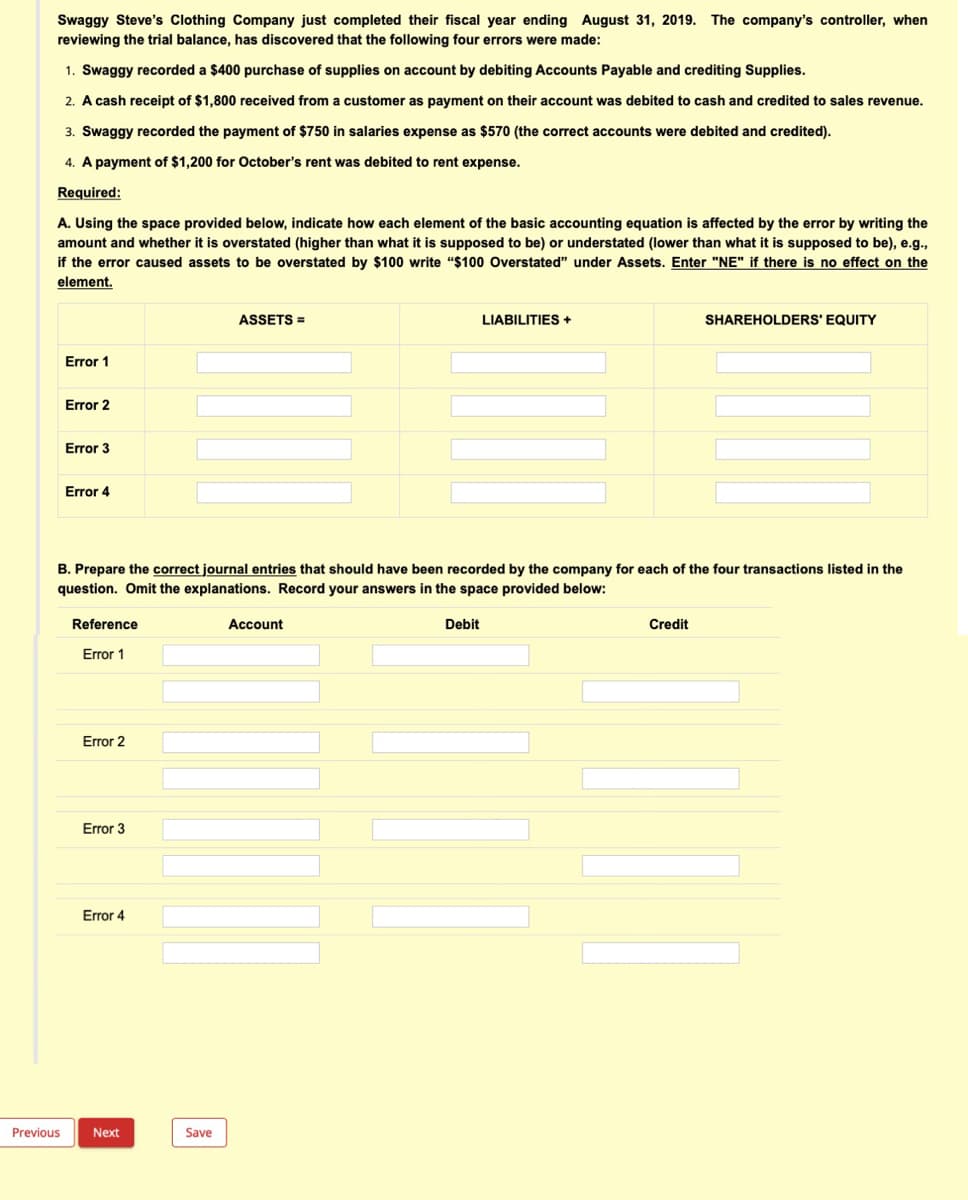

Swaggy Steve's Clothing Company just completed their fiscal year ending August 31, 2019. The company's controller, when reviewing the trial balance, has discovered that the following four errors were made: 1. Swaggy recorded a $400 purchase of supplies on account by debiting Accounts Payable and crediting Supplies. 2. A cash receipt of $1,800 received from a customer as payment on their account was debited to cash and credited to sales revenue. 3. Swaggy recorded the payment of $750 in salaries expense as $570 (the correct accounts were debited and credited). 4. A payment of $1,200 for October's rent was debited to rent expense. Required: A. Using the space provided below, indicate how each element of the basic accounting equation is affected by the error by writing the amount and whether it is overstated (higher than what it is supposed to be) or understated (lower than what it is supposed to be), e.g., if the error caused assets to be overstated by $100 write "$100 Overstated" under Assets. Enter "NE" if there is no effect on the element.

Swaggy Steve's Clothing Company just completed their fiscal year ending August 31, 2019. The company's controller, when reviewing the trial balance, has discovered that the following four errors were made: 1. Swaggy recorded a $400 purchase of supplies on account by debiting Accounts Payable and crediting Supplies. 2. A cash receipt of $1,800 received from a customer as payment on their account was debited to cash and credited to sales revenue. 3. Swaggy recorded the payment of $750 in salaries expense as $570 (the correct accounts were debited and credited). 4. A payment of $1,200 for October's rent was debited to rent expense. Required: A. Using the space provided below, indicate how each element of the basic accounting equation is affected by the error by writing the amount and whether it is overstated (higher than what it is supposed to be) or understated (lower than what it is supposed to be), e.g., if the error caused assets to be overstated by $100 write "$100 Overstated" under Assets. Enter "NE" if there is no effect on the element.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter3: The General Journal And The General Ledger

Section: Chapter Questions

Problem 6E: The bookkeeper for Nevado Company has prepared the following trial balance: The bookkeeper has asked...

Related questions

Question

Transcribed Image Text:Swaggy Steve's Clothing Company just completed their fiscal year ending August 31, 2019. The company's controller, when

reviewing the trial balance, has discovered that the following four errors were made:

1. Swaggy recorded a $400 purchase of supplies on account by debiting Accounts Payable and crediting Supplies.

2. A cash receipt of $1,800 received from a customer as payment on their account was debited to cash and credited to sales revenue.

3. Swaggy recorded the payment of $750 in salaries expense as $570 (the correct accounts were debited and credited).

4. A payment of $1,200 for October's rent was debited to rent expense.

Required:

A. Using the space provided below, indicate how each element of the basic accounting equation is affected by the error by writing the

amount and whether it is overstated (higher than what it is supposed to be) or understated (lower than what it is supposed to be), e.g.,

if the error caused assets to be overstated by $100 write "$100 Overstated" under Assets. Enter "NE" if there is no effect on the

element.

ASSETS =

LIABILITIES +

SHAREHOLDERS' EQUITY

Error 1

Error 2

Error 3

Error 4

B. Prepare the correct journal entries that should have been recorded by the company for each of the four transactions listed in the

question. Omit the explanations. Record your answers in the space provided below:

Reference

Account

Debit

Credit

Error 1

Error 2

Error 3

Error 4

Previous

Next

Save

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning