on tax debate heats up in Montpelier VT monters are debating the pros and cons of a state carbon tax-a ne- tate. Backers say the tax revenue would be used to cut other taxes va graph of the market for gasoline in Vermont to show the "pro" an graph shows the market for gasoline in Vermont when there is no c w a point that shows the market equilibrium. Label it 1. nsport that uses gasoline creates emissions pollution, and the quant reases. Draw the marginal social cost curve and label the curve. raw a point at the efficient market outcome. Label it 2. ow suppose the government places a carbon tax on gasoline equal to ansport. raw an arrow at the efficient quantity to show the tax that delivers the

on tax debate heats up in Montpelier VT monters are debating the pros and cons of a state carbon tax-a ne- tate. Backers say the tax revenue would be used to cut other taxes va graph of the market for gasoline in Vermont to show the "pro" an graph shows the market for gasoline in Vermont when there is no c w a point that shows the market equilibrium. Label it 1. nsport that uses gasoline creates emissions pollution, and the quant reases. Draw the marginal social cost curve and label the curve. raw a point at the efficient market outcome. Label it 2. ow suppose the government places a carbon tax on gasoline equal to ansport. raw an arrow at the efficient quantity to show the tax that delivers the

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter4: Supply And Demand: An Initial Look

Section: Chapter Questions

Problem 4DQ

Related questions

Question

Transcribed Image Text:Carbon tax debate heats up in Montpelier VT

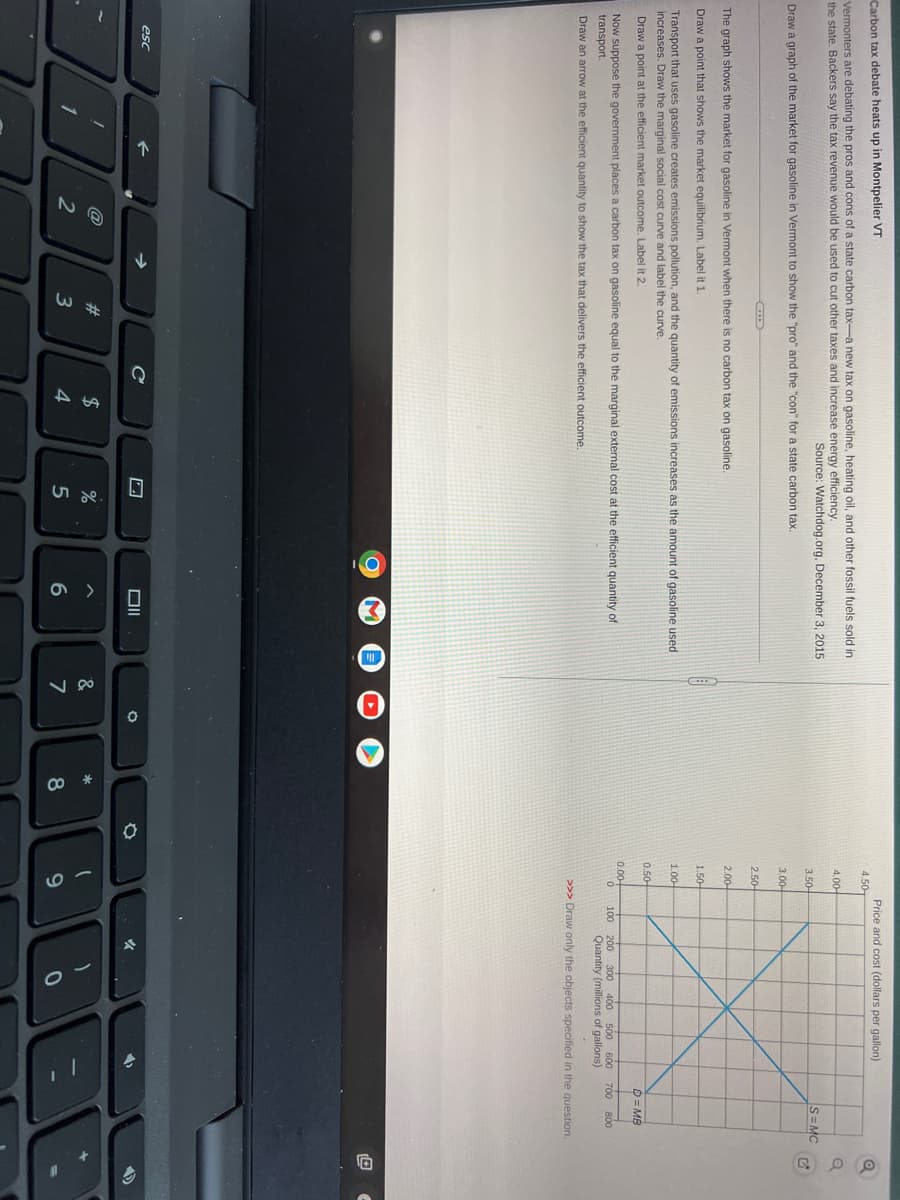

Vermonters are debating the pros and cons of a state carbon tax-a new tax on gasoline, heating oil, and other fossil fuels sold in

the state. Backers say the tax revenue would be used to cut other taxes and increase energy efficiency.

Source: Watchdog.org, December 3, 2015

Draw a graph of the market for gasoline in Vermont to show the "pro" and the "con" for a state carbon tax.

The graph shows the market for gasoline in Vermont when there is no carbon tax on gasoline.

Draw a point that shows the market equilibrium. Label it 1

Transport that uses gasoline creates emissions pollution, and the quantity of emissions increases as the amount of gasoline used

increases. Draw the marginal social cost curve and label the curve.

Draw a point at the efficient market outcome. Label it 2.

Now suppose the government places a carbon tax on gasoline equal to the marginal external cost at the efficient quantity of

transport.

Draw an arrow at the efficient quantity to show the tax that delivers the efficient outcome.

esc

106

2

*3

$

4

A

25

%

Oll

6

&

7

O

*

8

O

4.50

4,00

3.50-

3.00-

2.50

2.00

1.50-

0.50

0.00€

(

Price and cost (dollars per gallon)

9

100 200 300 400 500 600

Quantity (millions of gallons)

>>> Draw only the objects specified in the question.

1

O

S=MC

1'

D=MB

700 800

Q

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning