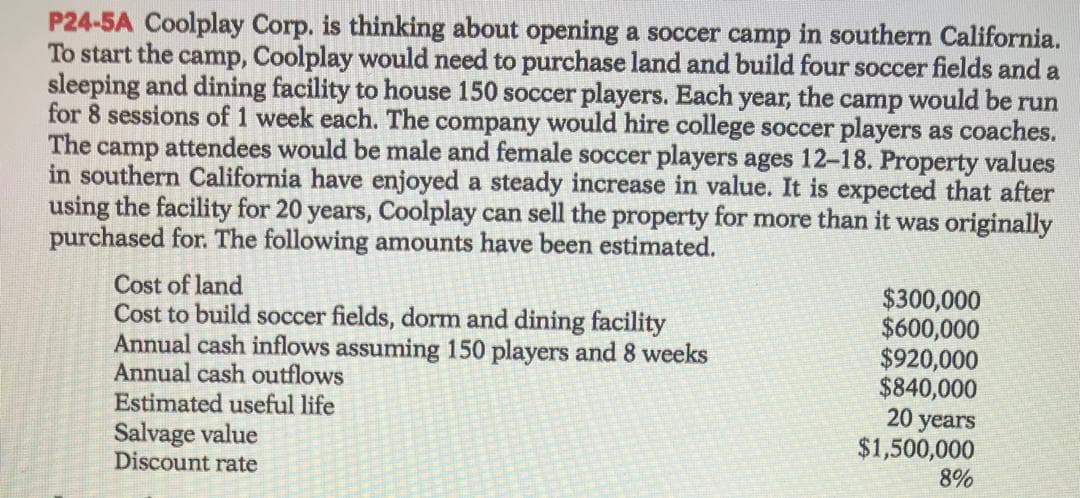

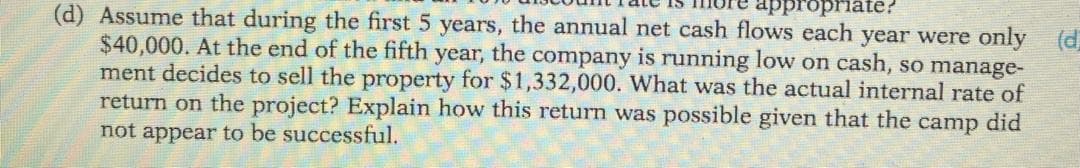

P24-5A Coolplay Corp. is thinking about opening a soccer camp in southern California. To start the camp, Coolplay would need to purchase land and build four soccer fields and a sleeping and dining facility to house 150 soccer players. Each year, the camp would be run for 8 sessions of 1 week each. The company would hire college soccer players as coaches. The camp attendees would be male and female soccer players ages 12-18. Property values in southern California have enjoyed a steady increase in value. It is expected that after using the facility for 20 years, Coolplay can sell the property for more than it was originally purchased for. The following amounts have been estimated. Cost of land Cost to build soccer fields, dorm and dining facility Annual cash inflows assuming 150 players and 8 weeks Annual cash outflows Estimated useful life Salvage value Discount rate $300,000 $600,000 $920,000 $840,000 20 years $1,500,000

Cost of Debt, Cost of Preferred Stock

This article deals with the estimation of the value of capital and its components. we'll find out how to estimate the value of debt, the value of preferred shares , and therefore the cost of common shares . we will also determine the way to compute the load of every cost of the capital component then they're going to estimate the general cost of capital. The cost of capital refers to the return rate that an organization gives to its investors. If an organization doesn’t provide enough return, economic process will decrease the costs of their stock and bonds to revive the balance. A firm’s long-run and short-run financial decisions are linked to every other by the assistance of the firm’s cost of capital.

Cost of Common Stock

Common stock is a type of security/instrument issued to Equity shareholders of the Company. These are commonly known as equity shares in India. It is also called ‘Common equity

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images