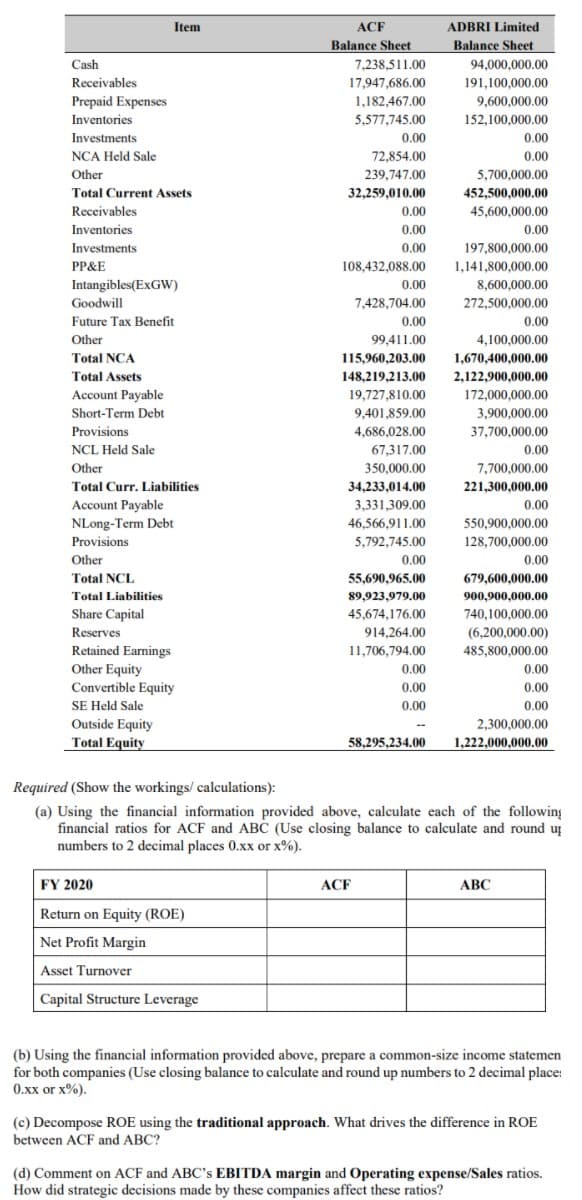

Item ACF ADBRI Limited Balance Sheet 7,238,511.00 Balance Sheet Cash 94,000,000.00 Receivables 17,947,686.00 191,100,000.00 Prepaid Expenses Inventories 1,182,467.00 9,600,000.00 5,577,745.00 152,100,000.00 Investments 0.00 0.00 NCA Held Sale 72,854.00 0.00 Other 239,747.00 5,700,000.00 Total Current Assets 32,259,010.00 452,500,000.00 Receivables 0.00 45,600,000.00 Inventories 0.00 0.00 Investments 0.00 197,800,000.00 1,141,800,000.00 ৪,600,000.00 PP&E 108,432,088.00 Intangibles(EXGW) 0.00 Goodwill 7,428,704.00 272,500,000.00 Future Tax Benefit t 0.00 0.00 Other 99,411.00 4,100,000.00 Total NCA 115,960,203.00 1.670,400,000.00 Total Assets 148,219,213.00 2,122,900,000.00 Account Payable 19,727,810.00 172,000,000.00 Short-Term Debt 9,401,859.00 3,900,000.00 Provisions 4,686,028.00 37,700,000.00 NCL Held Sale 67,317.00 0.00 Other 350,000.00 7,700,000.00 Total Curr. Liabilities 34,233,014.00 221,300,000.00 Account Payable 3,331,309.00 0.00 NLong-Term Debt 46,566,911.00 550,900,000.00 Provisions 5,792,745.00 128,700,000.00 Other 0.00 0.00 Total NCL 55,690,965.00 679,600,000.00 Total Liabilities 89,923,979.00 900,900,000.00 Share Capital 45,674,176.00 740,100,000.00 Reserves 914,264.00 (6,200,000.00) Retained Eamings Other Equity Convertible Equity 11,706,794.00 485,800,000.00 0.00 0.00 0.00 0.00 SE Held Sale 0.00 0.00 Outside Equity 2,300,000.00 Total Equity 58,295,234.00 1,222,000,000.00 Required (Show the workings/ calculations): (a) Using the financial information provided above, calculate each of the following financial ratios for ACF and ABC (Use closing balance to calculate and round up numbers to 2 decimal places 0.xx or x%). FY 2020 ACF ABC Return on Equity (ROE) Net Profit Margin Asset Turnover Capital Structure Leverage (b) Using the financial information provided above, prepare a common-size income statemen for both companies (Use closing balance to calculate and round up numbers to 2 decimal place: 0.xx or x%). (c) Decompose ROE using the traditional approach. What drives the difference in ROE between ACF and ABC? (d) Comment on ACF and ABC's EBITDA margin and Operating expense/Sales ratios. How did strategic decisions made by these companies affect these ratios?

Item ACF ADBRI Limited Balance Sheet 7,238,511.00 Balance Sheet Cash 94,000,000.00 Receivables 17,947,686.00 191,100,000.00 Prepaid Expenses Inventories 1,182,467.00 9,600,000.00 5,577,745.00 152,100,000.00 Investments 0.00 0.00 NCA Held Sale 72,854.00 0.00 Other 239,747.00 5,700,000.00 Total Current Assets 32,259,010.00 452,500,000.00 Receivables 0.00 45,600,000.00 Inventories 0.00 0.00 Investments 0.00 197,800,000.00 1,141,800,000.00 ৪,600,000.00 PP&E 108,432,088.00 Intangibles(EXGW) 0.00 Goodwill 7,428,704.00 272,500,000.00 Future Tax Benefit t 0.00 0.00 Other 99,411.00 4,100,000.00 Total NCA 115,960,203.00 1.670,400,000.00 Total Assets 148,219,213.00 2,122,900,000.00 Account Payable 19,727,810.00 172,000,000.00 Short-Term Debt 9,401,859.00 3,900,000.00 Provisions 4,686,028.00 37,700,000.00 NCL Held Sale 67,317.00 0.00 Other 350,000.00 7,700,000.00 Total Curr. Liabilities 34,233,014.00 221,300,000.00 Account Payable 3,331,309.00 0.00 NLong-Term Debt 46,566,911.00 550,900,000.00 Provisions 5,792,745.00 128,700,000.00 Other 0.00 0.00 Total NCL 55,690,965.00 679,600,000.00 Total Liabilities 89,923,979.00 900,900,000.00 Share Capital 45,674,176.00 740,100,000.00 Reserves 914,264.00 (6,200,000.00) Retained Eamings Other Equity Convertible Equity 11,706,794.00 485,800,000.00 0.00 0.00 0.00 0.00 SE Held Sale 0.00 0.00 Outside Equity 2,300,000.00 Total Equity 58,295,234.00 1,222,000,000.00 Required (Show the workings/ calculations): (a) Using the financial information provided above, calculate each of the following financial ratios for ACF and ABC (Use closing balance to calculate and round up numbers to 2 decimal places 0.xx or x%). FY 2020 ACF ABC Return on Equity (ROE) Net Profit Margin Asset Turnover Capital Structure Leverage (b) Using the financial information provided above, prepare a common-size income statemen for both companies (Use closing balance to calculate and round up numbers to 2 decimal place: 0.xx or x%). (c) Decompose ROE using the traditional approach. What drives the difference in ROE between ACF and ABC? (d) Comment on ACF and ABC's EBITDA margin and Operating expense/Sales ratios. How did strategic decisions made by these companies affect these ratios?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 11PC

Related questions

Question

Transcribed Image Text:Item

ACF

ADBRI Limited

Balance Sheet

Balance Sheet

Cash

7,238,511.00

94,000,000.00

Receivables

17,947,686.00

191,100,000.00

Prepaid Expenses

1,182,467.00

9,600,000.00

Inventories

5,577,745.00

152,100,000.00

Investments

0.00

0.00

NCA Held Sale

72,854.00

0.00

Other

239,747.00

5,700,000.00

Total Current Assets

32,259,010.00

452,500,000.00

Receivables

0.00

45,600,000.00

Inventories

0.00

0.00

Investments

0.00

197,800,000.00

PP&E

108,432,088.00

1,141,800,000.00

Intangibles(EXGW)

