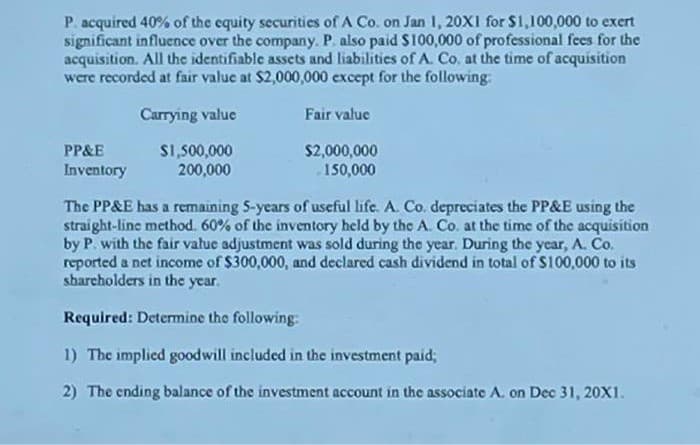

P. acquired 40% of the equity securities of A Co. on Jan 1, 20X1 for $1,100,000 to exert significant influence over the company. P. also paid $100,000 of professional fees for the acquisition. All the identifiable assets and liabilities of A. Co. at the time of acquisition were recorded at fair value at $2,000,000 except for the following: Carrying value Fair value PP&E Inventory $1,500,000 200,000 $2,000,000 150,000 The PP&E has a remaining 5-years of useful life. A. Co. depreciates the PP&E using the straight-line method. 60% of the inventory held by the A. Co. at the time of the acquisition by P. with the fair value adjustment was sold during the year. During the year, A. Co. reported a net income of $300,000, and declared cash dividend in total of $100,000 to its shareholders in the year. Required: Determine the following: 1) The implied goodwill included in the investment paid; 2) The ending balance of the investment account in the associate A. on Dec 31, 20X1.

P. acquired 40% of the equity securities of A Co. on Jan 1, 20X1 for $1,100,000 to exert significant influence over the company. P. also paid $100,000 of professional fees for the acquisition. All the identifiable assets and liabilities of A. Co. at the time of acquisition were recorded at fair value at $2,000,000 except for the following: Carrying value Fair value PP&E Inventory $1,500,000 200,000 $2,000,000 150,000 The PP&E has a remaining 5-years of useful life. A. Co. depreciates the PP&E using the straight-line method. 60% of the inventory held by the A. Co. at the time of the acquisition by P. with the fair value adjustment was sold during the year. During the year, A. Co. reported a net income of $300,000, and declared cash dividend in total of $100,000 to its shareholders in the year. Required: Determine the following: 1) The implied goodwill included in the investment paid; 2) The ending balance of the investment account in the associate A. on Dec 31, 20X1.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Do not give solution in image

Transcribed Image Text:P. acquired 40% of the equity securities of A Co. on Jan 1, 20X1 for $1,100,000 to exert

significant influence over the company. P. also paid $100,000 of professional fees for the

acquisition. All the identifiable assets and liabilities of A. Co. at the time of acquisition

were recorded at fair value at $2,000,000 except for the following:

Carrying value

Fair value

PP&E

Inventory

$1,500,000

200,000

$2,000,000

150,000

The PP&E has a remaining 5-years of useful life. A. Co. depreciates the PP&E using the

straight-line method. 60% of the inventory held by the A. Co. at the time of the acquisition

by P. with the fair value adjustment was sold during the year. During the year, A. Co.

reported a net income of $300,000, and declared cash dividend in total of $100,000 to its

shareholders in the year.

Required: Determine the following:

1) The implied goodwill included in the investment paid;

2) The ending balance of the investment account in the associate A. on Dec 31, 20X1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT