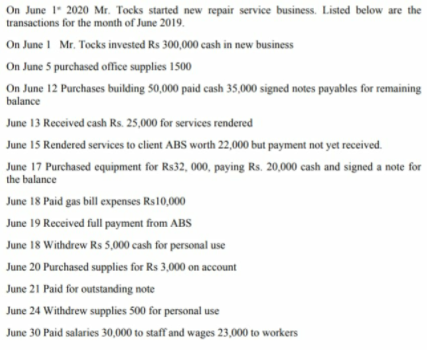

On June 1 2020 Mr. Tocks started new repair service business. Listed below are the transactions for the month of June 2019. On June 1 Mr. Tocks invested Rs 300,000 cash in new business On June 5 purchased office supplies 1500 On June 12 Purchases building 50,000 paid cash 35,000 signed notes payables for remaining balance June 13 Received cash Rs. 25,000 for services rendered June 15 Rendered services to client ABS worth 22,000 but payment not yet received. June 17 Purchased equipment for Rs32, 000, paying Rs. 20,000 cash and signed a note for the balance hill Rel0000

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Hey, since there are multiple questions posted, we will answer the first question alone. If you want…

Q: On September 1" 2020 Mr. SAM started new repair service business. Listed below are the transactions…

A:

Q: Tollow ansacti books of • Mr. Anwar decide to start a business of Computer Service Business that…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: On July 1, 2020, Matthew Victor opened a retail postal store. During July, the following…

A: 1. Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Q: Nelson Daganta formed the Liceo Signages on Oct. 1, 2019. He deposited P250,000 in GE Money Bank…

A: According to accounting equation, assets equal to sum of liabilities and equity.

Q: Answer the following questions: 1. Assume that Rolf Dorman invests $20,000 in cash in a new pool…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: On nov 1 Noman started his Repair service. Listed below are the transactions for the month of nov…

A: These are parts of accounting.

Q: Mr. Simon Valve, a dentist, started Valve Dental Company on January 1, 2021. The following…

A: Unadjusted trial balance is prepared before the adjusting entries are recorded in the books. It can…

Q: Mr. Klean opened a Cleaning Service shop on September 1, 2019. During the month, the business…

A: The journal entries refer to the accounting entries passed in the books of accounts using the…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Hey, since there are multiple questions posted, we will answer the first question alone. If you want…

Q: Mr. Mike Benter opened the Benter Servicing on June 1, 2019 with the following investments: 300, 000…

A: These accounts are prepared for recording the business transactions.

Q: Mr. Armin opened an online shop called "Mr. & Mrs. Bii's Online Shop" on January 1, 2020. The…

A: Financial statement means the trading and profit and loss account and balance sheet of the company…

Q: On April 1, 2019, Betty Booth incorporated a consulting business known as Booth Consulting. Booth…

A: Since you have asked for the preparation of Financial Statements, we have prepared the 1st three…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Mr. Salah Accounting analyst Company Income statement for the month ended Jan 31 Amount…

Q: WiCom Servicing completed these transactions during November 2020, its first month of operations: I…

A: Journal entries are used to record the accounting effect of the financial transactions. It generally…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular…

Q: 5. On September 1ª 2020 Mr. SAM started new repair service business. Listed below are the…

A: Trial balance is the statement prepared to get the balance of all the accounts at one single place.…

Q: 2021 April 5 Dr. Ramirez invested P725,000 in the business April 7 Purchased equipment from Triple X…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Journal is the primary book where the transactions are originally recoded. A journal entry is used…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Post the entries and calculate the balances:

Q: 2. Hongkun is sole owner of business. He has been started business since 2018. Following are…

A: Journal entries…

Q: The following business transactions relate to John Clark (financial planner) for his first month of…

A: 1. Accounting equation = Assets = Liabilities + Equity The affect of revenue and loss affect the…

Q: Ahmad started his own Computer service on January 1, 2020. The following transactions occurred…

A: Show the effects of the given transactions on the accounting equation:

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: SOLUTION- JOURNAL ENTRY IS USED TO RECORD A BUSINESS TRANSACTION IN THE ACCOUNTING RECORDS OF A…

Q: FDN Accounting Services started operations on November 1, 2021. The following were the transactions…

A: 1. The increase in the total liabilities of the business will be equal to the amount of loan…

Q: On 1 March 2021, Tom set up J Hair Salon by investing $50,000 cash and $30,000 of equipment in J…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: On April 1, 2020, Nels Ferrer organized a business called Friendly Trucking. During April, company…

A: Journal entry: It is also called as book of original entry. It is used to record a financial…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Hey, since there are multiple questions posted, we will answer the first question alone. If you want…

Q: The following transactions occurred during June 2020 for Rashid Est. June 1 Invested BD64,000 cash…

A: Journaling is the process of recording business transactions in accounting records. This activity…

Q: Ruth Lewis opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,000,…

A: Note: We'll answer the first question since the exact one wasn't specified. Please submit a new…

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular…

Q: Sarah's Repair Shop opened for business on November 1, 2021. The following transactions occurred in…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: Date Accounts title and explanation Debit ($) Credit ($) 31-Jul Depreciation expense…

Q: Ahmad started his own Computer service on January 1, 2020. The following transactions occurred…

A: 1) Transactions on accounting equation: In accounting equation Assets = Liabilities + Stock holders…

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Record journal entries for the following purchase transactions of Apex Industries, assuming…

A: Journal entry is a primary entry that records the financial transactions initially.

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: As posted multiple questions we are answering only first question kindly repost the unanswered…

Q: Alex Co., Ltd. started its cleaning service on June 1, 2019. Here below were its events and…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Mr. Salah opened the accounting analyst services in January 2020. He plans to prepare the monthly…

A: Unadjusted trial balance: Unadjusted trial balance is that statement which contains complete list of…

Q: 5. On September 1ª 2020 Mr. SAM started new repair service business. Listed below are the…

A: Three golden rules of accounting that are used in preparing journal entries are: Debit the receiver…

Q: Prepare the Income Statement for 2019 and Balance Sheet for December 31, 2019

A: Income statements and balance sheets are important financial statements that tell a lot about the…

Q: occurred in January 2020: date transaction January 1 Invested $10,000 in cash to start the business.…

A: Dear student , You asked multiple questions.…

Q: On June 1" 2020 Mr. Tocks started new repair service business. Listed below are the transactions for…

A: As posted multiple questions we are answering only first question kindly repost the unanswered…

Q: On December 1. 2021 Ebenezer Buenaventura opened EB Computer Shop, by investing P250,000 cash from…

A: Journal entry recording is the initial step in accounting process, under which atleast one account…

Q: Ali Hasan opened Ali's Cleaning Service on July 1 st, 2020. During July, the following transactions…

A: Cash paid on July 18 = 1500 + 1400 = 2900

Q: On July 1, 2020. Mr Mendez established the Mendez Rehab Clinic. Transactions completed during the…

A: Journal - It refers to the primary books of accounts in which transactions are recorded in the order…

Q: On September 1st 2020 Mr. SAM started new repair service business. Listed below are the transactions…

A: Journal entry: Journal is a book of prime entry or a book of original entry in which transactions…

Q: . On September 1" 2020 Mr. SAM started new repair service business. Listed below are the…

A: JOURNAL ENTRY DATE PARTICULARS L.F. DEBIT CREDIT Sep 1 Cash A/C Dr. To Capital…

Prepare all the journal entries.

Step by step

Solved in 2 steps with 3 images

- Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?Taylor Company recently purchased a piece of equipment for $2,000 which will be paid within 30 days after delivery. At what point would the event be recorded in Taylors accounting system? When Taylor signs the agreement with the seller When Taylor receives an invoice (a bill) from the setter When Taylor receives the asset from the seller When Taylor pays $2.000 cash to the seller

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, 6,500. 2.Purchased office supplies on account, 2,300. 5.Paid insurance premiums, 6,000. 10.Received cash from clients on account, 52,300. 15.Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17.Paid creditors on account, 6,450. 20.Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23.Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27.Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28.Paid automobile expense (including rental charges for an automobile), 1,500. 29.Paid miscellaneous expenses, 1,400. 30.Recorded revenue earned and billed to clients during the month, 57,000. 30.Paid salaries and commissions for the month, 11,900. 30.Withdrew cash for personal use, 4,000. 30.Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?Using the income statement for Adventure Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended April 30, 2019. Jerome Foley, the owner, invested an additional 60,000 in the business during the year and withdrew cash of 40,000 for personal use. Jerome Foley, capital as of May 1, 2018, was 1,020,000.Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business sets up a line of credit with a supplier. The company purchases $10,000 worth of equipment on credit. Terms of purchase are 5/10, n/30. B. A customer purchases a watering hose for $25. The sales tax rate is 5%. C. Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $250 per season ticket. Each customer purchased two season tickets. D. A company issues 2,000 shares of its common stock with a price per share of $15.