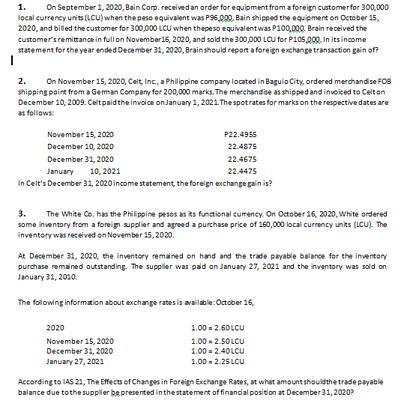

On September 1, 2020, Bain Corp. received an order for equipmentfrom a foreign cuatomerfor 300,000 local currency units (LCU) when the peso equivalent was P96000. Bain shipped the equipment on October 15, 2020, and billed the customer for 300,000 LCU when thepeso equlvalentwas P100,000, Brain received the customer's remittance in full on November16, 2020, and sold the 300,000 LCU for P105,000, In its income statement for the year ended December 31, 2020, Brainshould report a foreign exchange transaction gain of? 1.

On September 1, 2020, Bain Corp. received an order for equipmentfrom a foreign cuatomerfor 300,000 local currency units (LCU) when the peso equivalent was P96000. Bain shipped the equipment on October 15, 2020, and billed the customer for 300,000 LCU when thepeso equlvalentwas P100,000, Brain received the customer's remittance in full on November16, 2020, and sold the 300,000 LCU for P105,000, In its income statement for the year ended December 31, 2020, Brainshould report a foreign exchange transaction gain of? 1.

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 27P

Related questions

Question

100%

Transcribed Image Text:On September 1, 2020, Bain Corp. receivedan order for equipment from a foreign customerfor 300,000

local currency units (LCU) when the peso equivalent was P96,000, Bain shipped the equipment on October 15,

2020, and billed the customer for 300,000 LCU when thepeso equivalentwas P100,000. Brain received the

1.

customer's remittancein fullon November15, 2020, and sold the 300,000 LCU for P105,000, In its income

tatement for the year ended December 31, 2020, Brainshould repornt a foreign exchange transaction gain of?

2.

On November 15, 2020, Celt, Inc, a Philppine company located in Baguio City, ordered merchandise FOB

shipping point from a Geman Company for 200,000 marks. The merchandise as shipped and invoiced to Celton

December 10, 2009. Celt paidtheinvoioce onJanuary 1, 2021. The spotrates for marks on the respective dates are

as follows

November 15, 2020

December 10, 2020

December 31, 2020

P22.4955

22.4875

22.4675

January 10, 2021

22.4475

In Celt's December 31, 2020 income statement, the foreign exchange gain is?

3.

The White Co. has the Philippine pesos as its funtional currency. On October 16, 2020, White ordered

some inventory from a foreign supplier and agreed a purchase price of 160,000 local currency units (LCU). The

inventory was received on November 15, 2020.

At December 31, 2020, the inventory remained on hand and the trade payable balance for the inventony

purchase remained outstanding. The supplier was paid on January 27, 2021 and the inventory was soid on

January 31, 2010.

The following information about exchange ratesis available:October 16,

1.00 = 2.60LCU

1.00 - 2.50LCU

2020

November 15, 2020

December 31, 2020

1.00 = 2.40LCU

January 27, 2021

1.00 - 2.25 LCU

According to LAS 21, The Effects of Changes in Foreign Exchange Rates, at what amount shouldthe trade payable

balance due tothe supplier bepresented inthestatement offinandial position at December 31,2020?

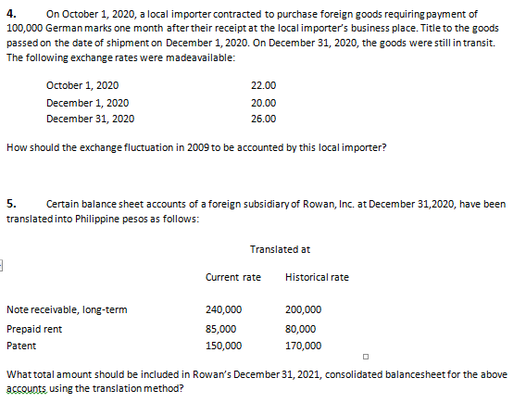

Transcribed Image Text:4.

On October 1, 2020, a local importer contracted to purchase foreign goods requiring payment of

100,000 German marks one month after their receipt at the local importer's business place. Title to the goods

passed on the date of shipment on December 1, 2020. On December 31, 2020, the goods were still in transit.

The following exchange rates were madeavailable:

October 1, 2020

22.00

December 1, 2020

20.00

December 31, 2020

26.00

How should the exchange fluctuation in 2009 to be accounted by this local importer?

5.

Certain balance sheet accounts of a foreign subsidiary of Rowan, Inc. at December 31,2020, have been

translated into Philippine pesos as follows:

Translated at

Current rate

Historical rate

Note receivable, long-term

240,000

200,000

Prepaid rent

85,000

80,000

Patent

150,000

170,000

What total amount should be included in Rowan's December 31, 2021, consolidated balancesheet for the above

accounts using the translation method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you