ould accept the factoring service offered by Powell. What use should the company make of any finance provided by

Q: 17. Late in Year One, a company buys one share of a publicly traded company for P75. This investment…

A: correct option with proper explanation are as follows

Q: A bond has an annual coupon of 67%, which makes semiannual payments. The next payment is 2 months…

A: Bonds clean price is the quoted price of the bond and it does not include accrued interest between…

Q: On January 1, 2020, PQR Company purchased 40,000 shares of Frank, Inc. at P100 per share. The…

A: Initial measurement of investment: Initially, the value of an investment property is determined by…

Q: Need help with accounting review

A: According to the accounting equation, a company's total assets are equal to the sum of its…

Q: On January 1, 2022, Villanueva Company classified noncurrent assets as held for sale that had a…

A: As per provisons of PFRS on the assets held for sale, when the asset fulfils the conditions for held…

Q: Discuss with examples, what are substantive audit procedures.

A: Audit procedures are processes taken by auditors to obtain all information regarding the quality of…

Q: In the income statement restated to current cost, what the inventory sold for the current year? 3.…

A: Dear student, as per bartleby guidelines we are supposed to answer only first 3 subparts. Kindly…

Q: the ABCD partnership on their 2020 income tax returns?

A:

Q: Peter's Tasty Chip Company Ltd manufactures potato chips. Suppose the company's January records…

A: Manufacturing overheads are all indirect costs incurred to manufacture a product. Example- Factory…

Q: Exercise 3 – 9. Net Income distribution and computation of partner's capital balance On July 1,…

A: The question is related to Partnership Accounting. First we will prepare Profit and Loss…

Q: If the ending inventory is valued at $80, what inventory cost flow assumption was usec O A. Average…

A: Introduction:- Inventory valuation methods used find out amount of value unsold inventory stock at…

Q: Materials are added at the beginning of the production process and ending work in process inventory…

A: A production cost report is a report which calculates and presents the total cost of production in a…

Q: On july 16, 2021, Empe exchanged a land for 15,000 ordinary shares of RH corporation to be held for…

A:

Q: state the assets, liabilities, and owners equity as of March 1 in equation similiar to that shown in…

A: Accounting equation is built on the foundation of Double-entry accounting system. As per Accounting…

Q: On December 31, 2019, an entity leased two automobiles for executive use. The lease required the…

A: Lease Liability: Lease liability is defined as a compulsion to pat leasing fees to the person who is…

Q: Required: Calculate Via Gelato revenue and spending variances for June. (Indicate the effect of each…

A: Variance refers to those deviation which is used to determine the difference between the actual…

Q: 1.) How much is adjusted Interest Expense on December 31, 2021? - 37,500 2.) How much is adjusted…

A: An adjusting entry is an entry made to assign the right amount of revenue and expenses to each…

Q: d 8,000 Sales revenue ₱7,200,000 Variable costs ₱4,000,000 Fixed costs…

A: To calculate the no of units to be sold to earn target profit, the contribution margin per unit is…

Q: 5. The adjusting entry to record bad debts: a. may either debit or credit bad debts expense b. may…

A: Bad debts are the debts which cannot be recovered and hence need to be written off. These are the…

Q: What should be reported in a hyper-inflationary statement of financial position prepared on December…

A: Carrying amount of the asset is the value of the asset which has been computed and determined by the…

Q: Using the following information about Sophie's business, answer the following question Credit Month…

A: Cash payment refers to the amount paid through the recipient of the goods and the services to the…

Q: ly at a total price of P7,000 per unit. The company also incurred actual repair costs of P3,500,000…

A: Warranty means the undertaking given by the company selling the goods that in case of any defect ,…

Q: Wage and Tax Statement Data on Efipioyel FICA Ehrlich Co. began business on January 2, 20Y8.…

A: A tax is a governmental organization's mandatory financial obligation or other form of levy enforced…

Q: Thomas Company is issuing 4 000 ordinary shares, payable by instalments. Investors must pay $10 per…

A: option c Debit cash, Credit Ordinary Share Capital

Q: Consider the following performance report for Jamie's Department Store for the month of October 2021…

A: Percentage increase in sales from Budget to Actual = (473,000 - 430,000)/430,000 = 10% Percentage…

Q: ty to dispose of the busine

A: Impairment loss is the result of decline in the fair market value of an asset than its carrying…

Q: How much is the unrealized gain that should be taken to profit or loss statement?

