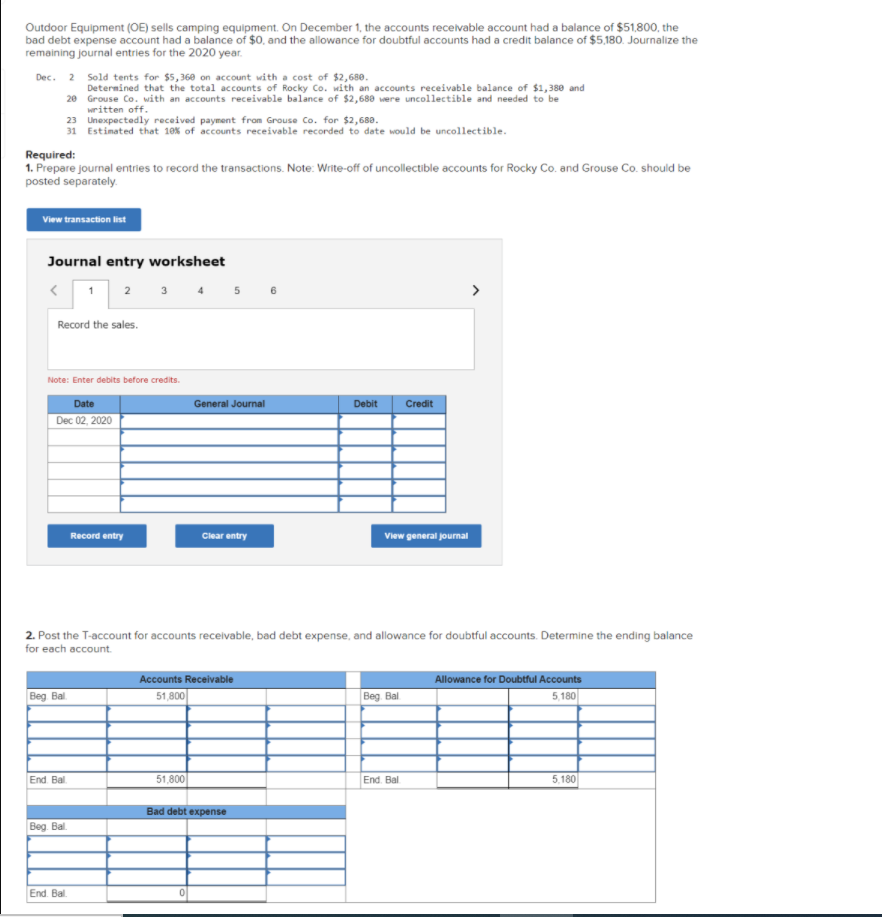

Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts recevable account had a balance of $51.800, the bad debt expense account had a balance of $0, and the allowance for doubtful accounts had a credit balance of $5,180. Journalize the remaining journal entries for the 2020 year. Dec. 2 Sold tents for $5,360 on account with a cost of $2,680. Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,380 and 20 Grouse Co. with an accounts receivable balance of $2,680 vere uncollectible and needed to be written off. 23 Unexpectedly received payment fron Grouse Co. for $2,680. 31 Estimated that 10% of accounts receivable recorded to date would be uncollectible. Required: 1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be posted separately. Viww transaction list Journal entry worksheet 2 3 > 5 Record the sales. Note: Enter debits before credits. Date General Journal Debit Credit Dec 02, 2020 Record entry Clear entry View general journal 2. Post the T-account for accounts receivable, bad debt expense, and allowance for doubtful accounts. Determine the ending balance for each account. Accounts Receivable Allowance for Doubtful Accounts Beg Bal 51,800 Beg Bal 5,180 End Bal 51,800 End. Bal 5,180 Bad debt expense Beg Bal End Bal

Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts recevable account had a balance of $51.800, the bad debt expense account had a balance of $0, and the allowance for doubtful accounts had a credit balance of $5,180. Journalize the remaining journal entries for the 2020 year. Dec. 2 Sold tents for $5,360 on account with a cost of $2,680. Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,380 and 20 Grouse Co. with an accounts receivable balance of $2,680 vere uncollectible and needed to be written off. 23 Unexpectedly received payment fron Grouse Co. for $2,680. 31 Estimated that 10% of accounts receivable recorded to date would be uncollectible. Required: 1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be posted separately. Viww transaction list Journal entry worksheet 2 3 > 5 Record the sales. Note: Enter debits before credits. Date General Journal Debit Credit Dec 02, 2020 Record entry Clear entry View general journal 2. Post the T-account for accounts receivable, bad debt expense, and allowance for doubtful accounts. Determine the ending balance for each account. Accounts Receivable Allowance for Doubtful Accounts Beg Bal 51,800 Beg Bal 5,180 End Bal 51,800 End. Bal 5,180 Bad debt expense Beg Bal End Bal

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

answer the following

Transcribed Image Text:Outdoor Equipment (OE) sells camping equipment. On December 1, the accounts receivable account had a balance of $51,800, the

bad debt expense account had a balance of $0. and the allowance for doubtful accounts had a credit balance of $5,180. Journalize the

remaining journal entries for the 2020 year.

Dec. 2 Sold tents for $5,360 on account with a cost of $2,680.

Determined that the total accounts of Rocky Co. with an accounts receivable balance of $1,380 and

20 Grouse Co. with an accounts receivable balance of $2,688 were uncollectible and needed to be

written off.

23 Unexpectedly received payment from Grouse Co. for $2,680.

31 Estimated that 10% of accounts receivable recorded to date would be uncollectible.

Required:

1. Prepare journal entries to record the transactions. Note: Write-off of uncollectible accounts for Rocky Co. and Grouse Co. should be

posted separately.

View transaction list

Journal entry worksheet

1

3 4

>

2

Record the sales.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 02, 2020

Record entry

Clear entry

View general journal

2. Post the T-account for accounts receivable, bad debt expense, and allowance for doubtful accounts. Determine the ending balance

for each account.

Accounts Receivable

Allowance for Doubtful Accounts

Beg Bal

51,800

Beg. Bal

5,180

End. Bal.

51,800

End. Bal

5,180

Bad debt expense

Beg. Bl.

End. Bal.

Expert Solution

Calculation

| Transaction | Accounts receivable | Allowance for Doubtful Accounts |

| Beg. | 51,800 | 5,180 |

| 1 | 5,360 | |

| 2 | ||

| 3 | - 4,060 | - 4,060 |

| 4 | 2,680 | 2,680 |

| 5 | - 2,680 | |

| Unadjusted balance | 53,100 | 3,800 |

| Adjusted Allowance of doubtful account (53100*10%) | 5,310 |

| Less: Unadjusted Allowance of doubtful account | 3,800 |

| Adjustment for Bad debts expense | 1,510 |

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage