On January 1, 202X, Dianne Corporation acquired the net assets of Cyril Corporation by issuing e shares with par and market values of P20 and P2,300,000, respectively. Moreover, it agreed to p additional Pi70,000 on January 1, 202Z if the average income in 202x and 202Y exceeds P150,0 year. The expected value of the additional payment is estimated at P102,000 based on the 60% prob of achieving the target average income. The carrying and fair values of Cyril Corporation's identifiab assets as of the acquisition date are P2,200,000 and P2,000,000, respectively. Required: a. Determine the amount of goodwill or gain on bargain purchase from the above transaction. b. Give the adiusting entry assuming that the company determined on September 30, 202X that th

On January 1, 202X, Dianne Corporation acquired the net assets of Cyril Corporation by issuing e shares with par and market values of P20 and P2,300,000, respectively. Moreover, it agreed to p additional Pi70,000 on January 1, 202Z if the average income in 202x and 202Y exceeds P150,0 year. The expected value of the additional payment is estimated at P102,000 based on the 60% prob of achieving the target average income. The carrying and fair values of Cyril Corporation's identifiab assets as of the acquisition date are P2,200,000 and P2,000,000, respectively. Required: a. Determine the amount of goodwill or gain on bargain purchase from the above transaction. b. Give the adiusting entry assuming that the company determined on September 30, 202X that th

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

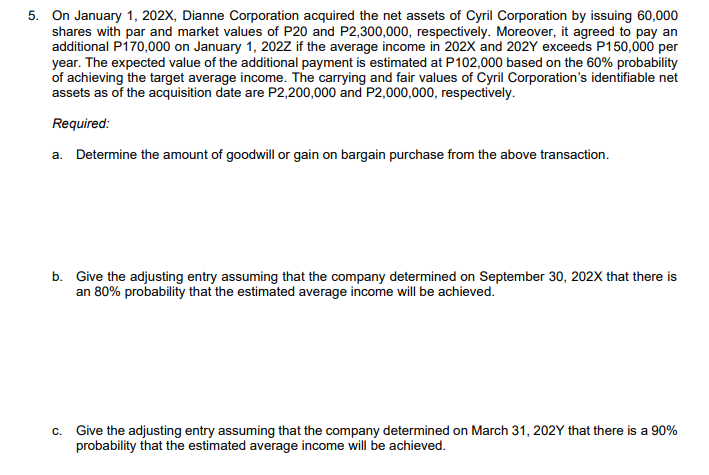

Transcribed Image Text:5. On January 1, 202X, Dianne Corporation acquired the net assets of Cyril Corporation by issuing 60,000

shares with par and market values of P20 and P2,300,000, respectively. Moreover, it agreed to pay an

additional Pi70,000 on January 1, 202Z if the average income in 202X and 202Y exceeds P150,000 per

year. The expected value of the additional payment is estimated at P102,000 based on the 60% probability

of achieving the target average income. The carrying and fair values of Cyril Corporation's identifiable net

assets as of the acquisition date are P2,200,000 and P2,000,000, respectively.

Required:

a. Determine the amount of goodwill or gain on bargain purchase from the above transaction.

b. Give the adjusting entry assuming that the company determined on September 30, 202X that there is

an 80% probability that the estimated average income will be achieved.

c. Give the adjusting entry assuming that the company determined on March 31, 202Y that there is a 90%

probability that the estimated average income will be achieved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT