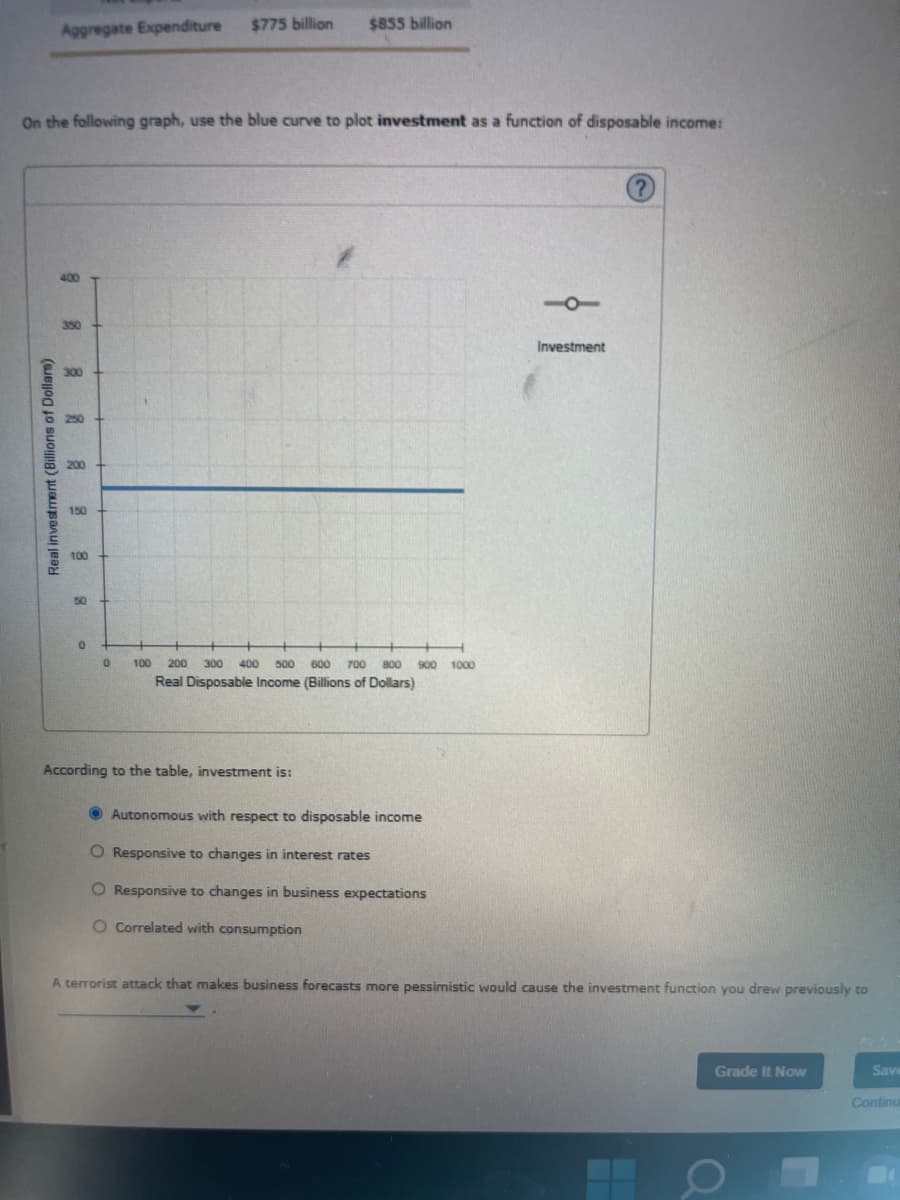

On the following graph, use the blue curve to plot investment as a function of disposable income: According to the table, investment is: a. Autonomous with respect to disposable income b. Responsive to changes in interest rates c. Responsive to changes in business expectations d. Correlated with consumption A terrorist attack that makes business forecasts more pessimistic would cause the investment function you drew previously to a. Slope upward b. Shift up c. Shift down d. Slope downward

On the following graph, use the blue curve to plot investment as a function of disposable income: According to the table, investment is: a. Autonomous with respect to disposable income b. Responsive to changes in interest rates c. Responsive to changes in business expectations d. Correlated with consumption A terrorist attack that makes business forecasts more pessimistic would cause the investment function you drew previously to a. Slope upward b. Shift up c. Shift down d. Slope downward

Chapter9: Aggregate Demand

Section: Chapter Questions

Problem 1.1P

Related questions

Question

On the following graph, use the blue curve to plot investment as a function of disposable income:

According to the table, investment is:

a. Autonomous with respect to disposable income

b. Responsive to changes in interest rates

c. Responsive to changes in business expectations

d. Correlated with consumption

A terrorist attack that makes business forecasts more pessimistic would cause the investment function you drew previously to

a. Slope upward

b. Shift up

c. Shift down

d. Slope downward

Transcribed Image Text:Aggregate Expenditure

Real investment (Billions of Dollars)

On the following graph, use the blue curve to plot investment as a function of disposable income:

400

300

200

150

100

150

0

$775 billion

0

$855 billion

100 200 300 400 500 600 700 800 900 1000

Real Disposable Income (Billions of Dollars)

According to the table, investment is:

Autonomous with respect to disposable income

O Responsive to changes in interest rates

O Responsive to changes in business expectations

O Correlated with consumption

Investment

A terrorist attack that makes business forecasts more pessimistic would cause the investment function you drew previously to

Grade It Now

Save

Continu

Transcribed Image Text:CENGAGE | MINDTAP

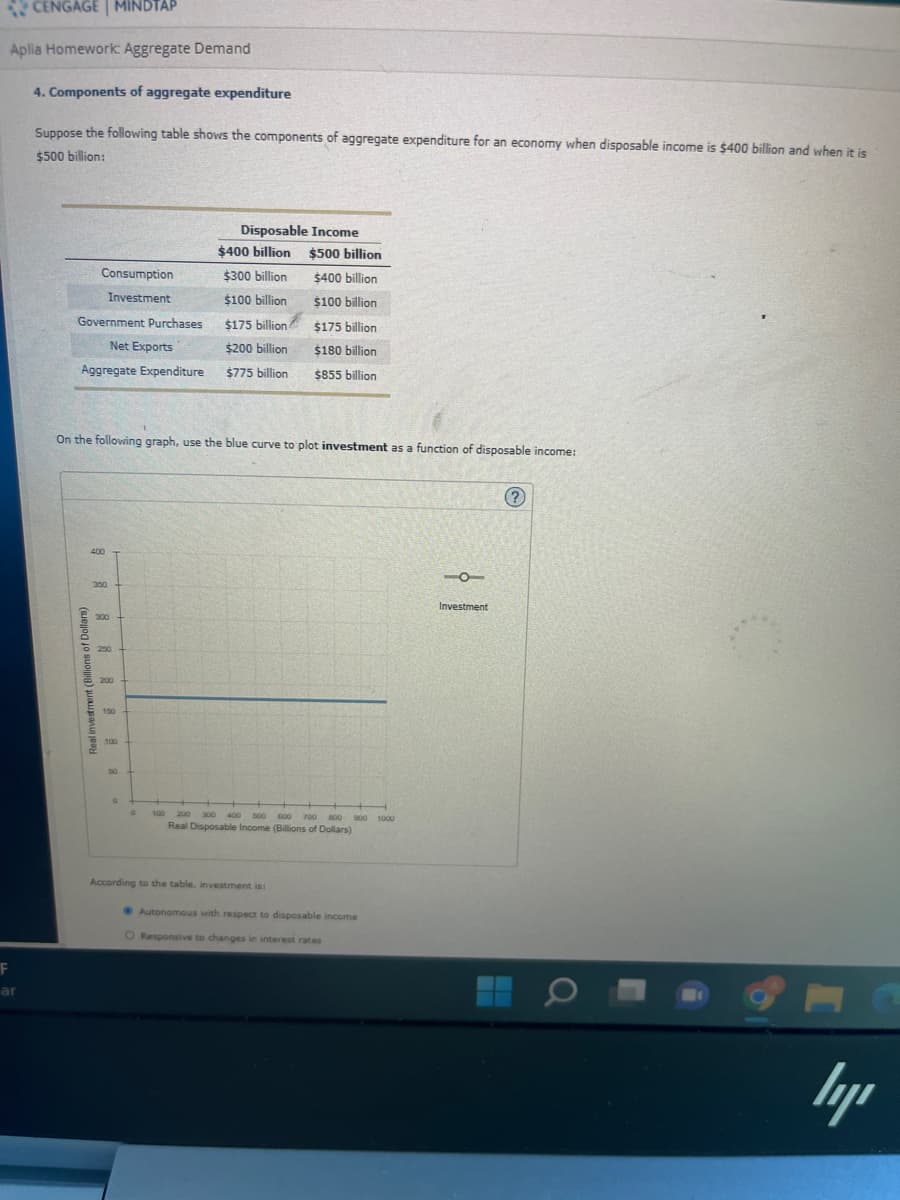

Aplia Homework: Aggregate Demand

4. Components of aggregate expenditure

Suppose the following table shows the components of aggregate expenditure for an economy when disposable income is $400 billion and when it is

$500 billion:

F

ar

Consumption

Investment

Government Purchases

Net Exports

Aggregate Expenditure

Real investment (Billions of Dollars)

400

350

On the following graph, use the blue curve to plot investment as a function of disposable income:

300

250

200

150

100

Disposable Income

0

$400 billion

$300 billion

$100 billion

$175 billion

$200 billion

$775 billion

$500 billion

$400 billion

$100 billion

$175 billion

$180 billion

$855 billion

According to the table, investment is:

100 200 300 400 500 600 700 800 900 1000

Real Disposable Income (Billions of Dollars)

Autonomous with respect to disposable income

O Responsive to changes in interest rates

10

Investment

(?)

ly

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc