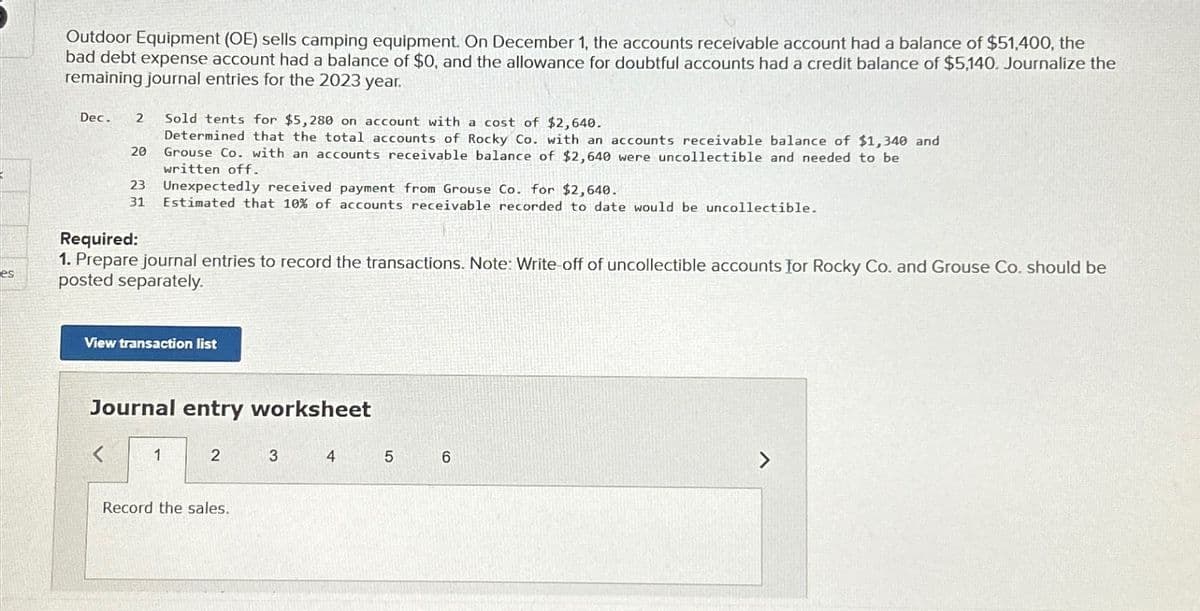

Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts receivable account had a balance of $51,400, the bad debt expense account had a balance of $0, and the allowance for doubtful accounts had a credit balance of $5,140. Journalize the remaining journal entries for the 2023 year. Dec. 2 Sold tents for $5,280 on account with a cost of $2,640. es 20 Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,340 and Grouse Co. with an accounts receivable balance of $2,640 were uncollectible and needed to be written off. 23 Unexpectedly received payment from Grouse Co. for $2,640. 31 Estimated that 10% of accounts receivable recorded to date would be uncollectible. Required: 1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be posted separately. View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record the sales. 7

Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts receivable account had a balance of $51,400, the bad debt expense account had a balance of $0, and the allowance for doubtful accounts had a credit balance of $5,140. Journalize the remaining journal entries for the 2023 year. Dec. 2 Sold tents for $5,280 on account with a cost of $2,640. es 20 Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,340 and Grouse Co. with an accounts receivable balance of $2,640 were uncollectible and needed to be written off. 23 Unexpectedly received payment from Grouse Co. for $2,640. 31 Estimated that 10% of accounts receivable recorded to date would be uncollectible. Required: 1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be posted separately. View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record the sales. 7

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section: Chapter Questions

Problem 1AP

Related questions

Question

sh

Transcribed Image Text:Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts receivable account had a balance of $51,400, the

bad debt expense account had a balance of $0, and the allowance for doubtful accounts had a credit balance of $5,140. Journalize the

remaining journal entries for the 2023 year.

Dec.

2

Sold tents for $5,280 on account with a cost of $2,640.

es

20

Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,340 and

Grouse Co. with an accounts receivable balance of $2,640 were uncollectible and needed to be

written off.

23 Unexpectedly received payment from Grouse Co. for $2,640.

31 Estimated that 10% of accounts receivable recorded to date would be uncollectible.

Required:

1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be

posted separately.

View transaction list

Journal entry worksheet

<

1

2

3

4

5

6

Record the sales.

7

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,