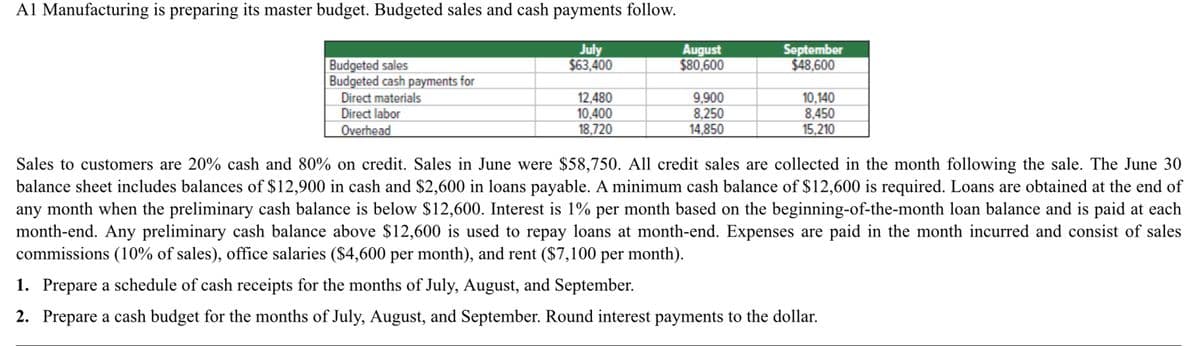

augeted salv Budgeted sales Budgeted cash payments for Direct materials Direct labor Overhead July $63,400 12,480 10,400 18,720 August $80,600 9,900 8,250 14.850 September $48.600 10,140 8,450 15,210 Sales to customers are 20% cash and 80% on credit. Sales in June were $58,750. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $12,900 in cash and $2,600 in loans payable. A minimum cash balance of $12,600 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $12,600. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. Any preliminary cash balance above $12,600 is used to repay loans at month-end. Expenses are paid in the month incurred and consist of sales commissions (10% of sales), office salaries ($4,600 per month), and rent ($7,100 per month). 1. Prepare a schedule of cash receipts for the months of July, August, and September. 2. Prepare a cash budget for the months of July, August, and September. Round interest payments to the dollar.

augeted salv Budgeted sales Budgeted cash payments for Direct materials Direct labor Overhead July $63,400 12,480 10,400 18,720 August $80,600 9,900 8,250 14.850 September $48.600 10,140 8,450 15,210 Sales to customers are 20% cash and 80% on credit. Sales in June were $58,750. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $12,900 in cash and $2,600 in loans payable. A minimum cash balance of $12,600 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $12,600. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. Any preliminary cash balance above $12,600 is used to repay loans at month-end. Expenses are paid in the month incurred and consist of sales commissions (10% of sales), office salaries ($4,600 per month), and rent ($7,100 per month). 1. Prepare a schedule of cash receipts for the months of July, August, and September. 2. Prepare a cash budget for the months of July, August, and September. Round interest payments to the dollar.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 72P: Cash Budget The controller of Feinberg Company is gathering data to prepare the cash budget for...

Related questions

Question

100%

Transcribed Image Text:Al Manufacturing is preparing its master budget. Budgeted sales and cash payments follow.

July

$63,400

Budgeted sales

Budgeted cash payments for

Direct materials

Direct labor

Overhead

12,480

10,400

18,720

August

$80,600

9,900

8,250

14,850

September

$48,600

10,140

8,450

15,210

Sales to customers are 20% cash and 80% on credit. Sales in June were $58,750. All credit sales are collected in the month following the sale. The June 30

balance sheet includes balances of $12,900 in cash and $2,600 in loans payable. A minimum cash balance of $12,600 is required. Loans are obtained at the end of

any month when the preliminary cash balance is below $12,600. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each

month-end. Any preliminary cash balance above $12,600 is used to repay loans at month-end. Expenses are paid in the month incurred and consist of sales

commissions (10% of sales), office salaries ($4,600 per month), and rent ($7,100 per month).

1. Prepare a schedule of cash receipts for the months of July, August, and September.

2. Prepare a cash budget for the months of July, August, and September. Round interest payments to the dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning