P3-1A On April 1, DeDonder Travel Agency Inc. was established. These transactions were completed during the month. 1. Stockholders invested $30,000 cash in the company in exchange for common stock. 2. Paid $900 cash for April office rent. 3. Purchased office equipment for $3,400 cash. 4. Purchased $200 of advertising in the Chicago Tribune, on account. 5. Paid $500 cash for office supplies. 6. Performed services worth $12,000. Cash of $3,000 is received from customers, and the balance of $9,000 is billed to customers on account. 7. Paid $400 cash dividends. 8. Paid Chicago Tribune amount due in transaction (4). 9. Paid employees' salaries $1,800. 10. Received $9,000 in cash from customers billed previously in transaction (6). Instructions (a) Prepare a tabular analysis of the transactions using these column headings: Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Common Stock, and Retained Earnings (with separate columns for Revenues, Expenses, and Dividends). Include margin explanations for any changes in Retained Earnings. (b) From an analysis of the Retained Earnings columns, compute the net income or net loss for April.

P3-1A On April 1, DeDonder Travel Agency Inc. was established. These transactions were completed during the month. 1. Stockholders invested $30,000 cash in the company in exchange for common stock. 2. Paid $900 cash for April office rent. 3. Purchased office equipment for $3,400 cash. 4. Purchased $200 of advertising in the Chicago Tribune, on account. 5. Paid $500 cash for office supplies. 6. Performed services worth $12,000. Cash of $3,000 is received from customers, and the balance of $9,000 is billed to customers on account. 7. Paid $400 cash dividends. 8. Paid Chicago Tribune amount due in transaction (4). 9. Paid employees' salaries $1,800. 10. Received $9,000 in cash from customers billed previously in transaction (6). Instructions (a) Prepare a tabular analysis of the transactions using these column headings: Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Common Stock, and Retained Earnings (with separate columns for Revenues, Expenses, and Dividends). Include margin explanations for any changes in Retained Earnings. (b) From an analysis of the Retained Earnings columns, compute the net income or net loss for April.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.21MCE

Related questions

Topic Video

Question

I need to resolve both P exercises as practice but I don't understand it.

Transcribed Image Text:Classify transactions as

E3-18 Review the transactions listed in E3-1 for Warner Advertising Company and clas-

or if no cash is exchanged, as a noncash event.

sify each transaction as either an operating activity, investing activity, or financing activity, cash-flow activities.

(LO 9), AP

E3-19 Review the transactions listed in E3-3 for Persinger Corp. and classify each trans-

action as either an operating activity, investing activity, or financing activity, or if no cash

is exchanged, as a noncash event.

Exercises: Set B and

Challenge Exercises

Visit the book's companion website, at www.wiley.com/college/kimmel, and choose the

Student Companion site to access Exercise Set B and Challenge Exercises.

Problems: Set A

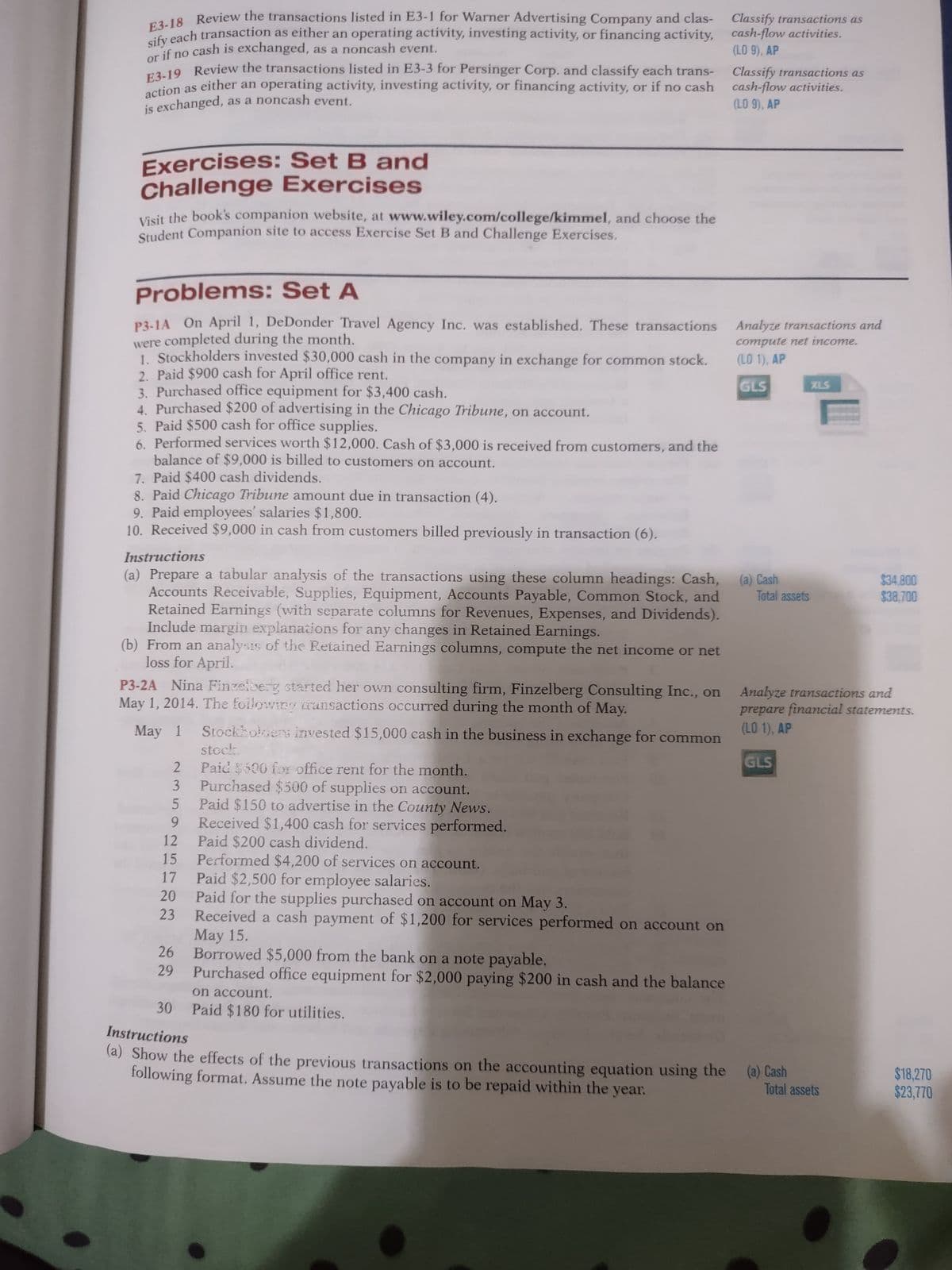

P3-1A On April 1, DeDonder Travel Agency Inc. was established. These transactions

were completed during the month.

1. Stockholders invested $30,000 cash in the company in exchange for common stock.

2. Paid $900 cash for April office rent.

3. Purchased office equipment for $3,400 cash.

4. Purchased $200 of advertising in the Chicago Tribune, on account.

5. Paid $500 cash for office supplies.

6. Performed services worth $12,000. Cash of $3,000 is received from customers, and the

balance of $9,000 is billed to customers on account.

7. Paid $400 cash dividends.

8. Paid Chicago Tribune amount due in transaction (4).

9. Paid employees' salaries $1,800.

10. Received $9,000 in cash from customers billed previously in transaction (6).

P3-2A Nina Finzelberg started her own consulting firm, Finzelberg Consulting Inc., on

May 1, 2014. The following transactions occurred during the month of May.

May 1

Stockholders invested $15,000 cash in the business in exchange for common

stock.

Paid $500 for office rent for the month.

Purchased $500 of supplies on account.

Paid $150 to advertise in the County News.

Received $1,400 cash for services performed.

Paid $200 cash dividend.

Instructions

Total assets

(a) Prepare a tabular analysis of the transactions using these column headings: Cash, (a) Cash

Accounts Receivable, Supplies, Equipment, Accounts Payable, Common Stock, and

Retained Earnings (with separate columns for Revenues, Expenses, and Dividends).

Include margin explanations for any changes in Retained Earnings.

(b) From an analysis of the Retained Earnings columns, compute the net income or net

loss for April.

2

3

5

9

12

15

17

20

23

26

29

Performed $4,200 of services on account.

Paid $2,500 for employee salaries.

Paid for the supplies purchased on account on May 3.

Received a cash payment of $1,200 for services performed on account on

May 15.

Borrowed $5,000 from the bank on a note payable.

Purchased office equipment for $2,000 paying $200 in cash and the balance

Classify transactions as

cash-flow activities.

(LO 9), AP

on account.

Paid $180 for utilities.

Analyze transactions and

compute net income.

(LO 1), AP

GLS

XLS

GLS

Analyze transactions and

prepare financial statements.

(LO 1), AP

$34,800

$38,700

30

Instructions

(a) Show the effects of the previous transactions on the accounting equation using the (a) Cash

following format. Assume the note payable is to be repaid within the year.

Total assets

$18,270

$23,770

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning