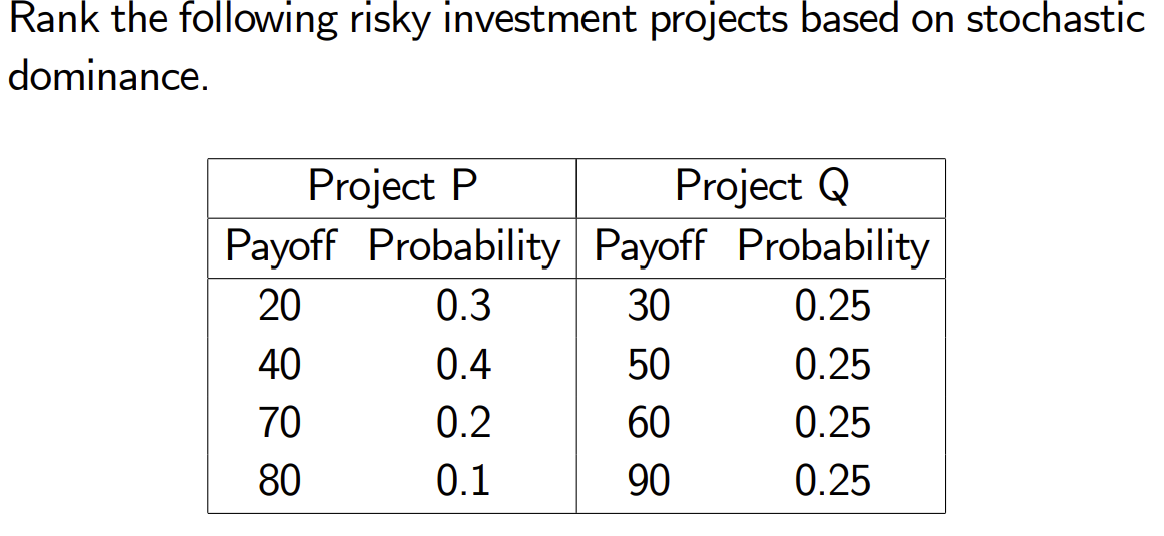

Rank the following risky investment projects based on stochastic dominance. Project P Payoff Probability Payoff Probability Project Q 20 0.3 30 0.25 40 0.4 50 0.25 70 0.2 60 0.25 80 0.1 90 0.25

Q: In Shiller’s terminology, what are ex post stock prices?

A: The intrinsic value of the stock could be higher or lower. The stock investor's purpose is to find…

Q: The SWEET Corp. is considering the purchase of a new piece of equipment. The cost savings from the…

A: The IRR is the rate which equates the Present value of Cash Outflow to Present value of Cash Inflow.…

Q: 12)) The price of $6050 face value commercial paper is $5900. If the annualized investment rate is…

A: Commercial paper is a form of uninsured debt security issued by firms to support payrolls, accounts…

Q: Carol has two job offers.One pays $655 per week, and the other pays $2,800 per month. Which is the…

A: As the given offers are not comparable, we can convert them into annual terms. Option 1 : $655…

Q: up to $700 monthly in order to repay the loan. Determine if it is enough for him to agree on this…

A: Loan payment: These represent periodic payments made by the borrower to the lender for the purpose…

Q: 6. Find the amount at the end of 15 years if P 55 000 is invested at an interest rate of 5%…

A: Initial investment (I) = ₱55,000 Interest rate for first 10 year = 0.05 Semiannual interest rate for…

Q: 1. Use MS Excel to determine the Present Worth of the following cash-flow diagram: a) At 7%, PW = b)…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: A 11-year, semiannual coupon bond sells for $938.52. The bond has a par value of $1,000 and a yield…

A: Price of the bond (P0) = $938.52 Maturity value of the bond (Z) = $1000 Semiannual yield to maturity…

Q: ctly negatively correlated risky securities A and B. A has an expected rate of return of 12% and a…

A: A minimal variance portfolio is a strategy for maximising returns while minimising risk.It entails…

Q: If the risk-free rate is 2.2 percent, the inflation rate is 1.9 percent, and the market rate of…

A: The risk premium on the U.S. Treasury bond will be zero as it is backed by US government and as…

Q: Using the corporate valuation model approach, what should be the company's stock price today?

