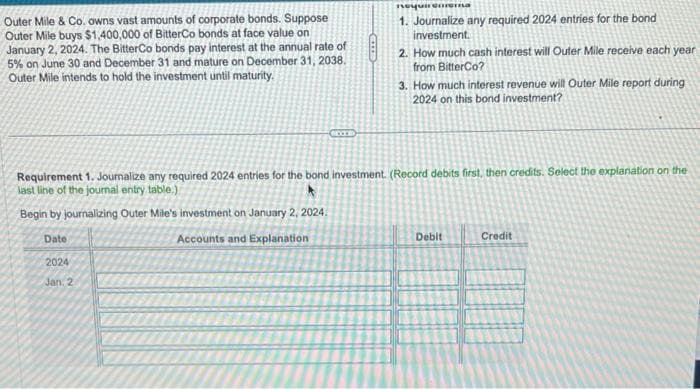

Outer Mile & Co. owns vast amounts of corporate bonds. Suppose Outer Mile buys $1,400,000 of BitterCo bonds at face value on January 2, 2024. The BitterCo bonds pay interest at the annual rate of 5% on June 30 and December 31 and mature on December 31, 2038. Outer Mile intends to hold the investment until maturity. CXTI 2024 Jan 2 neque enrerna 1. Journalize any required 2024 entries for the bond investment. 2. How much cash interest will Outer Mile receive each year from BitterCo? 3. How much interest revenue will Outer Mile report during 2024 on this bond investment? Requirement 1. Journalize any required 2024 entries for the bond investment. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Outer Mile's investment on January 2, 2024. Date Accounts and Explanation Debit Credit

Outer Mile & Co. owns vast amounts of corporate bonds. Suppose Outer Mile buys $1,400,000 of BitterCo bonds at face value on January 2, 2024. The BitterCo bonds pay interest at the annual rate of 5% on June 30 and December 31 and mature on December 31, 2038. Outer Mile intends to hold the investment until maturity. CXTI 2024 Jan 2 neque enrerna 1. Journalize any required 2024 entries for the bond investment. 2. How much cash interest will Outer Mile receive each year from BitterCo? 3. How much interest revenue will Outer Mile report during 2024 on this bond investment? Requirement 1. Journalize any required 2024 entries for the bond investment. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Outer Mile's investment on January 2, 2024. Date Accounts and Explanation Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 3C

Related questions

Question

3

Transcribed Image Text:Outer Mile & Co. owns vast amounts of corporate bonds. Suppose

Outer Mile buys $1,400,000 of BitterCo bonds at face value on

January 2, 2024. The BitterCo bonds pay interest at the annual rate of

5% on June 30 and December 31 and mature on December 31, 2038.

Outer Mile intends to hold the investment until maturity.

BOCK

2024

Jan. 2

neque enema

1. Journalize any required 2024 entries for the bond

investment.

2. How much cash interest will Outer Mile receive each year

from BitterCo?

3. How much interest revenue will Outer Mile report during

2024 on this bond investment?

Requirement 1. Journalize any required 2024 entries for the bond investment. (Record debits first, then credits. Select the explanation on the

last line of the journal entry table.)

Begin by journalizing Outer Mile's investment on January 2, 2024.

Date

Accounts and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College