0.00

৪,600,000.00

Goodwill

7,428,704.00

272,500,000.00

Future Tax Benefit

0.00

0.00

Other

99,411.00

4,100,000.00

Total NCA

115,960,203.00

1,670,400,000.00

Total Assets

148,219,213.00

2,122,900,000.00

Account Payable

19,727,810.00

172,000,000.00

Short-Term Debt

9,401,859.00

3,900,000.00

Provisions

4,686,028.00

37,700,000.00

NCL Held Sale

67,317.00

0.00

Other

350,000.00

7,700,000.00

Total Curr. Liabilities

34,233,014.00

221,300,000.00

Account Payable

NLong-Term Debt

3,331,309.00

0.00

46,566,911.00

550,900,000.00

Provisions

5,792,745.00

128,700,000.00

Other

0.00

0.00

Total NCL

55,690,965.00

679,600,000.00

Total Liabilities

89,923,979.00

900,900,000.00

Share Capital

45,674,176.00

740,100,000.00

Reserves

914,264.00

(6,200,000.00)

Retained Earnings

Other Equity

Convertible Equity

11,706,794.00

485,800,000.00

0.00

0.00

0.00

0.00

SE Held Sale

0.00

0.00

Outside Equity

2,300,000.00

Total Equity

58,295,234.00

1,222,000,000.00

Required (Show the workings/ calculations):

(a) Using the financial information provided above, calculate each of the following

financial ratios for ACF and ABC (Use closing balance to calculate and round u

numbers to 2 decimal places 0.xx or x%).

FY 2020

ACF

ABC

Return on Equity (ROE)

Net Profit Margin

Asset Turnover

Capital Structure Leverage

(b) Using the financial information provided above, prepare a common-size income statemen

for both companies (Use closing balance to calculate and round up numbers to 2 decimal place:

0.xx or x%).

(c) Decompose ROE using the traditional approach. What drives the difference in ROE

between ACF and ABC?

(d) Comment on ACF and ABC's EBITDA margin and Operating expense/Sales ratios.

How did strategic decisions made by these companies affect these ratios?

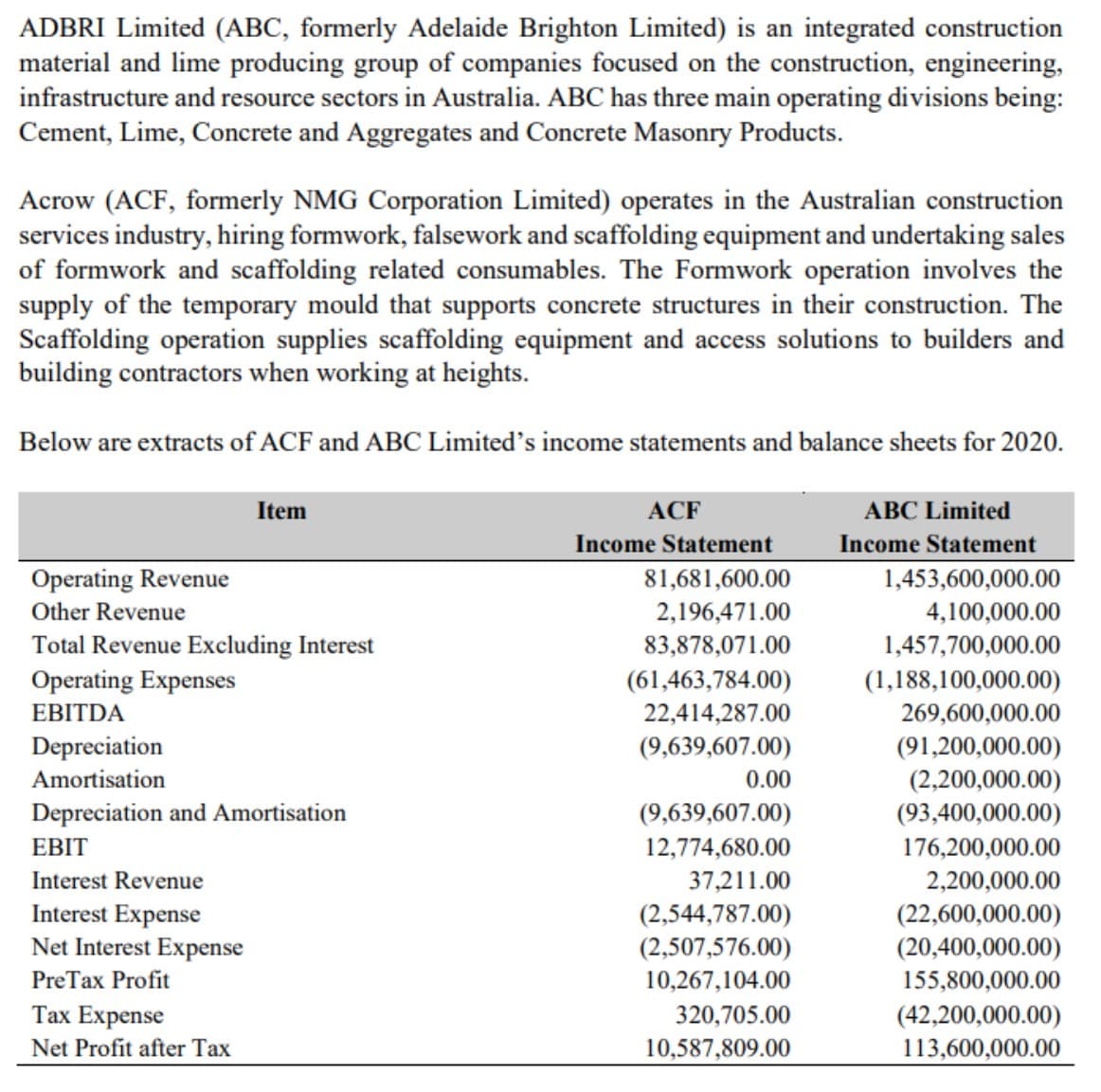

Transcribed Image Text:ADBRI Limited (ABC, formerly Adelaide Brighton Limited) is an integrated construction

material and lime producing group of companies focused on the construction, engineering,

infrastructure and resource sectors in Australia. ABC has three main operating divisions being:

Cement, Lime, Concrete and Aggregates and Concrete Masonry Products.

Acrow (ACF, formerly NMG Corporation Limited) operates in the Australian construction

services industry, hiring formwork, falsework and scaffolding equipment and undertaking sales

of formwork and scaffolding related consumables. The Formwork operation involves the

supply of the temporary mould that supports concrete structures in their construction. The

Scaffolding operation supplies scaffolding equipment and access solutions to builders and

building contractors when working at heights.

Below are extracts of ACF and ABC Limited's income statements and balance sheets for 2020.

Item

ACF

ABC Limited

Income Statement

Income Statement

Operating Revenue

81,681,600.00

1,453,600,000.00

Other Revenue

2,196,471.00

4,100,000.00

Total Revenue Excluding Interest

Operating Expenses

83,878,071.00

1,457,700,000.00

(61,463,784.00)

(1,188,100,000.00)

269,600,000.00

EBITDA

22,414,287.00

Depreciation

(9,639,607.00)

(91,200,000.00)

Amortisation

0.00

(2,200,000.00)

(93,400,000.00)

Depreciation and Amortisation

(9,639,607.00)

EBIT

12,774,680.00

176,200,000.00

Interest Revenue

37,211.00

2,200,000.00

Interest Expense

Net Interest Expense

(2,544,787.00)

(2,507,576.00)

(22,600,000.00)

(20,400,000.00)

155,800,000.00

PreTax Profit

10,267,104.00

Тах Expense

320,705.00

(42,200,000.00)

Net Profit after Tax

10,587,809.00

113,600,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning