P1-5 Using Financial Reports: Applying the Accounting Equation to Liquidate a Company LO1-1 On June 1, 2021, Bland Corporation prepared a statement of financial position just prior to going out of business. The totals for the three main components showed the following: Assets (no cash) Liabilities Shareholders' equity Shortly thereafter, all of the assets were sold for cash. Required: 1. How would the statement of financial position appear immediately after the sale of the assets for cash for each of the following cases? (Enter any decreases to account balances with a minus sign.) Case A Case B Case C Case D Cash Received for the Assets $ $136,000 73,000 63,000 136,000 123,000 149,000 55,000 Balances Immediately after Sale Liabilities Assets Shareholders Equity

P1-5 Using Financial Reports: Applying the Accounting Equation to Liquidate a Company LO1-1 On June 1, 2021, Bland Corporation prepared a statement of financial position just prior to going out of business. The totals for the three main components showed the following: Assets (no cash) Liabilities Shareholders' equity Shortly thereafter, all of the assets were sold for cash. Required: 1. How would the statement of financial position appear immediately after the sale of the assets for cash for each of the following cases? (Enter any decreases to account balances with a minus sign.) Case A Case B Case C Case D Cash Received for the Assets $ $136,000 73,000 63,000 136,000 123,000 149,000 55,000 Balances Immediately after Sale Liabilities Assets Shareholders Equity

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.14E

Related questions

Question

accounting

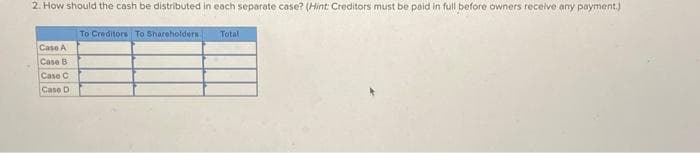

Transcribed Image Text:2. How should the cash be distributed in each separate case? (Hint: Creditors must be paid in full before owners receive any payment.)

Case A

Case B

Case C

Case D

To Creditors To Shareholders

Total

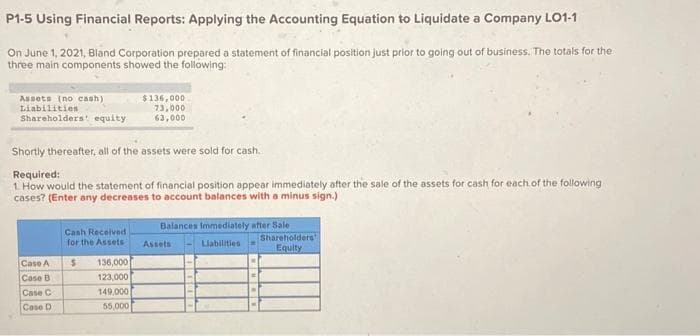

Transcribed Image Text:P1-5 Using Financial Reports: Applying the Accounting Equation to Liquidate a Company LO1-1

On June 1, 2021, Bland Corporation prepared a statement of financial position just prior to going out of business. The totals for the

three main components showed the following:

Assets (no cash)

Liabilities

Shareholders' equity

Shortly thereafter, all of the assets were sold for cash.

Required:

1. How would the statement of financial position appear immediately after the sale of the assets for cash for each of the following

cases? (Enter any decreases to account balances with a minus sign.)

Case A

Case B

Case C

Case D

Cash Received

for the Assets

$

$136,000

73,000

63,000

136,000

123,000

149,000

55,000

Balances Immediately after Sale

Liabilities

Assets

Shareholders

Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning