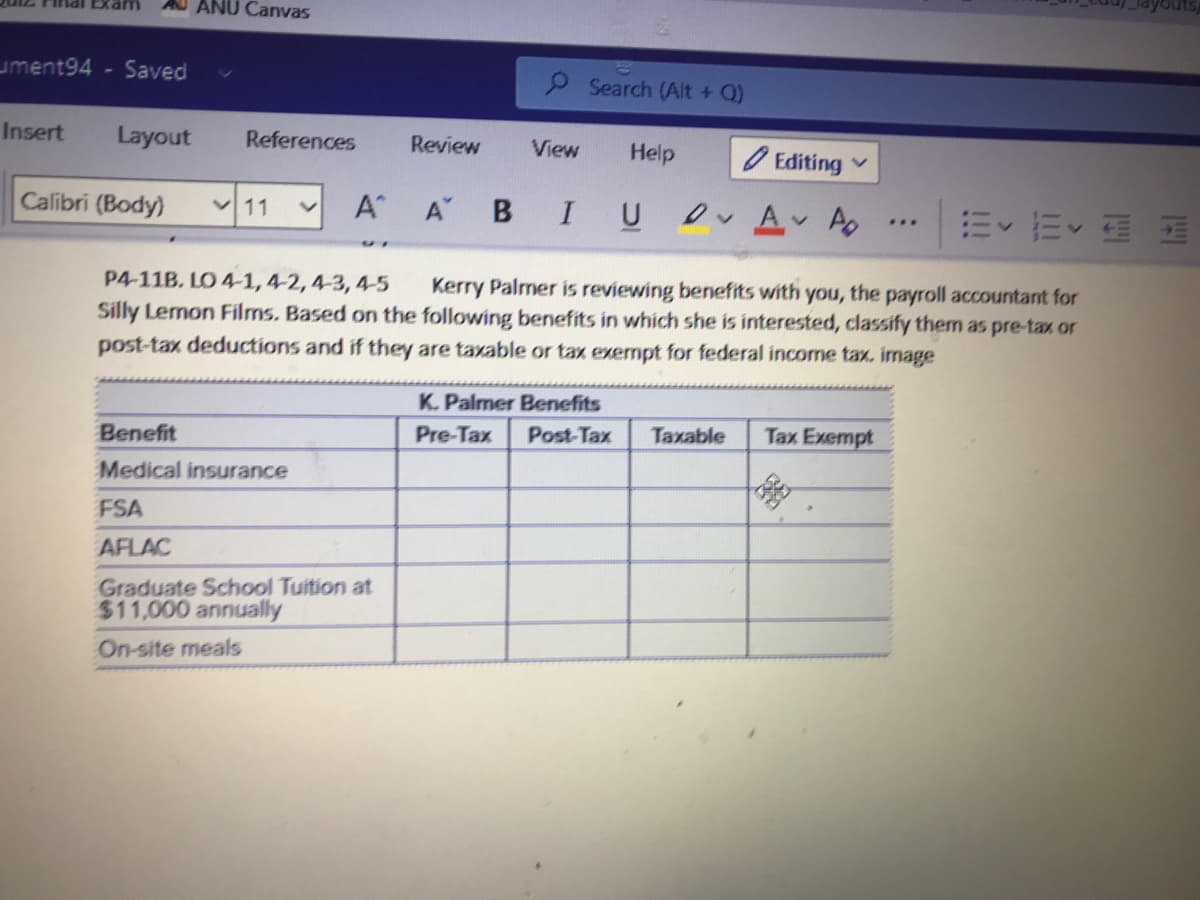

P4-11B. LO 4-1,4-2, 4-3, 4-5 Kerry Palmer is reviewing benefits with you, the payroll accountant fom Silly Lemon Films. Based on the following benefits in which she is interested, classify them as pre-tax on post-tax deductions and if they are taxable or tax exempt for federal income tax. image K. Palmer Benefits Benefit Pre-Tax Post-Tax Taxable Tax Exempt Medical insurance FSA AFLAC Graduate School Tuition at $11,000 annually On-site meals

P4-11B. LO 4-1,4-2, 4-3, 4-5 Kerry Palmer is reviewing benefits with you, the payroll accountant fom Silly Lemon Films. Based on the following benefits in which she is interested, classify them as pre-tax on post-tax deductions and if they are taxable or tax exempt for federal income tax. image K. Palmer Benefits Benefit Pre-Tax Post-Tax Taxable Tax Exempt Medical insurance FSA AFLAC Graduate School Tuition at $11,000 annually On-site meals

Chapter21: Partnerships

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:ANU Canvas

ument94 Saved

2 Search (Alt + Q)

Insert

Layout

References

Review

View

Help

O Editing

Calibri (Body)

A

A B

I U

m<市< 向品

V11

P4-11B. LO 4-1,4-2, 4-3, 4-5

Silly Lemon Films. Based on the following benefits in which she is interested, classify them as pre-tax or

post-tax deductions and if they are taxable or tax exempt for federal income tax. image

Kerry Palmer is reviewing benefits with you, the payroll accountant for

K. Palmer Benefits

Benefit

Pre-Tax

Post-Tax

Taxable

Tax Exempt

Medical insurance

FSA

AFLAC

Graduate School Tuition at

$11,000 annually

On-site meals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you