A: Free cash flow = (EBIT*(1-T)) + Depreciation exp. - Capital expenditure - Changes in working capital…

Q: AIX Investment Group considers two alternative portfolios. The risk and return characteristics of…

A: A risk adjusted return is the profit earned in an investment after taking the risk associated to it…

Q: Art purchase a house and lot worth ₱1,410,000, he made a down payment of ₱150, 000 and the remaining…

A: A home loan taken from a bank or a financial institution is termed as mortgage. The home and the…

Q: Identify which anti-hostile takeover strategies are being described. [S1] A merger will only push…

A: When a prospective merger or acquisition needs to be thwarted then there are several anti-hostile…

Q: Find the present value of $800 due in the future under each of the following conditions. Do not…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Larry wants to make a decision on a six- year amortized loan for him to buy a new car. The value of…

A: Maximum amount of loan that Larry can pay in 6 years will be equal to the the present value of…

Q: Tax evasion and tax avoidance costs the UK government £34 billion a year.” In the light of the above…

A: Tax evasion: One sign of tax evasion is the amount of unreported income, which is the difference…

Q: An analyst is studying the movement of the stock ABC. His research and came up with a different…

A: Probability of Economic conditions; Strong (Ps) = 0.30 Normal (Pn) = 0.50 Weak (Pw) = 0.20 Rate…

Q: The company DstriBut.inc decides to take a technological shift by replacing its old distribution…

A: NPV NPV is a capital budgeting tool to decide on whether the capital project should be accepted or…

Q: Assume the Black-Scholes framework holds. Consider an option on a stock. You are given the following…

A: Here, Stock Price is 50 Option Price is 3.00 Option Delta is 0.611 Option Gamma is 0.020 Option…

Q: 1) If you deposit $4,000 today in a bank account and the interest is compounded annually at 10…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Henry purchased a stock for $45 a share, held it for one year, received a $2.34 dividend, and sold…

A: To calculate the rate of return we will use the following formula Rate of return = [D+(P1-P0)]/P0…

Q: What is the variance of returns for Security ABC

A: In finance we use variance of returns as a measure of risk that is inherent in a stock or a…

Q: Which of the following statements is false? A. Asset-backed securities (ABS) may be backed by…

A: A financial asset-backed securities (ABS) is a form of financial investment that is backed by a pool…

Q: Rudolf Company had the following items in its “Cash and cash equivalents” account as of December 31,…

A: Cash and Cash Equivalent majorly includes 1) Cash in Hand 2) Cash at Bank 3) Short Term investment (…

Q: Would you rather receive $1,000 now and $2,000 in two years or $2,500 in one year, using a 4%…

A: Present value = C0 + (C1 * (1+r)-1) + (C2*(1+r)-2) Where C0 = Cash flow year 0 C1 = Cash flow year 1…

Q: What is standard deviation? What type of risk does it measure

A: Standard deviation measures the risk of an investment regarding how it will fluctuate or deviate…

Q: You are considering buying a stock that will pay a dividend of $2.3 next year. The dividend is…

A: To calculate the stock price we will use the following formula Stock price = D1/(R-G) Where D1-…

Q: in facility for a short sale, Stella sold 200 lots of TULIPS shares at a price of $7,000. Initial…

A: When you short sell the stock than you will get profit if prices goes below the selling price of…

Q: A venture will provide a net cash inflow of $57,000 in Year 1. The annual cash flows are projected…

A: Year 1 cash inflow = $57,000 Required return = 0.156 Initial cost = $739,000 Growth rate to break…

Q: The rationales of Corporate Parents. Explain styles of Parenting – where do they potentially add or…

A: A corporate parent is a label given to an organization or someone with unique obligations for the…

Q: ABC Inc expects to have EPS (earning per share) of $5 in the coming year. The firms plan to pay all…

A: EPS next year = $5 All earning is paid as dividend, hence growth rate (g) = 0 Dividend next year…

Q: Find the following values, using the equations, and then work the problems using a financial…

A: The concept of the time value of money states that the same amount of money has more value today…

Q: The YTM on a three year bond is 5%. What is the average expected short rate over the life of the…

A: The yield to maturity (YTM) is the annual percentage rate of return on a bond provided the investor…

Q: The future value of $3000 deposited a year of 4 years earning 6 percent would be

A: The question is related to Time Value of money. Future Value is the value at some future time of a…

Q: Suppose Watch-Over-Ya Corp's projected free cash flow for next year is FCF1 = $500,000 and FCF is…

A: Value of operations is the present value of future cash inflow, and value of stock may be calculated…

Q: A waitress's base wage is $11 per hour, plus 10% automatic gratuity for all tables served. If she…

A: Gratuity is a benefit paid by an employer to their employee for services rendered.

Q: A tractor was purchased for $74486 and at the bank interest rate of 4.67% per year. The residual…

A: Compound interest is interest charged on a loan or deposit. It is the most widely utilized idea in…

Q: National Co. has portfolio consist of three shares below: Stock Investment Beta АВС 140,000 1.45 CDE…

A: Stock Investment Beta ABC 140000 1.45 CDE 75000 1.2 EFG 160000 0.7

Q: Suppose you invest into Fund X for 15 months with a monthly interest rate of 8%. Each month you pay…

A: Future Value: It is the worth of a current asset at a future date based on an assumed rate of…

Q: Of all the money jars, which need to receive 50% of your income? A. Necessity B. Give C. Long-term…

A: After tax income you receive should not spend all income but should save the money for future and…

Q: With a decrease in time preference, the supply of loanable funds will increase. Select one: True…

A: Loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. There is an…

Q: There are many indicators that can be used to determine a community’s needs and resources. Which of…

A: The answer is option 4: Homeownership. Homeownership is not a community need and resource indicator.

Q: proposed new product. The land `costs P15,000,000, the building costs P30,000,000, the equipment…

A: Capital budgeting is a financial commitment as well as an investment.By applying active, the…

Q: Ritter Sports Industries has preferred stock outstanding with a par value of $100. The stock pays a…

A: To calculate the effective rate of return we will use below formula Effective rate of return =…

Q: A solid waste disposal company borrowed money at 10% pe and other equipment needed at the…

A: The principal amount would the present value of single payment done after 2 years considering the…

Q: is NOT a consideration for Cost of Capital? A. Invetsor requirements B. Size of the Company C. All…

A: Cost of capital is very important for the company and cost of capital will decide the value of…

Q: What is the dividend growth rate using the constant growth model

A: Constant Growth Model: This model assists in the evaluation of share. Another name of constant…

Q: poking to purchase a home that costs $ 160,000. The interest rate is currently at 3.7 %. payment…

A: Mortgage loans are paid by equal monthly payments that carry the payment of interest and payment of…

Q: A firm's current investment opportunity schedule and the weighted marginal cost of capital schedule…

A: Capital rationing: It is the demonstration of putting limitations on how much new ventures or tasks…

Step by step

Solved in 2 steps with 2 images

- Wolff Enterprises must consider several investment projects, A through E, using the capital asset pricing model (CAPM) and its graphical representation, the security market line (SML). Relevant information is presented in the following table ITEM RATE OF RETURN BETA Risk-free asset 9% 0.0 Market portfolio 14% 1.0 Project A - 1.5 Project B - 0.75 Project C - 2.00 Project D - 0.0 Project E - -0.50 Calculate (1) the required rate of return and (2) the risk premium for each project, given its level of nondiversifiable risk. Use your findings in part a to draw the security market line (required rate of return relative to nondiversifiable risk) Discuss the relative nondiversifiable risk of projects A through E. Assume that recent economic events have caused investors to become less risk-averse, causing the market return to decline to 12%. Calculate the new required returns fcor assets A through E and draw the new security market line on the same graph you drew for b. Compare your findings…Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. Item Rate of return Beta, b Risk-free asset 9% 0.00 Market portfolio 14% 1.00 Project 1.74 a. Calculate the required rate of return for the project, given its level of nondiversifiable risk. b. Calculate the risk premium for the project, given its level of nondiverisifiable risk.a. Find the expected return for each project. b. Find the proportion of funds in each project to achieve an expected portfolio return of 20%. (c) Calculate the correlation coefficient between projects A and B. d) Find the portfolio risk.

- Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. Item Rate of Return Beta, b Risk free asset 8% 0.00 Market Portfolio 13% 1.00 Project 1.12 The required rate of return for the project is? THe risk premium for the price is?Your firm is considering what has been estimated to be a positive NPV project (NPV > 0). What can you say or infer about the project's payback period, discounted payback method, IRR, profitability index, and accounting rate of return?. Suppose that your organization wants to decide which one of the given two projects can be selected for the development, as summarized in the following table. Calculate the Expected Monetary Value (EMV) for each project and suggest which project can be selected? Probability of occurrence of risk/opportunity (Impact) Estimated Profits/Losses Project 1 40% $140000 60% -$60000 Project 2 80% $40000 20% -$8000

- Supposing the return from an investment has the following probability distribution Return Probability R (%) 8 0.2 10 0.2 12 0.5 14 0.1 Required: What is the expected return of the investment? What is the risk as measured by the standard deviation of expected returns?Calculate the expected return for an investment with the following probability distribution. Return (%) Probability (%) -10 20 5 20 10 20 17 30 26 10You are considering Project A, with the following information (Assume all statistics given are correct): Economy Probability of Rates of Return ____ Condition State Occurring Project A Market T-Bill Bad 0.2 3.0% 0.0% 4.82% Average 0.4 10.0% 8.0% 4.82% Good 0.4 15.0% 12.0% 4.82% Expected return 10.6% 8.0% 4.82% Standard deviation 5.72% 4.38% 0% Correlation Coefficient between…

- Suppose the net present values of projects A and B show a distribution as follows. Net Present Value (TL) 750 1000 1250 1500 1750 Project A 0.1 0.15 0.2 0.25 0.3 Project B 0.15 0.25 0.3 0.1 0.2 a) Compare the projects according to the expected value criteria? b) Compare the projects by standard deviation criteria? c) Evaluate A and B projects according to the coefficient of variation criteria?Consider the following information about the various states of economy and the returns ofvarious investment alternatives for each scenario. Answer the questions that follow.% Return on T-Bills, Stocks and MarketIndexState of the Economy Probability TBills Phillips PayupRubbermadeMarketIndexRecession 0.2 7 -22 28 10 -13Below Average 0.1 7 -2 14.7 -10 1Average 0.3 7 20 0 7 15Above Average 0.3 7 35 -10 45 29Boom 0.1 7 50 -20 30 43MeanStandard DeviationCoefficient of VariationCovariance with MPCorrelation with Market IndexBetaCAPM Req. ReturnValuation(Overvalued/Undervalued/FairlyValued)Nature of stock(Aggressive/Defensive)Question 1 Fill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Each line item is worth 2 marksQuestion 2 Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and…Consider the following information about the various states of economy and the returns ofvarious investment alternatives for each scenario. Answer the questions that follow.% Return on T-Bills, Stocks and MarketIndexState of the Economy Probability TBills Phillips PayupRubbermadeMarketIndexRecession 0.2 7 -22 28 10 -13Below Average 0.1 7 -2 14.7 -10 1Average 0.3 7 20 0 7 15Above Average 0.3 7 35 -10 45 29Boom 0.1 7 50 -20 30 43MeanStandard DeviationCoefficient of VariationCovariance with MPCorrelation with Market IndexBetaCAPM Req. ReturnValuation(Overvalued/Undervalued/FairlyValued)Nature of stock(Aggressive/Defensive)Question 1 Fill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Question 2 Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML? d) If an…