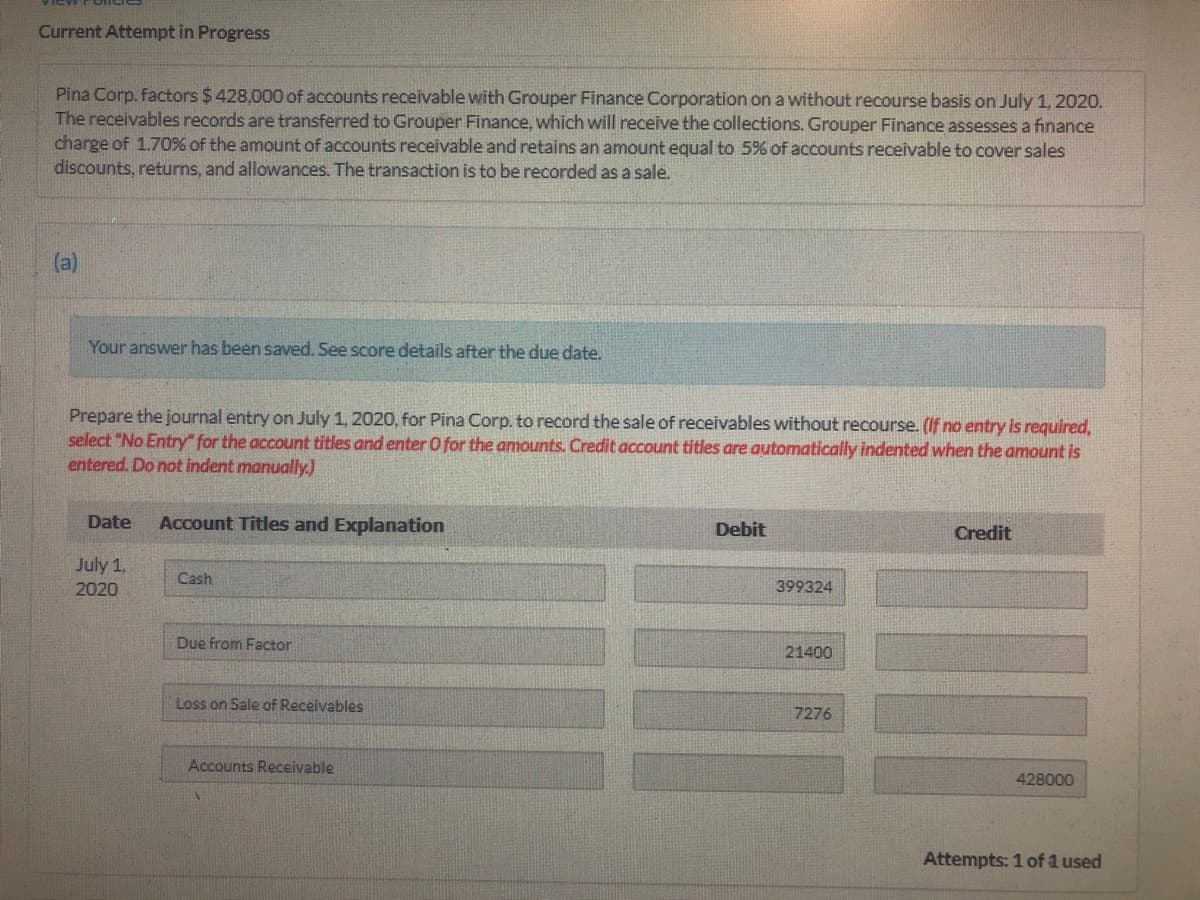

Pina Corp. factors $ 428,000 of accounts receivable with Grouper Finance Corporation on a without recourse basis on July 1, 2020. The receivables records are transferred to Grouper Finance, which will receive the collections. Grouper Finance assesses a finance charge of 1.70% of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable to cover sales discounts, returns, and allowances. The transaction is to be recorded as a sale. (a) Your answer has been saved. See score details after the due date. Prepare the journal entry on July 1, 2020, for Pina Corp. to record the sale of receivables without recourse. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit July 1, Cash 2020 399324 Due from Factor 21400 Loss on Sale of Receivables 7276 Accounts Receivable 428000

Pina Corp. factors $ 428,000 of accounts receivable with Grouper Finance Corporation on a without recourse basis on July 1, 2020. The receivables records are transferred to Grouper Finance, which will receive the collections. Grouper Finance assesses a finance charge of 1.70% of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable to cover sales discounts, returns, and allowances. The transaction is to be recorded as a sale. (a) Your answer has been saved. See score details after the due date. Prepare the journal entry on July 1, 2020, for Pina Corp. to record the sale of receivables without recourse. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit July 1, Cash 2020 399324 Due from Factor 21400 Loss on Sale of Receivables 7276 Accounts Receivable 428000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

Pina Corp. factors $ 428,000 of accounts receivable with Grouper Finance Corporation on a without recourse basis on July 1, 2020.

The receivables records are transferred to Grouper Finance, which will receive the collections. Grouper Finance assesses a finance

charge of 1.70% of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable to cover sales

discounts, returns, and allowances. The transaction is to be recorded as a sale.

(a)

Your answer has been saved. See score details after the due date.

Prepare the journal entry on July 1, 2020, for Pina Corp. to record the sale of receivables without recourse. (If no entry is required,

select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is

entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

July 1,

2020

Cash

399324

Due from Factor

21400

Loss on Sale of Receivables

7276

Accounts Receivable

428000

Attempts: 1 of 1 used

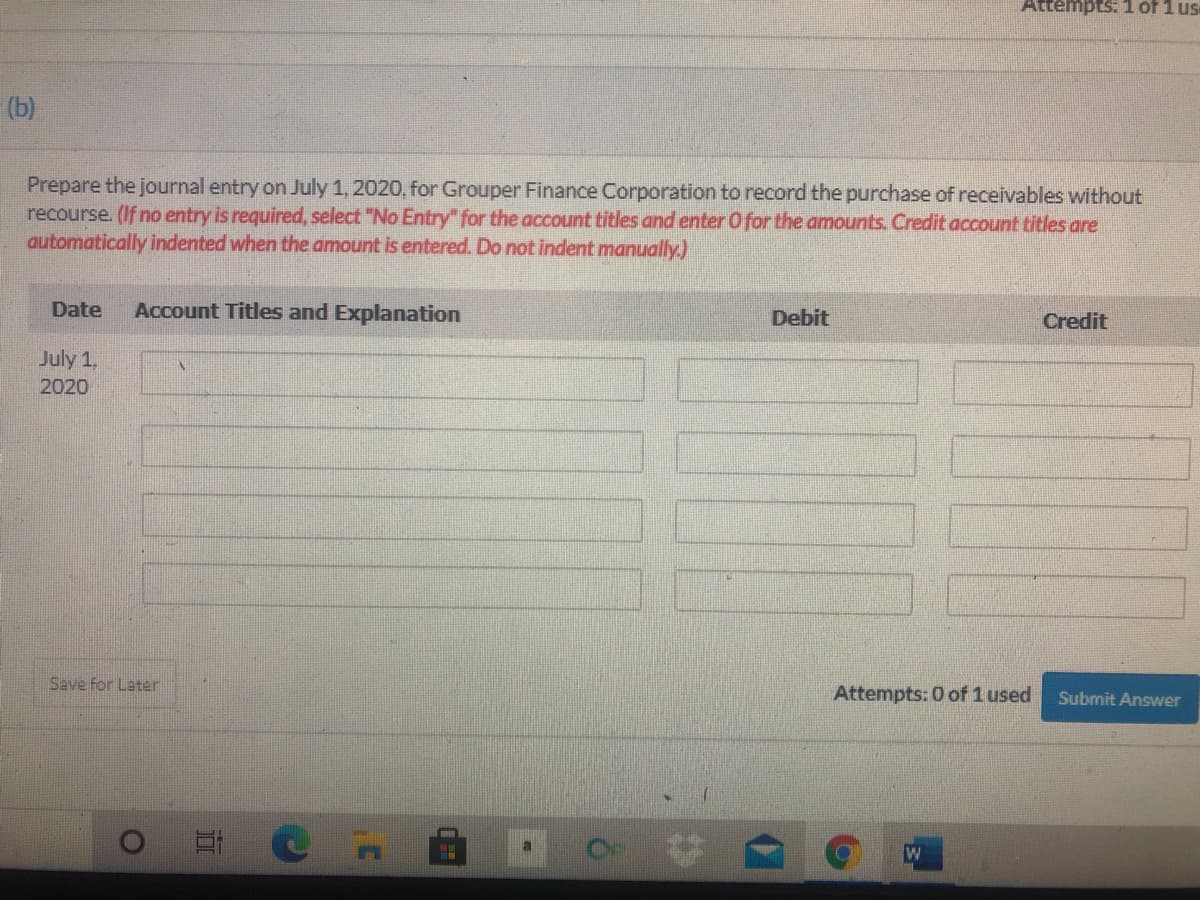

Transcribed Image Text:Attempts: 1 of 1 us

(b)

Prepare the journal entry on July 1, 2020, for Grouper Finance Corporation to record the purchase of receivables without

recourse. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are

automatically indented when the amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

July 1,

2020

Save for Later

Attempts: 0 of 1 used

Submit Answer

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning