On October 26, 20x1, Entity A acquired 100% interest in Entity B for 2,800,000. On this date, Entity B's identifiable assets and liabilities have fair values of P4,000,000 and 1,600,000, respectively. Included in Entity B's liabilities are cash dividends of 280,000 declared on October 1, 20x1, to shareholders of record on November 1, 20x1, and payable on December 1, 20x1. sirement: Compute for the goodwill.

On October 26, 20x1, Entity A acquired 100% interest in Entity B for 2,800,000. On this date, Entity B's identifiable assets and liabilities have fair values of P4,000,000 and 1,600,000, respectively. Included in Entity B's liabilities are cash dividends of 280,000 declared on October 1, 20x1, to shareholders of record on November 1, 20x1, and payable on December 1, 20x1. sirement: Compute for the goodwill.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

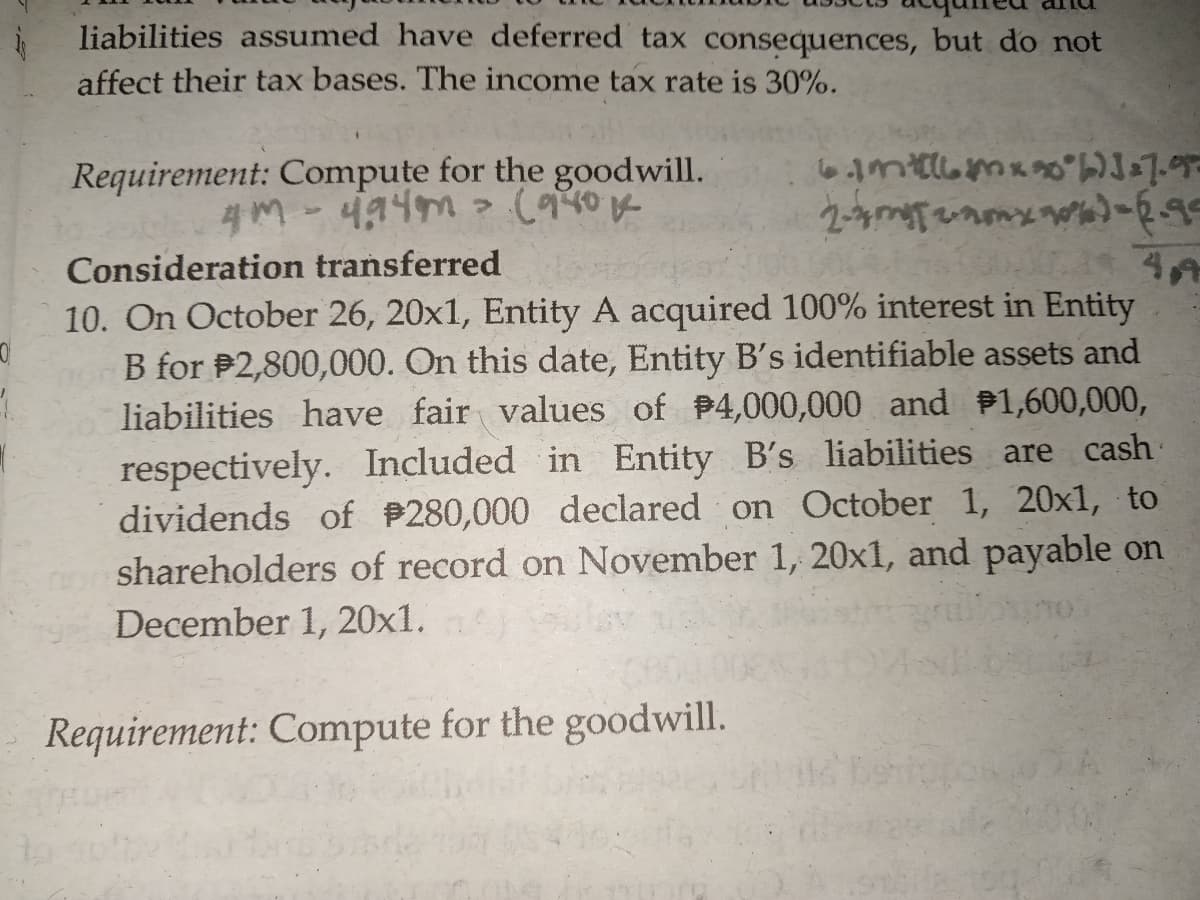

Transcribed Image Text:liabilities assumed have deferred tax consequences, but do not

affect their tax bases. The income tax rate is 30%.

Requirement: Compute for the goodwill.

4M-494m > (940K

Consideration transferred

10. On October 26, 20x1, Entity A acquired 100% interest in Entity

B for P2,800,000. On this date, Entity B's identifiable assets and

liabilities have fair values of 4,000,000 and 1,600,000,

respectively. Included in Entity B's liabilities are cash

dividends of P280,000 declared on October 1, 20x1, to

shareholders of record on November 1, 20x1, and payable on

December 1, 20x1.

Requirement: Compute for the goodwill.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you