P 5.6 (L0 23) (Prereration 0f a statement at Cash Elaws ond A Bal, Sheet) Lansbury Inc had the following balance sheet Bal. Sheet Dec.31,2019 Accounts PaY No tes Pay. (long-thmo 4],000 $2g000 Allounts Receiv. Invest. Retained Egm Plant assets (net) 8]o00 During 2020y the following occurced I. Lansbury Inc. sold Part of its debt invest. Portfolio for $1500. This transaction resulted in a Sain of $3,400 for the finmi The ComPany classifies these invest, As qvailable-for-sale. 2A tract of land was Purchased for $73000 cash 3. Long-term notes PaY. in the amount of $16o00 were retired before maturity by PaYing F36j000 Cash An additional $o00 in common Stock was issved at Par Dividends of $8jloo rere declared and Paid to stockhedders. Net income for 2020 was 332p00 after gllowing for depre. Lood was Purchased through te isswance of 335,000.in bonds, L

P 5.6 (L0 23) (Prereration 0f a statement at Cash Elaws ond A Bal, Sheet) Lansbury Inc had the following balance sheet Bal. Sheet Dec.31,2019 Accounts PaY No tes Pay. (long-thmo 4],000 $2g000 Allounts Receiv. Invest. Retained Egm Plant assets (net) 8]o00 During 2020y the following occurced I. Lansbury Inc. sold Part of its debt invest. Portfolio for $1500. This transaction resulted in a Sain of $3,400 for the finmi The ComPany classifies these invest, As qvailable-for-sale. 2A tract of land was Purchased for $73000 cash 3. Long-term notes PaY. in the amount of $16o00 were retired before maturity by PaYing F36j000 Cash An additional $o00 in common Stock was issved at Par Dividends of $8jloo rere declared and Paid to stockhedders. Net income for 2020 was 332p00 after gllowing for depre. Lood was Purchased through te isswance of 335,000.in bonds, L

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

100%

I need help to work on these problems.

![P 5.6 (LO23) (Preperation 0f a statement of Cash Elows and

a Bali Sheet) Lansbury Jnc had the following balance sheet

Bal. Sheet

Accounts Pay.

$29000

Notes Pay. Clong-lermo 4],000

Aclounts Receiv.

Invest.

Retained Egrn.

Plant assets (net) 81000

ूर

90

During 2020y thefollowing occurred.

I. Lansbury Inc. Sold Part of its debt invest. Portfolio for $15000.

This transaction resulted in a gain of

ComPany classifies these invest. 1s qvailable-for-sale.

2. A tract of land was Purchased for $13,000 cash

3. Long-term notes pay. in the amount of $16,000 Were reticed

$3400 for the fim The

before maturitY by PaYing $IfjooD cash.

4. An additional $20j000 in common Stock was issued at Par.

Dividends of $83o vrere declared and Paid to stockhdlders.

Net income tor 2020 was $32po0 after glowing for depre.

000000-](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb7b9bc12-9bec-475d-bc99-e13d2a9b76e2%2F55a954b4-079a-4e5c-9e2d-80bff69d5c38%2F78x03qq_processed.jpeg&w=3840&q=75)

Transcribed Image Text:P 5.6 (LO23) (Preperation 0f a statement of Cash Elows and

a Bali Sheet) Lansbury Jnc had the following balance sheet

Bal. Sheet

Accounts Pay.

$29000

Notes Pay. Clong-lermo 4],000

Aclounts Receiv.

Invest.

Retained Egrn.

Plant assets (net) 81000

ूर

90

During 2020y thefollowing occurred.

I. Lansbury Inc. Sold Part of its debt invest. Portfolio for $15000.

This transaction resulted in a gain of

ComPany classifies these invest. 1s qvailable-for-sale.

2. A tract of land was Purchased for $13,000 cash

3. Long-term notes pay. in the amount of $16,000 Were reticed

$3400 for the fim The

before maturitY by PaYing $IfjooD cash.

4. An additional $20j000 in common Stock was issued at Par.

Dividends of $83o vrere declared and Paid to stockhdlders.

Net income tor 2020 was $32po0 after glowing for depre.

000000-

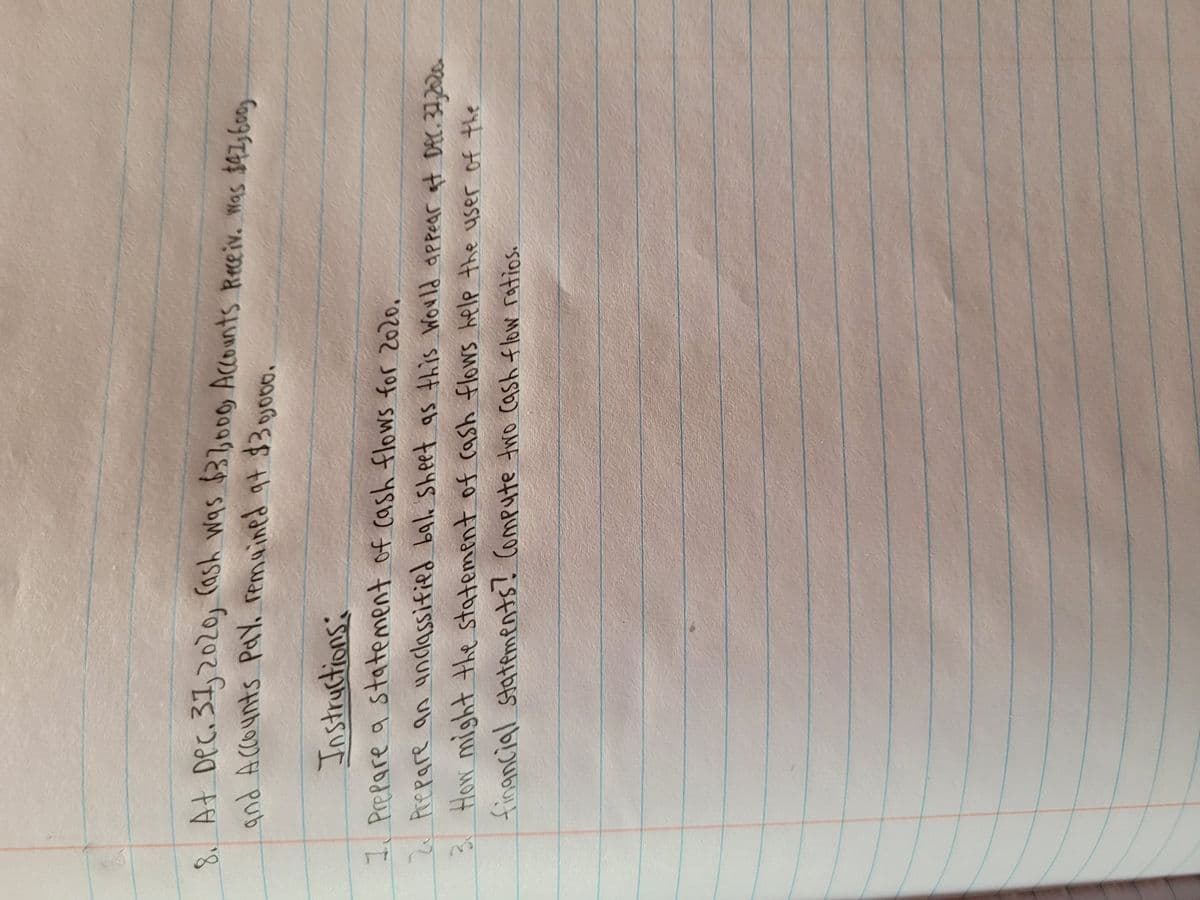

Transcribed Image Text:At Dec.31,2020, (ash was 37bo00 Acounts Receiv. Was $42,600

and Accounts PaY. remuined qt $3 gooo.

Instructions:

1. Prepare a statement of Cash flows for Z020.

W Prepare an undassified bal Sheet as this Would appear aat DAC. 32,220

3/ How might the statement of cash flowS help the user of the

financial statements? Compute tro cash flow ratios.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning