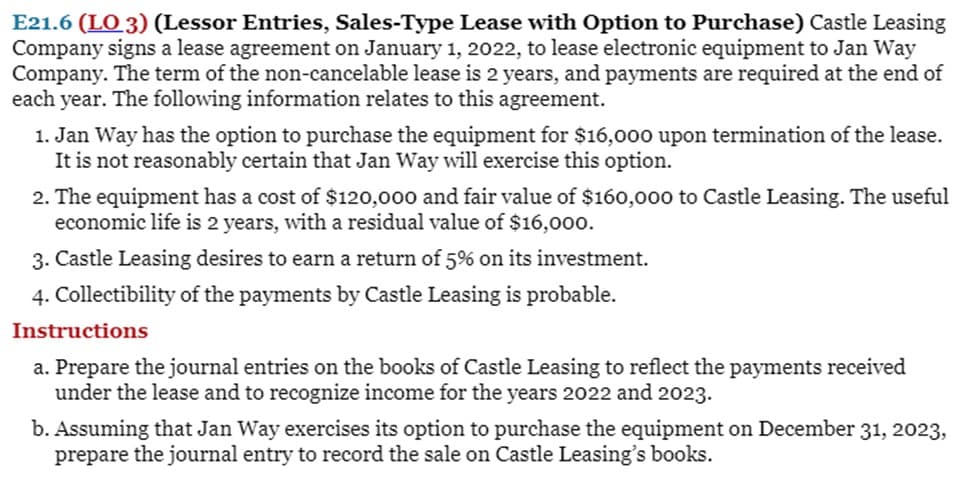

on relates to this agreement. rchase the equipment for $16, at Jan Way will exercise this o 120,000 and fair value of $16 a residual value of $16,000.

Q: You are an internal auditor for Shannon Supplies, Inc., and are reviewing the company’s preliminary…

A: Journal Entries: Journal entries are recorded to show the transactions entered by a company in day…

Q: $100,800. The book value of the bonds in S's books at the beginning of 2022 was $98,400. What is the…

A: When a company issues a bond, it imposes a long-term loan for which interest payments are made from…

Q: A company records its various business transactions in the book of original entries using various…

A: In this question, we will explain that the answer is True or False and if True then why it is True…

Q: During a recent week, Charlie Scott works 37 regular hours. He earns $9/hour and contributes 3% of…

A: Taxable income is the portion of your gross income that the IRS deems subject to taxes. It consists…

Q: a-1. Determine the unadjusted rate of return and (use ave places. (i.e., 0.2345 should be entered as…

A: IRR is a tool that is used to calculate the return over the project cash flow or its investment. If…

Q: Which among the sentences below is incorrect? An entity shall measure a current asset or disposal…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of…

A: No. Account Titles and Explanation Debit Credit 1 Sales Revenue $1,437,000 Income Summary…

Q: The following items appeared on the 2021 financial records of ABC Company: Service Income P600,000…

A: STATEMENT OF NET INCOME PARTICULARS AMOUNT SERVICE INCOME 600000 COMMISSION 80000…

Q: Below are amounts for two companies: Beginning Ending net sales Accounts…

A: The question is based on the concept of Financial Ratios.

Q: 4/ 2 Purchased a company automobile for $32.000, with a cash down payment of S1,000 and the…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The following account balances were taken from the books of ABC Company for the month of March.…

A: Salaries payable is current liability which should be reported under liabilities section of balance…

Q: On January 1, 20x1, Kageyama Corporation issues P1,500,000 of 10% bonds at 97 due December 31, 2x10.…

A: Introduction:- A bond is a form of instrument in which the issuer (the debtor) owes the holder (the…

Q: 1.) Prepare statement of Comprehensive Income from the information given below of ABC SAOC for the…

A: A comprehensive income statement is prepared to know the actual income incurred after the year-end.

Q: Which of the following statements is correct? Multiple Cholce Purchases should be made only after…

A: The question is related to Auditing and procedures of Purchase.

Q: Problem 5 Ready Flashlights, Inc. needs P300,000 to take a cash discount of 2/10, net 70. A banker…

A: The Effective Annual Rate (EAR) seems to be the interest rate received or payable on a loan as a…

Q: Marshall Company purchases a machine for $640,000. The machine has an estimated residual value of…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: Luebke Incorporated has provided the following data for the month of November. The balance in the…

A: The cost of goods sold refers to the direct costs of manufacturing the commodities supplied by a…

Q: Match the statements below with the accounting assumption, characteristic, or principle to which the…

A: Introduction: Accounting: Accounting is an art of recording , classifying , summarising and…

Q: ABC Company, a computer repair shop provided the following information at the end of its first month…

A: Statement of profit or loss depicts the profit earned or loss incurred during the designated period…

Q: nd equipment which has a fair market value of mer made an additional investment of P150,00 of the…

A: Owners capital is the owners personal assets invested by him in the business . It could be cash or…

Q: The Justice Corporation is authorized to issue 500,000 shares of ordinary share capital with a…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Harry is divorced with net income for tax purposes of $50,000. His 21 year old dependent daughter,…

A: In this question, we will calculate Harry’s medical expenses tax credit for 2021, we have to choose…

Q: X wishes to file his 2019 income tax return. To avoid penalty, he must file his return on or before:…

A: Income tax return is the statement of income and tax required to file with tax authorities by the…

Q: Johnson Company bought a light general purpose truck for $20,000. Calculate the yearly depreciation…

A: MACRS is a method of depreciating the assets. Under this method, the rates at which the asset is to…

Q: On June 1, 2021, Demer Consulting provides services to a customer for $150,000. To pay for the…

A: The journal entries are prepared to record the day to day transactions of the business during the…

Q: for example on this question. Received bill from the water and sewer department for services,…

A: Operating Utilities Expenses: A utility expense is the cost of energy, heat, sewage, and water use…

Q: The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been…

A: Given: The information available in the question are as follows: Comparative balance sheet and…

Q: What are the similarities in calculating the cost of materials used in production, the cost of goods…

A: Cost of the materials used in production: This is the additional amount of material put in the…

Q: You have been asked by a client to review the records of Sheffield Company, a small manufacturer of…

A: Introduction Accounting changes and error analysis is carried out at the end of each accounting…

Q: What is in the nature of work of an auditor that puts his or her safety at risk? Answer in your own…

A: Auditor is the person who checks the accounts and the financial statements which have to be verified…

Q: Using the declining-balance method, complete the table as shown (twice the straight-line rate):…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Luebke Incorporated has provided the following data for the month of November. The balance in the…

A: When manufacturing overheads are applied to the products at predetermined rates then overapplied or…

Q: rmining federal income withholding found?

A: Wage bracket method is straight forward approach. The wage bracket method of calculating withholding…

Q: The total liabilities of ABC Company for the period ending December 31, 202 amounted to P300,000.…

A: The liabilities are the amount due to be paid to the outsiders including creditors, suppliers, etc.

Q: Through the effects of financial leverage, when EBIT decreases, earnings per share will

A: EBIT(Earnings before interest and taxes) is a measurement of a company's profitability directly…

Q: A company purchased a computer system on January 1, 2021 for S 1,600,00 and sold it one year later…

A: Formula: Straight line method Depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: Barney Stinson purchased land and a building for his new men’s clothing store. The price paid was…

A: Historical cost of the building = Total Purchase cost for land and a building x fair value of the…

Q: Assume that AntonTech starts selling TechStop franchises. TrueTech charges. Franchisees an initial…

A: Revenue is the revenue from normal business operations and is calculated by multiplying the average…

Q: Schonhardt Corporation's relevant range of activity is 4,800 units to 6,000 units. When it produces…

A: Fixed costs are those costs that do not change when the activity of production changes within the…

Q: A long term note ($400,000 face value) matured. The interest of $40,000 was paid but the principle…

A: Long-Term Note: As opposed to bonds, which are more sophisticated financial instruments that often…

Q: Your Company’s cost formula for its wages and salaries is $2,500 per month plus $475 per unit sold.…

A: Spending variance = Budgeted expense for actual activity - Actual expense

Q: On a recent trip to Hongkong, Brian Santos, sales manager of Micro electronic Devices, took his wife…

A: General Journal shows the recording of transactions during an accounting year and in the journal,…

Q: True or False. 1. A company records its various business transactions in the book of original…

A: In a business organization, many types of transactions occur. These transactions are recorded via…

Q: a. Zach is 29 years old and his AGI is $5,000.

A: Given: Zach is an individual without any dependents. No claim was made by him on other people's…

Q: Determine the net income (loss) of ABC Company on its first month of operation.

A: Net income refers to the amount of profit earned by the company from selling its goods or providing…

Q: Assume that in the first step of the reorganization, Auto Corp. will exchange $6,071,963 worth of…

A: A reorganization is defined as the process or a way under which the structure and ownership of…

Q: How much is the net cash flows from operating activities?

A: Answer:

Q: 1. It is a bank account wherein the depositor can draw checks. a. Drawing account b. Savings account…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Impact on Impact on profit 1 Account Debit Credit current ratio margin Payroll expense 72,000 3…

A: Current ratio is calculated by dividing the current assets with current liabilities. Current ratio =…

Q: Assume that a bank has lent a firm a P 200,000 for 60 days at 10% interest. The loan is discounted,…

A: Principal amount (P) = P 200,000 Interest for 60 days (I) = P200,000 x 10% x 60/360 days = P3,333…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On January 1, 2022, Yencay, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Thol Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. The fair value of the building on January 1, 2022 is P4,000,000; however, the book value to Holt is P3,300,000. The building has an estimated economic life of 10 years, with no residual value. Yencay depreciates similar buildings on the straight-line method. At the termination of the lease, the title to the building will be transferred to the lessee. Yencay's incremental borrowing rate is 11% per year. Thol Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yencay, Inc. The yearly rental payment includes P10,000 of executory costs related to taxes on the property. The agreement…On January 1, 2022, Yencay, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Thol Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. The fair value of the building on January 1, 2022 is P4,000,000; however, the book value to Holt is P3,300,000. The building has an estimated economic life of 10 years, with no residual value. Yencay depreciates similar buildings on the straight-line method. At the termination of the lease, the title to the building will be transferred to the lessee. Yencay's incremental borrowing rate is 11% per year. Thol Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yencay, Inc. The yearly rental payment includes P10,000 of executory costs related to taxes on the property. The agreement…Eubank Company, a lessee, enters into a lease agreement on January 1, 2021, for equipment. The following data are relevant to the lease agreement: - The term of the noncancelable lease is 4 years. Payments of $978,446 are due on January 1 of each year. The first payment is January 2021. - The fair value of the equipment on January 1, 2021 is $3,500,000. The equipment has an economic life of 6 years with nosalvage value. - Eubank uses the straight-line method of depreciation. - Eubank’s implicit rate is 8%. - This will be treated as a finance lease (Lessee Perspective). Instructions: Prepare the journal entries on Eubank’s books (lessee) that relate to the lease agreement for the following dates, you do not need to create an amortization schedule. a. January 1, 2021. b. December 31, 2021.

- Oriole Leasing Corporation, which uses IFRS 16, signs a lease agreement on January 1, 2020, to lease electronic equipment to Wai Corporation, which also uses IFRS 16. The term of the non-cancellable lease is two years and payments are required at the end of each year. The following information relates to this agreement. 1. Wai Corporation has the option to purchase the equipment for $12,800 upon the termination of the lease and this option is reasonably certain to be exercised. 2. The equipment has a cost and fair value of $180,000 to Oriole Leasing Corporation. The useful economic life is two years, with a residual value of $12,800. 3. Wai Corporation is required to pay $5,400 each year to the lessor for insurance costs. 4. Oriole Leasing Corporation wants to earn a return of 10% on its investment. 5. Collectibility of the payments is reasonably predictable, and there are no important uncertainties surrounding the costs that have not yet been incurred by the…On January 1, 2021, Sandhill, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2018 is $5800000; however, the book value to Holt is $4750000.(c) The building has an estimated economic life of 10 years, with no residual value. Sandhill depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Sandhill’s incremental borrowing rate is 10% per year. Holt Warehouse Co. set the annual rental to insure a 9% rate of return. The implicit rate of the lessor is known by Sandhill, Inc.(f) The yearly rental…On January 1, 2021, Blossom, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2018 is $6500000; however, the book value to Holt is $5450000.(c) The building has an estimated economic life of 10 years, with no residual value. Blossom depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Blossom’s incremental borrowing rate is 12% per year. Holt Warehouse Co. set the annual rental to insure a 11% rate of return. The implicit rate of the lessor is known by Blossom, Inc.(f) The yearly rental…

- On January 1, 2021, Sunland, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $5700000; however, the book value to Holt is $4650000.(c) The building has an estimated economic life of 10 years, with no residual value. Sunland depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Sunland’s incremental borrowing rate is 12% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Sunland, Inc.(f) The yearly rental…On January 1, 2021, Pharoah, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $5600000; however, the book value to Holt is $4550000.(c) The building has an estimated economic life of 10 years, with no residual value. Pharoah depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Pharoah’s incremental borrowing rate is 11% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Pharoah, Inc.(f) The yearly rental…P21-15 (Please use the latest IFRS accounting standards to answer the question, and take note that lessee do recognise depreciation) Cleveland Group leased a new crane to Abriendo Construction under a 5-year, non-cancelable contract starting January 1, 2022. Terms of the lease require payments of R$48,555 each January 1, starting January 1, 2022. The crane has an estimated life of 7 years, a fair value of R$240,000, and a cost to Cleveland of R$240,000. The estimated fair value of the crane is expected to be R$45,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and the crane is not a specialized asset. Both Cleveland and Abriendo adjust and close books annually at December 31. Collectibility of the lease payments is probable. Abriendo's incremental borrowing rate is 8%, and Cleveland's implicit interest rate of 8% is known to Abriendo. Instructions a. Identify the type of lease involved and give reasons for your…

- On January 1, 2021, Yancey, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $6,000,000; however, the book value to Holt is $4,950,000.(c) The building has an estimated economic life of 10 years, with no residual value. Yancey depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Yancey’s incremental borrowing rate is 11% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yancy (f) The yearly rental payment…On 1 July 2019, Cars Limited signed a 7-year non-cancelable lease for equipment that requires equal rental payment of $3,500,000 at the beginning of each year. The equipment has a fair value at the inception of the lease of $15,000,000, an estimated useful life of 10 years and no residual value. The lease does not transfer title or contain a bargain-purchase option. The Cars Limited’s incremental borrowing rate is 15% and PVIFA (n=7, i=15%) is 4.1604. RequiredIndicate and explain the type of lease Cars Limited signed in 2019. Include a separate analysis for the scenarios where Cars Limited is the lessee and lessor.Crane Leasing Limited, which has a fiscal year end of October 31 and follows IFRS 16, signs an agreement on January 1, 2020, to lease equipment to Irvine Limited. The following information relates to the agreement. 1. The term of the non-cancellable lease is six years, with no renewal option. The equipment has an estimated economic life of eight years. 2. The asset’s cost to Crane, the lessor, is $314,000. The asset’s fair value at January 1, 2020, is $314,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $45,374, which is not guaranteed. 4. Irvine Limited, the lessee, assumes direct responsibility for all executory costs. 5. The agreement requires equal annual rental payments, beginning on January 1, 2020. 6. Collectibility of the lease payments is reasonably predictable. There are no important uncertainties about costs that have not yet been incurred by the lessor.…