A:

Q: From the following details, calculate interest coverage ratio: Net Profit after tax $ 60,000; IS%…

A: The interest coverage ratio is calculating as EBIT divided by interest expense.

Q: Vhat is the correct amount of inventory?

A: amount of inventory = FG + cost + goods in process +material + factory supplies

Q: ousins Rohit and Shymal for several years in a business consulting firm. With the intense level of…

A: The answer has been mentioned below.

Q: On June 30, 2015, Gell-O Corp paid USD48 per share for 50,000 shares, representing a 25% ownership…

A: Since Gell-O Corp acquired 25%, ownership interest in Migs Company, it will be treated as investment…

Q: Kindly explain and give an example of Capital Gains Tax

A: Introduction:- The capital gains tax is a federal tax. It is charged on profit made from selling…

Q: Agustin Company has the following transactions relating to its investments during 2022. January 5 -…

A: Introduction:- The following basic information as follows under:- Shares held-for-trading means…

Q: Ahlia Industries allocates manufacturing overhead at a predetermined rate of 180% of direct labor…

A: The cost of goods manufactured includes the costs incurred during the period.

Q: Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The…

A: 1. Determination of overtime premium company would be willing to pay to keep the upholstery shop…

Q: The average price of a gallon of gas In 2018 Increased $0.30 (12.4 percent) from $242 in 2017 to…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: Exercise 3-5. Distribution of Net Income Luz, Olivia, Vera, and Ethel are partners of LOVE Trading…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Use Service-Output Method. A Machine costs ₱80,000 and an estimated life of 10 years with a salvage…

A: Introduction: Service Output Method also known as Working Hours Method. The formula for Working…

Q: Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted…

A: Journal entry is the primary step to record the transaction in the books of account. The debit and…

Q: Discuss the effect of the misstatement identified on the audit opinion.

A: Introduction: A misstatement is the variation between the necessary quantity, classification,…

Q: On January 1, year 1, P Company sold a machine for P900,000 to S Company, its wholly owned…

A:

Q: From the following details, calculate interest coverage ratio: Net Profit after tax $ 60,000; IS%…

A: The interest coverage ratio determines a firm's ability to pay interest on its outstanding debt.…

Q: 54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C.…

A: Capital gain refers to the concept where the profit earned on the asset sale which has increase in…

Q: Wendy ice cream factory is considering the purchase of a new machine. The machine would cost…

A: The question is related to Capital Budgeting. The Net Present Value is calculated with the help of…

Q: Vicki Vale operates a convenience store while at the same time offers bookkeeping services to her…

A: Taxable income is the one which is computed after deducting the expenses from the revenues. It also…

Q: Trail Balance of Mis ram and Sons Particulars Purchases Discount Allowed Dr.(Rs.) CrRs.) Particulars…

A: The financial statements of the business are income statement and balance sheet , which are prepared…

Q: of goods sold yergge inventory

A: Inventory turnover a financial ratio the no of times the inventory has been replaced during a given…

Q: ustrial machine costs $124000 and is expected to earn annual net cash inflows as per the following…

A: NPV if the business sets their required rate of return at 11% Year Cash flow DF@ 11% Discounted…

Q: ginning of curr with the follow lative preferenc a value P12, aut areş, P1,000,000

A: To find the amount of ordinary share and preference share as,

Q: In the long-term liabilities section of its balance sheet at December 31, 2016, Welington Company…

A: Lease refers to an agreement in order to rent an asset in exchange of periodic payments. The two…

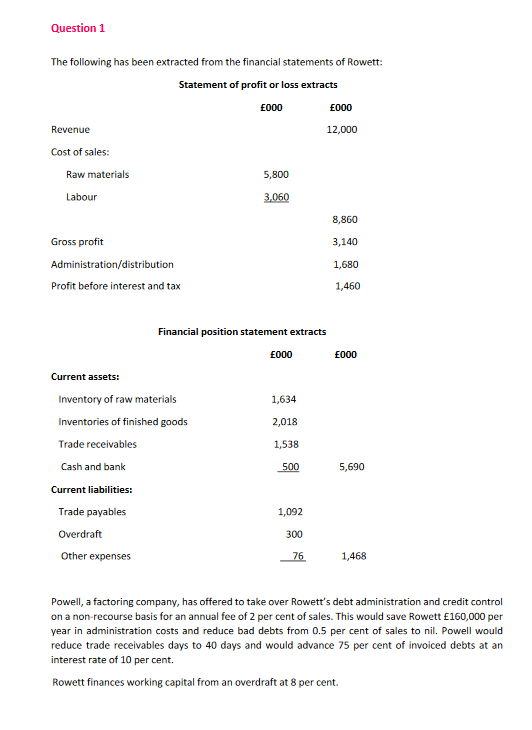

(b). Using the information given, assess whether Rowett should accept the factoring service offered

by Powell. What use should the company make of any finance provided by the factor?

Step by step

Solved in 2 steps

- Question The financial statements of Harry Ltd and its subsidiary Olivia Ltd have been extracted from their financial records at 30 June 2023 and are presented below. Harry Ltd$ Olivia Ltd$Sales 839 250 725 000Cost of goods sold (580 000) (297 500)Gross profit 259 250 427 500Dividends received 116 250 -Management fee revenue 33 125 Gain on sale of plant 43 750 Less Expenses Administration (38 500) (48 375)Depreciation (30 625) (71 000)Management fee - (33 125)Other expenses (126 375) (96 250)Profit before tax 256 875 178 750Tax expense (76 875) (52 750)Profit after tax 180 000 126 000Retained earnings 1 July 2022 399 250 299 000 579 250 425 000Dividends paid (171 750) (116 250)Retained earnings 30 June 2023 407 500 308 750 Statement of financial position Harry Ltd$ Olivia Ltd$Shareholders’ equity Retained earnings 407 500 308 750Share capital 437…Question 5The Income Statement and additional data of Crawford Properties, Inc., follows:CRAWFORD PROPERTIES Inc.Income StatementFor Year Ended June 30, 20X6Revenues:Sales revenue $237,000Expenses:Cost of goods sold $103,000Salary expense 58,000Depreciation expense 29,000Income taxes expense 9,000 199,000Net Income $38,000Additional data:a) Acquisition of plant assets is $116,000. Of this amount $101,000 is paid in cash and$15,000 by signing a note payable.b) Proceeds from sale of land total $24,000c) Proceeds from issuance of common stock total $30,000d) Payment of long-term note payable is $15,000e) Payment of dividends is $11,000f) From the balance sheet30/6/X 6 30/6/X 5Current Assets:Cash & cash equivalents $27,000 $20,000Accounts receivable 43,000 58,000Inventories 92,000 85,000Current Liabilities:Accounts payable $35,000 $22,000Accrued liabilities 13,000 21,000Required:Prepare Crawford Properties, Inc.’s statement of cash flows for the year ended June 30, 20X6, using the…5. During the current year an entity sold a piece of equipment used in production. The equipment had been accounted for using the revaluation method and details of the accounts and sale are presented below: Sales price P100,000 Equipment carrying amount (net) 90,000 Revaluation surplus 20,000 Which of the following is correct regarding recording the sale? Group of answer choices The gain that should be recorded in other comprehensive income is P10,000 The gain that should be recorded in profit and loss is P10,000; the P20,000 revaluation surplus may be transferred to retained earnings. The gain that should be recorded in other comprehensive income is P30,000 The gain that should be recorded in profit and loss is P30,000

- A2 aii Use the following information for Delta Corporation: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…QUESTION 1The following are extracts of the income statement and the statement of financial position forMorula Industries.STATEMENT OF INCOME FOR THE YEAR ENDED 31 DECEMBER 2019PulaSales 500,000Less Cost of sales:Opening inventory 120,000Purchases 415,000Cost of goods available for sale 535,000Closing inventory (115,000) (420,000)Gross profit 80,000Operating expenses (40,000)Net surplus for the year 40,000 STAMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2019PulaCurrent assetsInventory 115,000Receivables 133,000Bank overdraft 124,000Current LiabilitiesPayables 96,000Capital and reservesShare capital 70,000General reserve 110,000Retained profit 110,000Additional Information The receivables and payables opening balances were P50, 000 each. All sales and purchases were made on credit.Required:a. Calculate the:i. Average payment period. ii. Average age of inventory. iii. Average collection period. iv. Cash conversion cycle. b. Explain five strategies that can improve the cash conversion…The following are the financial statement Kin Ltd. for the year ended 31 March 2020: Kin Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 Kin Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities:…

- The comparative statements of Waterway Company are presented here. Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300 $1,753,100 Cost of goods sold1,008,900 983,000 Gross profit804,400 770,100 Selling and administrative expenses516,800 477,800 Income from operations287,600 292,300 Other expenses and losses Interest expense18,900 14,800 Income before income taxes268,700 277,500 Income tax expense78,224 77,700 Net income$ 190,476 $ 199,800 Waterway CompanyBalance SheetsDecember 31Assets20222021Current assets Cash$60,200 $64,500 Debt investments (short-term)70,600 49,200 Accounts receivable (net)117,800 102,700 Inventory123,600 114,700 Total current assets372,200 331,100 Plant assets (net)602,200 517,900 Total…The comparative statements of Waterway Company are presented here. Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300 $1,753,100 Cost of goods sold1,008,900 983,000 Gross profit804,400 770,100 Selling and administrative expenses516,800 477,800 Income from operations287,600 292,300 Other expenses and losses Interest expense18,900 14,800 Income before income taxes268,700 277,500 Income tax expense78,224 77,700 Net income$ 190,476 $ 199,800 Waterway CompanyBalance SheetsDecember 31Assets20222021Current assets Cash$60,200 $64,500 Debt investments (short-term)70,600 49,200 Accounts receivable (net)117,800 102,700 Inventory123,600 114,700 Total current assets372,200 331,100 Plant assets (net)602,200 517,900 Total…PROBLEM SOLVING 1 The profit or loss section of the statement of comprehensive income of ITS NOT OK TO BE OK Company for the year ended December 31, 2020 is reproduced below: Sales P 6,100,000 Cost of goods sold 3,700,000 Gross profit P2,400,000 Gain on sale of equipment 100,000 Salaries expense -820,000 Insurance expense -380,000 Depreciation expense 220,000 Profit before interest and income tax P1,080,000 Interest expense 120,000 Profit before income tax P960,000 Income tax expense 288,000 Profit P672,000 The following information is also available: Decrease in accounts receivable P120,000 Increase in inventory 280,000 Decrease in accounts payable 160,000 Increase in salaries payable 100,000 Increase in prepaid insurance 180,000 Decrease in interest payable 30,000 Increase in income tax payable 18,000

- Prepare an income statement with the information listed below: Accumulated Depreciation $ 35,000Accounts Payable $ 65,000Advertising Expense $ 20,625Prepaid Advertising $ 61,875Common Stock $ 50,000Depreciation Expense $ 12,500Dividend Payable $ 50,000Dividends $ 100,000Income Tax expense $ 48,000Income Tax Payable $ 35,000Interest Expense $ 3,750Interest Revenue $ 500Loss on Disposal of Assets $ 10,000Prepaid Rent $ 56,250Rent Expense $ 18,750Retained Earnings $ 836,875Sales Revenue $ 300,000Utilities Expense $ 8,750Utilities Payable $ 7,000Wage Expense $ 41,250Wages Payable $ 10,125Question # 6 Waqar is a sole trader. He provides the following financial information in respect of his business. Income statement for the year ended 31 December 2019 Sales 3380000 Cost of sales (2000000) Expenses (1200000) Profit for the year 180000 Statements of financial position at: 31 December 2018 31 December 2019 Non-current assets Freehold land 2000000 3500000 Plant and machinery at cost 900000 1020000 Less: depreciation (500000) (470000) Net book value 400000 550000…The following is information for Charles Company for the current year Cost of Goods Sold Operating Expenses Other Income and (Expenses) Gain on Sale of Equipment Loss on Disposal of Equipment Descontinued Operations Gain Income Tax Expense What is the company's net income for the year? $214,000 151.000 19,000 7.000 (6,000) 2,000 40%