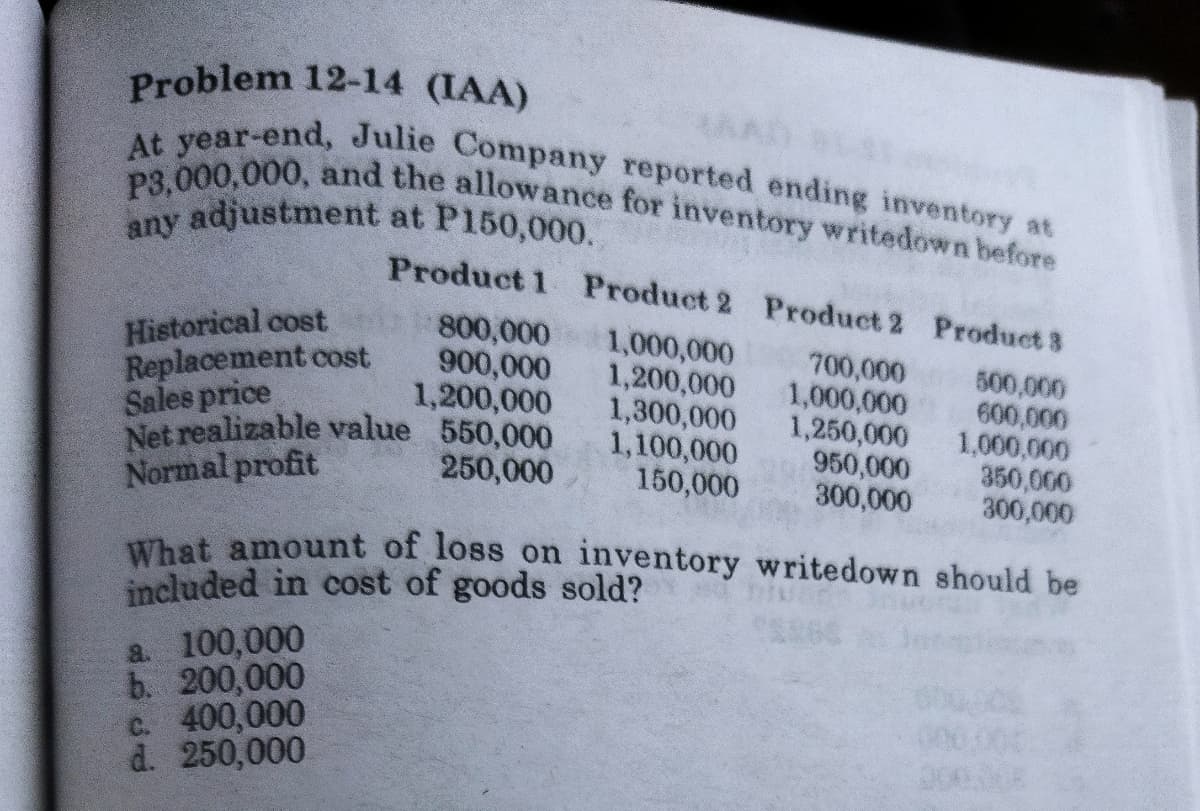

P3,000,000, and the allowance for inventory writedown before At year-end, Julie Company reported ending inventory at any adjustment at P150,000. Product 1 Product 2 Product 2 Product 3 Historical cost Replacement cost Sales price Net realizable value 550,000 Normal profit 800,000 900,000 1,200,000 1,000,000 1,200,000 1,300,000 1,100,000 150,000 700,000 1,000,000 1,250,000 950,000 300,000 500,000 600,000 1,000,000 350,000 300,000 250,000 What amount of loss on inventory writedown should be included in cost of goods sold? a. 100,000 b. 200,000

P3,000,000, and the allowance for inventory writedown before At year-end, Julie Company reported ending inventory at any adjustment at P150,000. Product 1 Product 2 Product 2 Product 3 Historical cost Replacement cost Sales price Net realizable value 550,000 Normal profit 800,000 900,000 1,200,000 1,000,000 1,200,000 1,300,000 1,100,000 150,000 700,000 1,000,000 1,250,000 950,000 300,000 500,000 600,000 1,000,000 350,000 300,000 250,000 What amount of loss on inventory writedown should be included in cost of goods sold? a. 100,000 b. 200,000

Chapter10: Inventory

Section: Chapter Questions

Problem 2TP: Assume your company uses the periodic inventory costing method, and the inventory count left out an...

Related questions

Topic Video

Question

Transcribed Image Text:any adjustment at P150,000.

At year-end, Julie Company reported ending inventory at

P3,000,000, and the allowance for inventory writedown before

Problem 12-14 (IAA)

Product 1 Product 2 Product 2 Product 3

Historical cost

Replacement cost

Sales price

Net realizable value 550,000

Normal profit

800,000

900,000

1,200,000

1,000,000

1,200,000

1,300,000

1,100,000

150,000

700,000

1,000,000

1,250,000

950,000

300,000

500,000

600,000

1,000,000

350,000

300,000

250,000

What amount of loss on inventory writedown should be

included in cost of goods sold?

a. 100,000

b. 200,000

c. 400,000

d. 250,000

00000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning