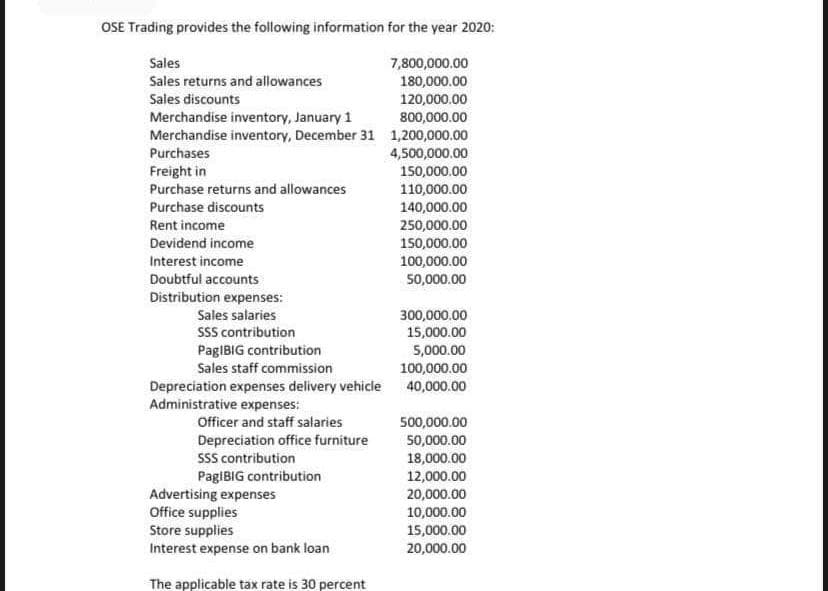

OSE Trading provides the following information for the year 2020: Sales Sales returns and allowances Sales discounts 7,800,000.00 180,000.00 120,000.00 Merchandise inventory, January 1 800,000.00 Merchandise inventory, December 31 1,200,000.00 Purchases 4,500,000.00 150,000.00 110,000.00 140,000.00 250,000.00 150,000.00 Freight in Purchase returns and allowances Purchase discounts Rent income Devidend income Interest income Doubtful accounts Distribution expenses: Sales salaries SSS contribution PagIBIG contribution Sales staff commission Depreciation expenses delivery vehicle Administrative expenses: Officer and staff salaries Depreciation office furniture SSS contribution PagIBIG contribution Advertising expenses Office supplies Store supplies Interest expense on bank loan The applicable tax rate is 30 percent 100,000.00 50,000.00 300,000.00 15,000.00 5,000.00 100,000.00 40,000.00 500,000.00 50,000.00 18,000.00 12,000.00 20,000.00 10,000.00 15,000.00 20,000.00

OSE Trading provides the following information for the year 2020: Sales Sales returns and allowances Sales discounts 7,800,000.00 180,000.00 120,000.00 Merchandise inventory, January 1 800,000.00 Merchandise inventory, December 31 1,200,000.00 Purchases 4,500,000.00 150,000.00 110,000.00 140,000.00 250,000.00 150,000.00 Freight in Purchase returns and allowances Purchase discounts Rent income Devidend income Interest income Doubtful accounts Distribution expenses: Sales salaries SSS contribution PagIBIG contribution Sales staff commission Depreciation expenses delivery vehicle Administrative expenses: Officer and staff salaries Depreciation office furniture SSS contribution PagIBIG contribution Advertising expenses Office supplies Store supplies Interest expense on bank loan The applicable tax rate is 30 percent 100,000.00 50,000.00 300,000.00 15,000.00 5,000.00 100,000.00 40,000.00 500,000.00 50,000.00 18,000.00 12,000.00 20,000.00 10,000.00 15,000.00 20,000.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

REQUIRED: PREPARE A STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR USING THE FOLLOWING METHOD: • NATURE OF EXPENSE WITH SUPPORTING NOTES

Transcribed Image Text:OSE Trading provides the following information for the year 2020:

Sales

7,800,000.00

Sales returns and allowances

180,000.00

Sales discounts

120,000.00

800,000.00

Merchandise inventory, January 1

Merchandise inventory, December 31 1,200,000.00

Purchases

4,500,000.00

Freight in

Purchase returns and allowances

Purchase discounts

Rent income

Devidend income

Interest income

Doubtful accounts

Distribution expenses:

Sales salaries

SSS contribution

PagIBIG contribution

Sales staff commission

Depreciation expenses delivery vehicle

Administrative expenses:

Officer and staff salaries

Depreciation office furniture

SSS contribution

PagIBIG contribution

Advertising expenses

Office supplies

Store supplies

Interest expense on bank loan

The applicable tax rate is 30 percent

150,000.00

110,000.00

140,000.00

250,000.00

150,000.00

100,000.00

50,000.00

300,000.00

15,000.00

5,000.00

100,000.00

40,000.00

500,000.00

50,000.00

18,000.00

12,000.00

20,000.00

10,000.00

15,000.00

20,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning