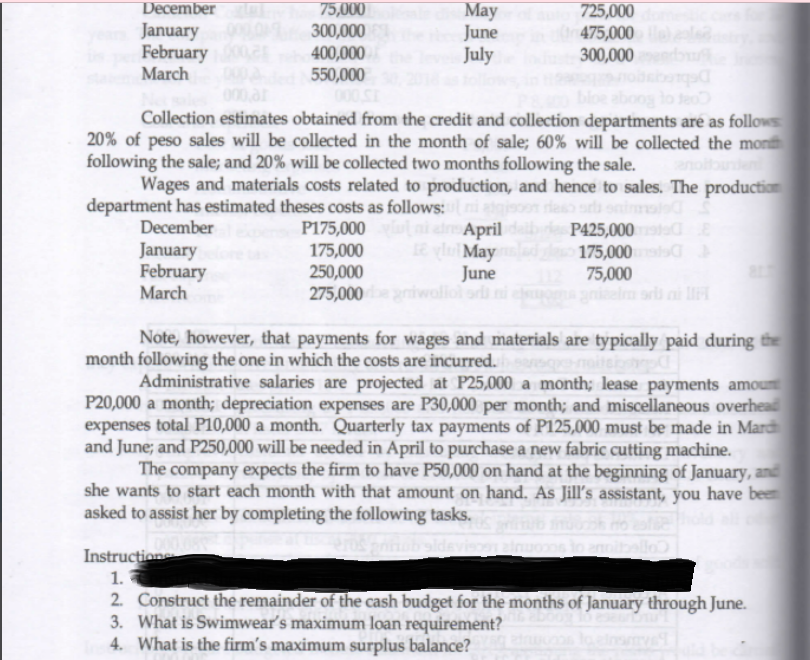

mber May 725,000 00's January 300,000 February March 400,000 550,000 June July 475,000 300,000 000ar bloe aboos Collection estimates obtained from the credit and collection departments aré as follows 20% of peso sales will be collected in the month of sale; 60% will be collected the mon following the sale; and 20% will be collected two months following the sale. Wages and materials costs related to production, and hence to sales. The production department has estimated theses costs as follows: ni December January February March P175,000 175,000 250,000 275,000 aApril lMay June on re st snim P425,000 175,000 75,000 slai l Note, however, that payments for wages and materials are typically paid during the month following the one in which the costs are incurred. Administrative salaries are projected at P25,000 a month; lease payments amount P20,000 a month; depreciation expenses are P30,000 per month; and miscellaneous overhead expenses total P10,000 a month. Quarterly tax payments of P125,000 must be made in Mardh and June; and P250,000 will be needed in April to purchase a new fabric cutting machine. The company expects the firm to have P50,000 on hand at the beginning of January, and she wants to start each month with that amount on hand. As Jill's assistant, you have bee asked to assist her by completing the following tasks. Instruction 1. 2. Construct the remainder of the cash budget for the months of January through June. 3. What is Swimwear's maximum loan requirement? 4. What is the firm's maximum surplus balance?

mber May 725,000 00's January 300,000 February March 400,000 550,000 June July 475,000 300,000 000ar bloe aboos Collection estimates obtained from the credit and collection departments aré as follows 20% of peso sales will be collected in the month of sale; 60% will be collected the mon following the sale; and 20% will be collected two months following the sale. Wages and materials costs related to production, and hence to sales. The production department has estimated theses costs as follows: ni December January February March P175,000 175,000 250,000 275,000 aApril lMay June on re st snim P425,000 175,000 75,000 slai l Note, however, that payments for wages and materials are typically paid during the month following the one in which the costs are incurred. Administrative salaries are projected at P25,000 a month; lease payments amount P20,000 a month; depreciation expenses are P30,000 per month; and miscellaneous overhead expenses total P10,000 a month. Quarterly tax payments of P125,000 must be made in Mardh and June; and P250,000 will be needed in April to purchase a new fabric cutting machine. The company expects the firm to have P50,000 on hand at the beginning of January, and she wants to start each month with that amount on hand. As Jill's assistant, you have bee asked to assist her by completing the following tasks. Instruction 1. 2. Construct the remainder of the cash budget for the months of January through June. 3. What is Swimwear's maximum loan requirement? 4. What is the firm's maximum surplus balance?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 34E: A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and...

Related questions

Question

Transcribed Image Text:75,000

300,000

400,000

550,000

Мay

June

July

December

January

February

March

725,000

475,000

300,000

000,ar

bloe aboog lo teo

Collection estimates obtained from the credit and collection departments are as follows

20% of peso sales will be collected in the month of sale; 60% will be collected the mon

following the sale; and 20% will be collected two months following the sale.

Wages and materials costs related to production, and hence to sales. The production

department has estimated theses costs as follows:ni anj

P175,000 ni d April de

e ylu May

December

P425,000

175,000

75,000

January

175,000

250,000

February

March

June

275,000 iwoliol odi ni

ri ni l

Note, however, that payments for wages and materials are typically paid during the

month following the one in which the costs are incurred.

Administrative salaries are projected at P25,000 a month; lease payments amoun

P20,000 a month; depreciation expenses are P30,000 per month; and miscellaneous overhead

expenses total P10,000 a month. Quarterly tax payments of P125,000 must be made in Mard

and June; and P250,000 will be needed in April to purchase a new fabric cutting machine.

The company expects the firm to have P50,000 on hand at the beginning of January, and

she wants to start each month with that amount on hand. As Jill's assistant, you have been

asked to assist her by completing the following tasks.

eemite

Instruction

1.

2. Construct the remainder of the cash budget for the months of January through June.

3. What is Swimwear's maximum loan requirement?

4. What is the firm's maximum surplus balance?

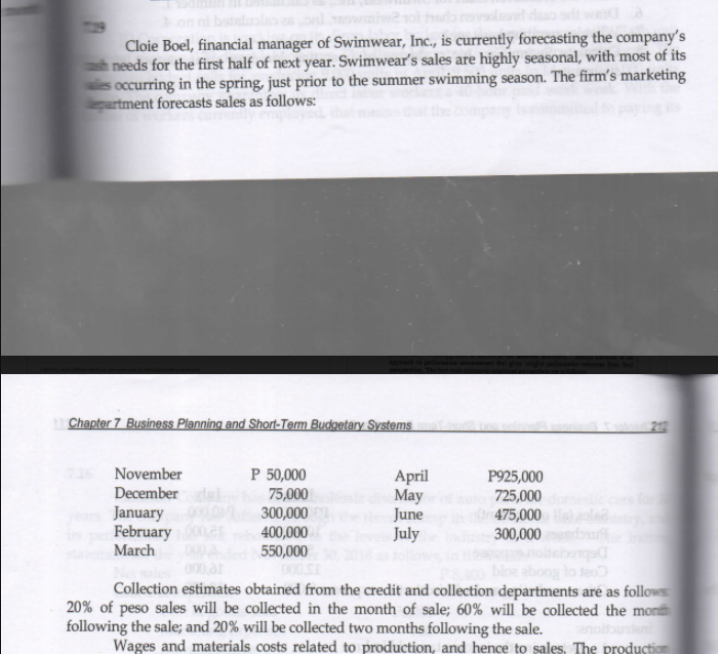

Transcribed Image Text:Cloie Boel, financial manager of Swimwear, Inc., is currently forecasting the company's

a needs for the first half of next year. Swimwear's sales are highly seasonal, with most of its

s occurring in the spring, just prior to the summer swimming season. The firm's marketing

purtment forecasts sales as follows:

Chapter 7 Business Planning and Short-Term Budgetary Systems

November

P 50,000

April

May

June

July

P925,000

725,000

475,000

300,000

December

75,000

300,000

la

January

February

March

400,000

550,000

000 S

000 a

Collection estimates obtained from the credit and collection departments aré as follows

20% of peso sales will be collected in the month of sale; 60% will be collected the mon

following the sale; and 20% will be collected two months following the sale.

Wages and materials costs related to production, and hence to sales. The production

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT