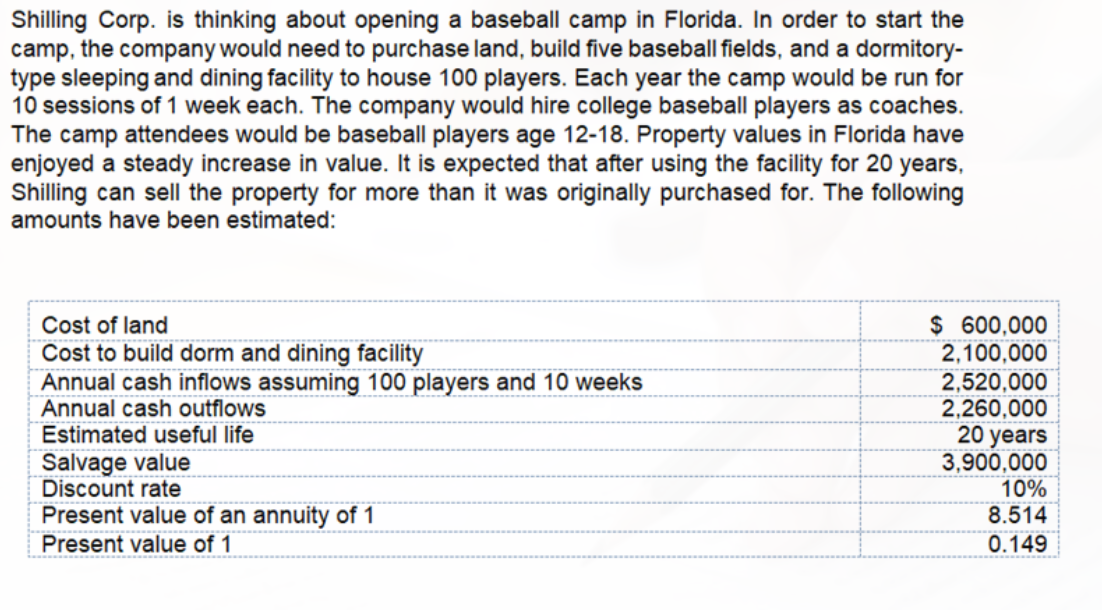

Shilling Corp. is thinking about opening a baseball camp in Florida. In order to start the camp, the company would need to purchase land, build five baseball fields, and a dormitory- type sleeping and dining facility to house 100 players. Each year the camp would be run for 10 sessions of 1 week each. The company would hire college baseball players as coaches. The camp attendees would be baseball players age 12-18. Property values in Florida have enjoyed a steady increase in value. It is expected that after using the facility for 20 years, Shilling can sell the property for more than it was originally purchased for. The following amounts have been estimated: $ 600,000 2,100,000 Cost of land Cost to build dorm and dining facility Annual cash inflows assuming 100 players and 10 weeks Annual cash outflows Estimated useful life Salvage value Discount rate Present value of an annuity of 1 2,520,000 2,260,000 20 years 3,900,000 10% 8.514 Present value of 1 0.149

Shilling Corp. is thinking about opening a baseball camp in Florida. In order to start the camp, the company would need to purchase land, build five baseball fields, and a dormitory- type sleeping and dining facility to house 100 players. Each year the camp would be run for 10 sessions of 1 week each. The company would hire college baseball players as coaches. The camp attendees would be baseball players age 12-18. Property values in Florida have enjoyed a steady increase in value. It is expected that after using the facility for 20 years, Shilling can sell the property for more than it was originally purchased for. The following amounts have been estimated: $ 600,000 2,100,000 Cost of land Cost to build dorm and dining facility Annual cash inflows assuming 100 players and 10 weeks Annual cash outflows Estimated useful life Salvage value Discount rate Present value of an annuity of 1 2,520,000 2,260,000 20 years 3,900,000 10% 8.514 Present value of 1 0.149

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1dM

Related questions

Question

1. Calculate the

2. To gauge the sensitivity of the project to these estimates, assume that if only 80 campers attend each week, revenues will be $2,085,000 and expenses will be $1,865,000. What is the net present value using these alternative estimates? (use 3 decimal places for the PV factor)

3. Assuming the original facts, what is the net present value if the project is actually riskier than first assumed, and a 12% discount rate is more appropriate? The present value of 1 at 12% is .104 and the present value of an annuity of 1 is 7.469.

Transcribed Image Text:Shilling Corp. is thinking about opening a baseball camp in Florida. In order to start the

camp, the company would need to purchase land, build five baseball fields, and a dormitory-

type sleeping and dining facility to house 100 players. Each year the camp would be run for

10 sessions of 1 week each. The company would hire college baseball players as coaches.

The camp attendees would be baseball players age 12-18. Property values in Florida have

enjoyed a steady increase in value. It is expected that after using the facility for 20 years,

Shilling can sell the property for more than it was originally purchased for. The following

amounts have been estimated:

Cost of land

Cost to build dorm and dining facility

Annual cash inflows assuming 100 players and 10 weeks

Annual cash outflows

Estimated useful life

$ 600,000

2,100,000

2,520,000

2,260,000

20 years

0,000

10%

Salvage value

Discount rate

Present value of an annuity of 1

Present value of 1

8.514

0.149

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College