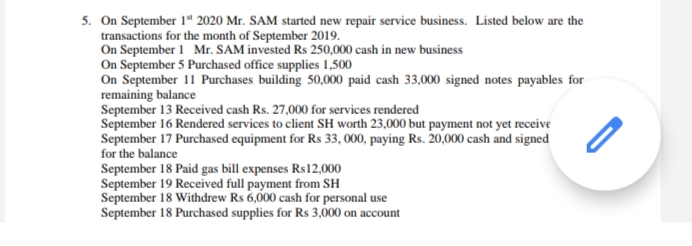

On September 1" 2020 Mr. SAM started new repair service business. Listed below are the transactions for the month of September 2019. On September 1 Mr. SAM invested Rs 250,000 cash in new business On September 5 Purchased office supplies 1,500 On September 11 Purchases building 50,000 paid cash 33,000 signed notes payables for remaining balance September 13 Received cash Rs. 27,000 for services rendered September 16 Rendered services to client SH worth 23,000 but payment not yet receive September 17 Purchased equipment for Rs 33, 000, paying Rs. 20,000 cash and signed for the balance September 18 Paid gas bill expenses Rs12,000 September 19 Received full payment from SH September 18 Withdrew Rs 6,000 cash for personal use September 18 Purchased supplies for Rs 3,000 on account

On September 1" 2020 Mr. SAM started new repair service business. Listed below are the transactions for the month of September 2019. On September 1 Mr. SAM invested Rs 250,000 cash in new business On September 5 Purchased office supplies 1,500 On September 11 Purchases building 50,000 paid cash 33,000 signed notes payables for remaining balance September 13 Received cash Rs. 27,000 for services rendered September 16 Rendered services to client SH worth 23,000 but payment not yet receive September 17 Purchased equipment for Rs 33, 000, paying Rs. 20,000 cash and signed for the balance September 18 Paid gas bill expenses Rs12,000 September 19 Received full payment from SH September 18 Withdrew Rs 6,000 cash for personal use September 18 Purchased supplies for Rs 3,000 on account

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 10DQ

Related questions

Topic Video

Question

Transcribed Image Text:5. On September 1“ 2020 Mr. SAM started new repair service business. Listed below are the

transactions for the month of September 2019.

On September 1 Mr. SAM invested Rs 250,000 cash in new business

On September 5 Purchased office supplies 1,500

On September 11 Purchases building 50,000 paid cash 33,000 signed notes payables for

remaining balance

September 13 Received cash Rs. 27,000 for services rendered

September 16 Rendered services to client SH worth 23,000 but payment not yet receive

September 17 Purchased equipment for Rs 33, 000, paying Rs. 20,000 cash and signed

for the balance

September 18 Paid gas bill expenses Rs12,000

September 19 Received full payment from SH

September 18 Withdrew Rs 6,000 cash for personal use

September 18 Purchased supplies for Rs 3,000 on account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub