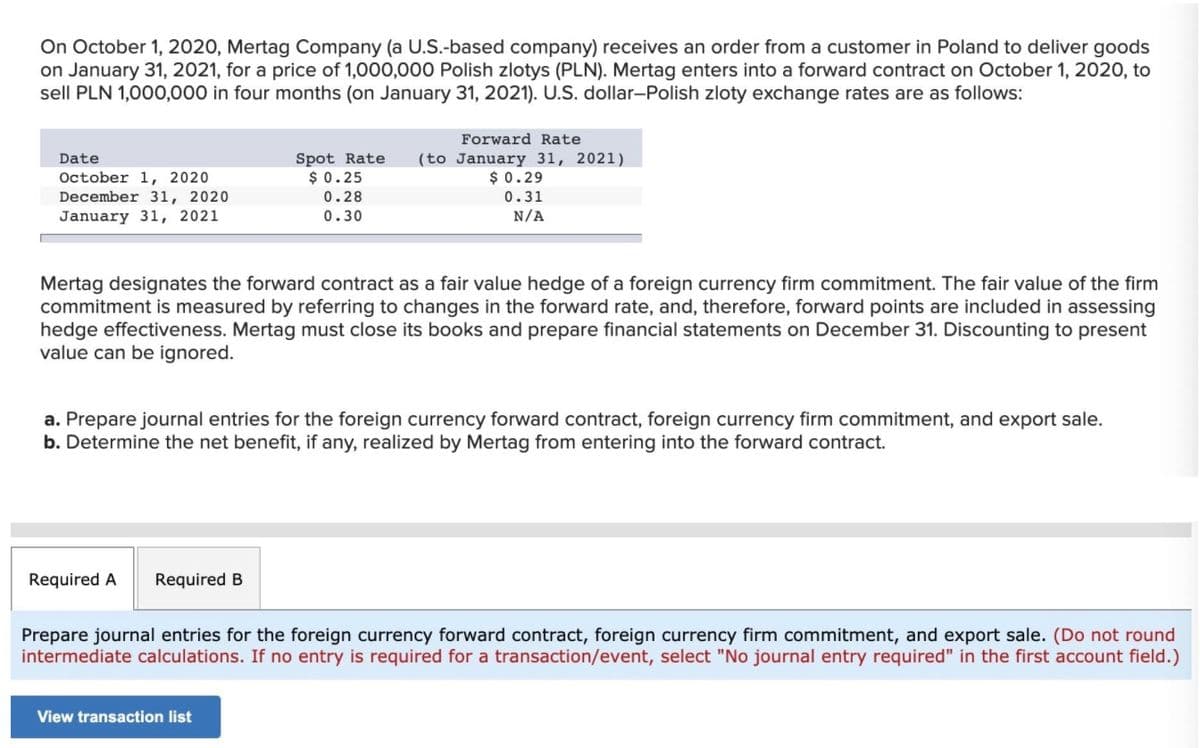

On October 1, 2020, Mertag Company (a U.S.-based company) receives an order from a customer in Poland to deliver goods on January 31, 2021, for a price of 1,000,000 Polish zlotys (PLN). Mertag enters into a forward contract on October 1, 2020, to sell PLN 1,000,000 in four months (on January 31, 2021). U.S. dollar-Polish zloty exchange rates are as follows: Forward Rate Spot Rate $0.25 (to January 31, 2021) $ 0.29 Date October 1, 2020 December 31, 2020 January 31, 2021 0.28 0.31 0.30 N/A Mertag designates the forward contract as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured by referring to changes in the forward rate, and, therefore, forward points are included in assessing hedge effectiveness. Mertag must close its books and prepare financial statements on December 31. Discounting to present value can be ignored. a. Prepare journal entries for the foreian currency forward contract foreian currency firm commitment and export sale

Required A

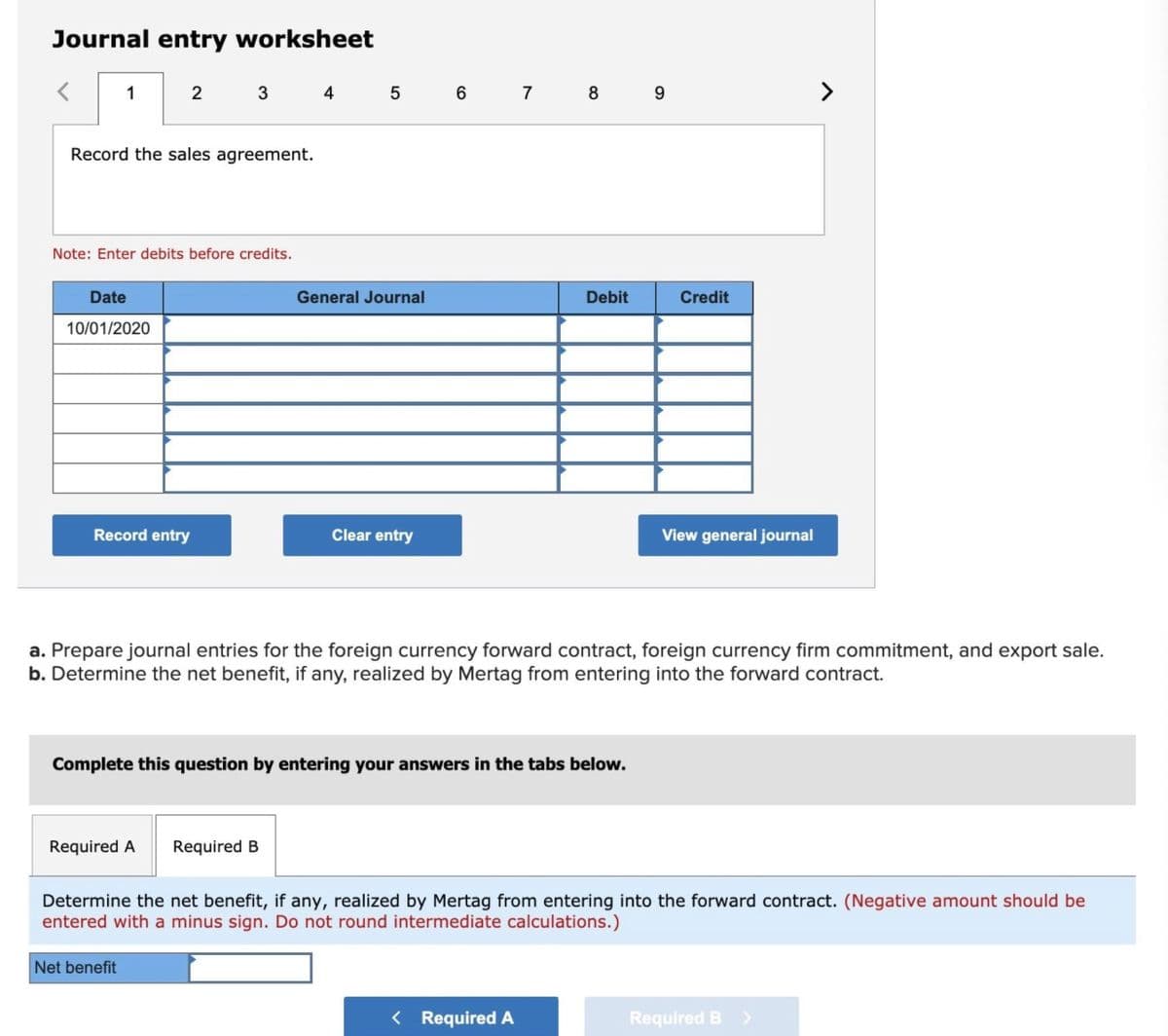

1. Record the sales agreement. 10.01.2020

2.Record entry for forward contract entered into by Mertag Company. 10.01.2020

3. Record the forward contract and recognize the change in fair value. 12.31.2020

4. Record the firm commitment and recognize the change in fair value. 12.31.2020

5. Record the entry to adjust the fair value of the forward contract. 01.31.2021

6. Record the entry to adjust the fair value of the firm commitment. 01.31.2021

7. Record the sale and receipt of PLN. 01.31.2021

8. Record settlement of forward contract. 01.31.2021

9.Record entry to close the firm commitment. 01.31.2021

Required B Determine the net benefit, if any, realized by Mertag from entering into the forward contract. (Do not round intermediate calculations. Negative amount should be entered with a minus sign.)

Net benefit:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps