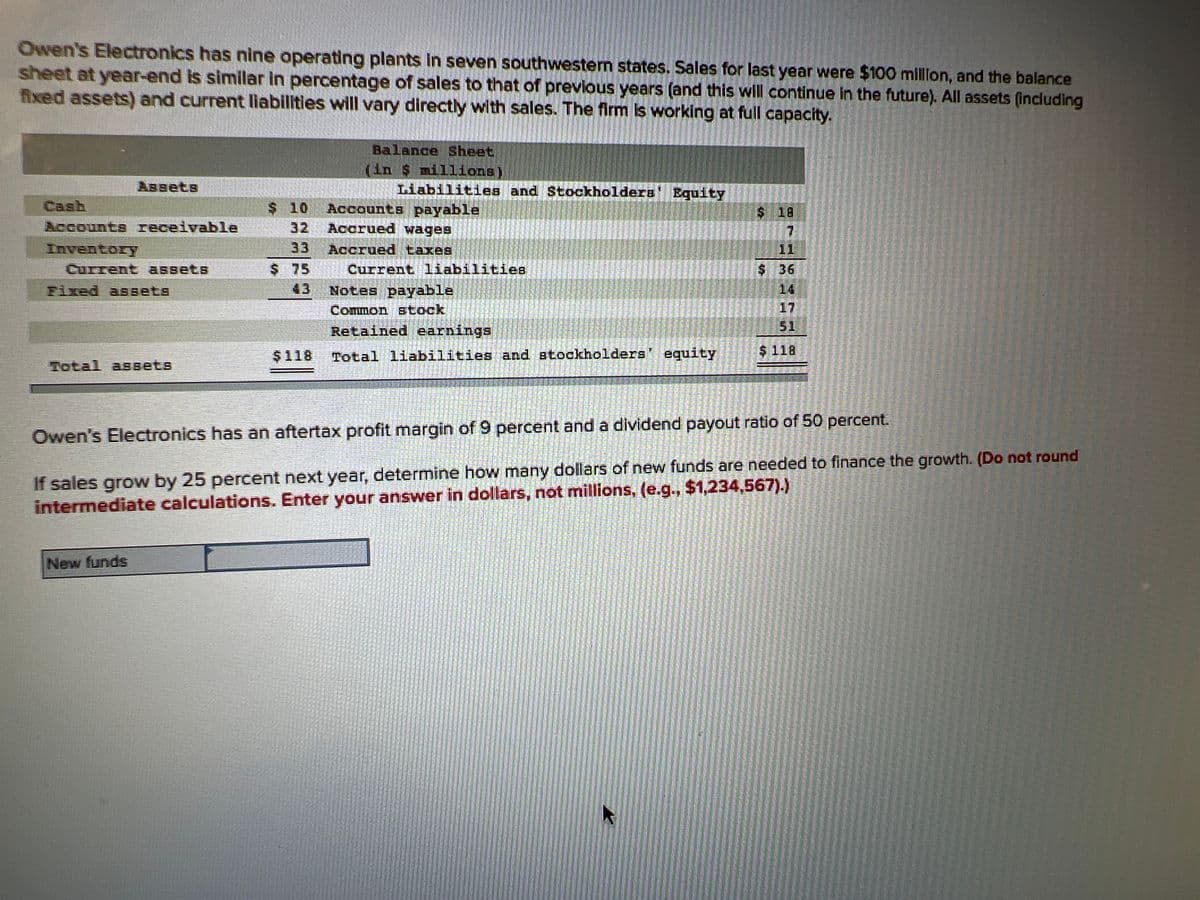

Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets $ 10 32 33 $75 43 $118 Balance Sheet (in $ millions) Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity $18 7 11 $36 14 17 51 $118 Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 50 percent. If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g., $1,234,567).)

Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets $ 10 32 33 $75 43 $118 Balance Sheet (in $ millions) Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity $18 7 11 $36 14 17 51 $118 Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 50 percent. If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g., $1,234,567).)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 3MAD: Deere Company (DE) manufactures and distributes farm and construction machinery that it sells...

Related questions

Question

Transcribed Image Text:Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance

sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including

fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity.

Assets

Cash

Accounts receivable

Inventory

Current assets

Fixed assets

Total assets

$ 10

32

33

$ 75

New funds

$118

Balance Sheet

(in $ millions)

Liabilities and Stockholdera Equity

Accounts payable

Accrued wages

Accrued taxes

Current liabilities

Notes payable

Common stock

Retained earnings

Total liabilities and stockholders' equity

$18

7

11

$ 36

14

17

51

$118

TOUS REPOR

Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 50 percent.

STA

U SLU

KUTEN

HOTEL

If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round

intermediate calculations. Enter your answer in dollars, not millions, (e.g., $1,234,567).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning