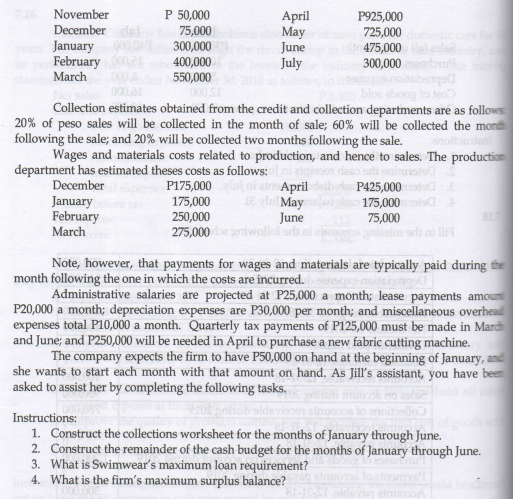

P 50,000 75,000 300,000 400,000 550,000 November April Мay June July P925,000 725,000 475,000 300,000 December January February March Collection estimates obtained from the credit and collection departments aré as follows 20% of peso sales will be collected in the month of sale; 60% will be collected the mont following the sale; and 20% will be collected two months following the sale. Wages and materials costs related to production, and hence to sales. The productiom department has estimated theses costs as follows: December P175,000 April May June 275,000 iwoliosd P425,000 January February March 175,000 175,000 250,000 75,000 sris ni l Note, however, that payments for wages and materials are typically paid during the month following the one in which the costs are incurred. Administrative salaries are projected at P25,000 a month; lease payments amou P20,000 a month; depreciation expenses are P30,000 per month; and miscellaneous overhead expenses total P10,000 a month. Quarterly tax payments of P125,000 must be made in Mardh and June; and P250,000 will be needed in April to purchase a new fabric cutting machine. The company expects the firm to have P50,000 on hand at the beginning of January, she wants to start each month with that amount on hand. As Jill's assistant, you have beem asked to assist her by completing the following tasks. Instructions: 1. Construct the collections worksheet for the months of January through June. 2. Construct the remainder of the cash budget for the months of January through June. 3. What is Swimwear's maximum loan requirement?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Cloie Boel,

Step by step

Solved in 4 steps with 2 images