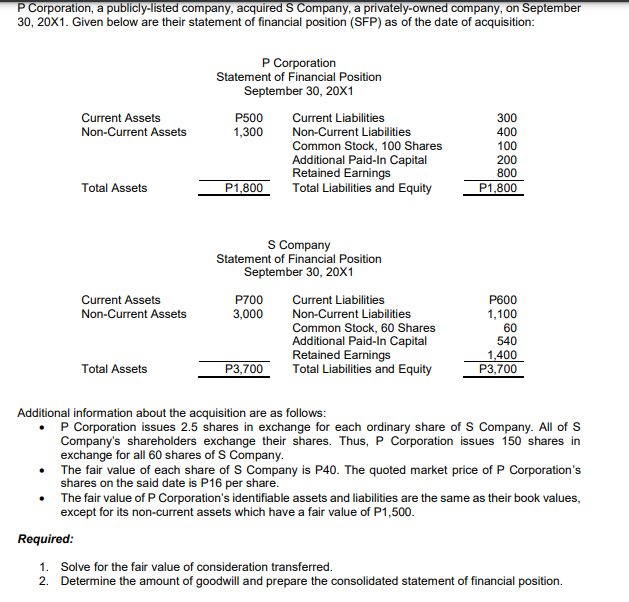

P Corporation, a publicly-listed company, acquired S Company, a privately-owned company, on September 30, 20X1. Given below are their statement of financial position (SFP) as of the date of acquisition: P Corporation Statement of Financial Position September 30, 20X1 Current Assets Non-Current Assets P500 1,300 Current Liabilities Non-Current Liabilities Common Stock, 100 Shares Additional Paid-In Capital Retained Earnings Total Liabilities and Equity 300 400 100 200 800 P1,800 Total Assets P1,800 S Company Statement of Financial Position September 30, 20x1 Current Assets Non-Current Assets P700 3,000 Current Liabilities Non-Current Liabilities Common Stock, 60 Shares Additional Paid-In Capital Retained Earnings Total Liabilities and Equity P600 1,100 60 540 1,400 P3.700 Total Assets P3,700 Additional information about the acquisition are as follows: P Corporation issues 2.5 shares in exchange for each ordinary share of S Company. All of S Company's shareholders exchange their shares. Thus, P Corporation issues 150 shares in exchange for all 60 shares of S Company. • The fair value of each share of S Company is P40. The quoted market price of P Corporation's shares on the said date is P16 per share. • The fair value of P Corporation's identifiable assets and liabilities are the same as their book values, except for its non-current assets which have a fair value of P1,500. Required: 1. Solve for the fair value of consideration transferred. 2. Determine the amount of goodwill and prepare the consolidated statement of financial position.

P Corporation, a publicly-listed company, acquired S Company, a privately-owned company, on September 30, 20X1. Given below are their statement of financial position (SFP) as of the date of acquisition: P Corporation Statement of Financial Position September 30, 20X1 Current Assets Non-Current Assets P500 1,300 Current Liabilities Non-Current Liabilities Common Stock, 100 Shares Additional Paid-In Capital Retained Earnings Total Liabilities and Equity 300 400 100 200 800 P1,800 Total Assets P1,800 S Company Statement of Financial Position September 30, 20x1 Current Assets Non-Current Assets P700 3,000 Current Liabilities Non-Current Liabilities Common Stock, 60 Shares Additional Paid-In Capital Retained Earnings Total Liabilities and Equity P600 1,100 60 540 1,400 P3.700 Total Assets P3,700 Additional information about the acquisition are as follows: P Corporation issues 2.5 shares in exchange for each ordinary share of S Company. All of S Company's shareholders exchange their shares. Thus, P Corporation issues 150 shares in exchange for all 60 shares of S Company. • The fair value of each share of S Company is P40. The quoted market price of P Corporation's shares on the said date is P16 per share. • The fair value of P Corporation's identifiable assets and liabilities are the same as their book values, except for its non-current assets which have a fair value of P1,500. Required: 1. Solve for the fair value of consideration transferred. 2. Determine the amount of goodwill and prepare the consolidated statement of financial position.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

explain the answer

Transcribed Image Text:P Corporation, a publicly-listed company, acquired S Company, a privately-owned company, on September

30, 20X1. Given below are their statement of financial position (SFP) as of the date of acquisition:

P Corporation

Statement of Financial Position

September 30, 20X1

Current Assets

P500

Current Liabilities

300

Non-Current Liabilities

Common Stock, 100 Shares

Additional Paid-In Capital

Retained Earnings

Total Liabilities and Equity

Non-Current Assets

1,300

400

100

200

800

Total Assets

P1,800

P1,800

S Company

Statement of Financial Position

September 30, 20X1

Current Assets

Non-Current Assets

P700

Current Liabilities

P600

3,000

Non-Current Liabilities

1,100

60

540

Common Stock, 60 Shares

Additional Paid-In Capital

Retained Earnings

Total Liabilities and Equity

1,400

Total Assets

P3,700

P3,700

Additional information about the acquisition are as follows:

P Corporation issues 2.5 shares in exchange for each ordinary share of S Company. All of S

Company's shareholders exchange their shares. Thus, P Corporation issues 150 shares in

exchange for all 60 shares of S Company.

The fair value of each share of S Company is P40. The quoted market price of P Corporation's

shares on the said date is P16 per share.

The fair value of P Corporation's identifiable assets and liabilities are the same as their book values,

except for its non-current assets which have a fair value of P1,500.

Required:

1. Solve for the fair value of consideration transferred.

2. Determine the amount of goodwill and prepare the consolidated statement of financial position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning