ONLY SOLVE C,D,F WITHOUT USING SHORTCUTS AND EXCEL PLEASE SOLVE USING FORMULA MANUALLY.

ONLY SOLVE C,D,F WITHOUT USING SHORTCUTS AND EXCEL PLEASE SOLVE USING FORMULA MANUALLY.

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 7FPE

Related questions

Question

ONLY SOLVE C,D,F WITHOUT USING SHORTCUTS AND EXCEL PLEASE SOLVE USING FORMULA MANUALLY.

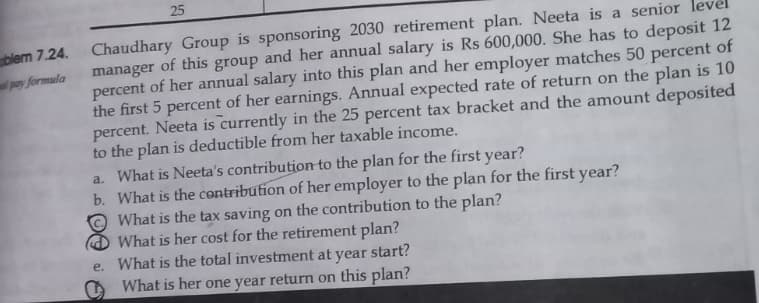

Transcribed Image Text:blem 7.24.

pay formula

25

Chaudhary Group is sponsoring 2030 retirement plan. Neeta is a senior

manager of this group and her annual salary is Rs 600,000. She has to deposit 12

percent of her annual salary into this plan and her employer matches 50 percent of

the first 5 percent of her earnings. Annual expected rate of return on the plan is 10

percent. Neeta is currently in the 25 percent tax bracket and the amount deposited

to the plan is deductible from her taxable income.

a. What is Neeta's contribution to the plan for the first year?

b. What is the contribution of her employer to the plan for the first year?

What is the tax saving on the contribution to the plan?

What is her cost for the retirement plan?

e. What is the total investment at

year

start?

What is her one year return on this plan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT