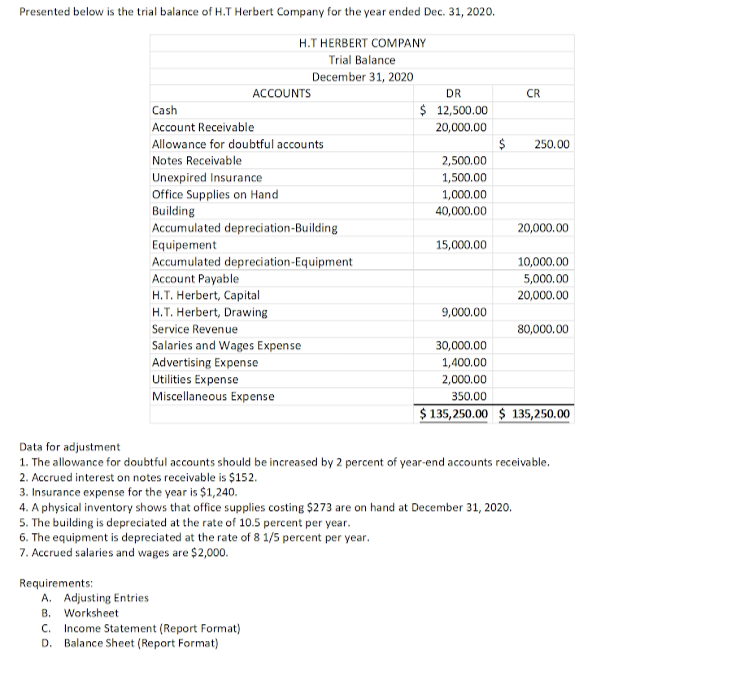

Presented below is the trial balance of H.T Herbert Company for the year ended Dec. 31, 2020. H.T HERBERT COMPANY Trial Balance December 31, 2020 ACCOUNTS DR CR Cash $ 12,500.00 Account Receivable 20,000.00 Allowance for doubtful accounts 250.00 Notes Receivable 2,500.00 Unexpired Insurance Office Supplies on Hand Building Accumulated depreciation-Building 1,500.00 1,000.00 40,000.00 20,000.00 Equipement 15,000.00 Accumulated depreciation-Equipment Account Payable H.T. Herbert, Capital 10,000,00 5,000.00 20,000,00 H.T. Herbert, Drawing 9,000.00 Service Revenue 80,000.00 Salaries and Wages Expense Advertising Expense Utilities Expense Miscellaneous Expense 30,000.00 1,400.00 2,000.00 350.00 $ 135,250.00 $ 135,250.00 Data for adjustment 1. The allowance for doubtful accounts should be increased by 2 percent of year-end accounts receivable. 2. Accrued interest on notes receivable is $152. 3. Insurance expense for the year is $1,240. 4. A physical inventory shows that office supplies costing $273 are on hand at December 31, 2020. 5. The building is depreciated at the rate of 1o.5 percent per year. 6. The equipment is depreciated at the rate of 8 1/5 percent per year. 7. Accrued salaries and wages are $2,000. Requirements: A. Adjusting Entries B. Worksheet Cc. Income Statement (Report Format) D. Balance Sheet (Report Format)

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images