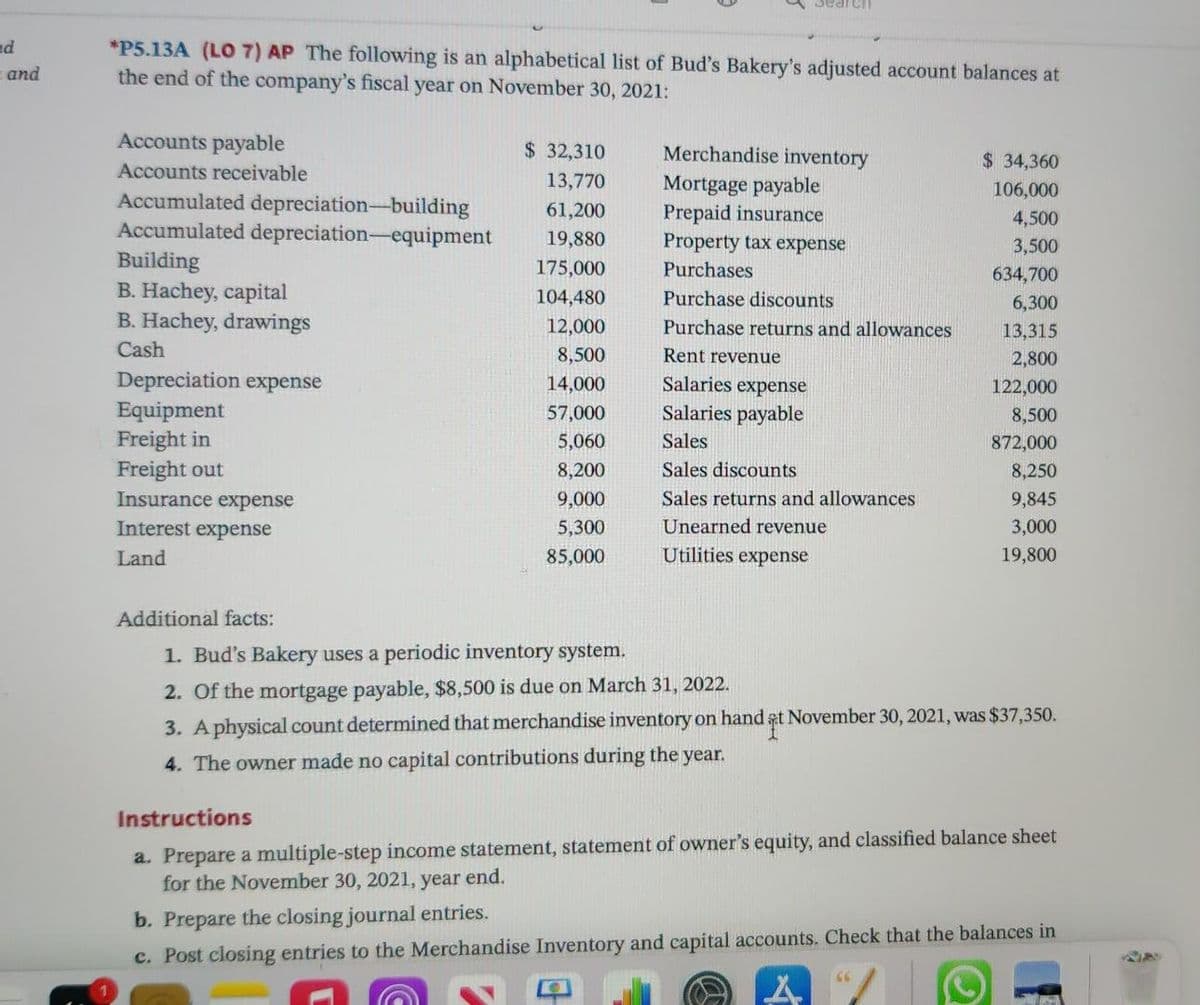

*P5.13A (LO 7) AP The following is an alphabetical list of Bud's Bakery's adjusted account balances at the end of the company's fiscal year on November 30, 2021: Accounts payable $ 32,310 Merchandise inventory $ 34,360 Accounts receivable 13,770 Mortgage payable Prepaid insurance Property tax expense Purchases 106,000 Accumulated depreciation-building Accumulated depreciation-equipment 61,200 4,500 19,880 3,500 Building B. Hachey, capital B. Hachey, drawings 175,000 634,700 104,480 Purchase discounts 6,300 12,000 Purchase returns and allowances 13,315 Cash 8,500 Rent revenue 2,800 Depreciation expense Equipment Freight in Freight out Insurance expense 14,000 Salaries expense 122,000 57,000 Salaries payable 8,500 5,060 Sales 872,000 8,200 Sales discounts 8,250 9,000 Sales returns and allowances 9,845 Interest expense 5,300 Unearned revenue 3,000 Land 85,000 Utilities expense 19,800 Additional facts: 1. Bud's Bakery uses a periodic inventory system. 2. Of the mortgage payable, $8,500 is due on March 31, 2022. 3. A physical count determined that merchandise inventory on hand st November 30, 2021, was $37,350. 4. The owner made no capital contributions during the year. Instructions a. Prepare a multiple-step income statement, statement of owner's equity, and classified balance sheet for the November 30, 2021, year end. b. Prepare the closing journal entries. c. Post closing entries to the Merchandise Inventory and capital accounts. Check that the balances in

*P5.13A (LO 7) AP The following is an alphabetical list of Bud's Bakery's adjusted account balances at the end of the company's fiscal year on November 30, 2021: Accounts payable $ 32,310 Merchandise inventory $ 34,360 Accounts receivable 13,770 Mortgage payable Prepaid insurance Property tax expense Purchases 106,000 Accumulated depreciation-building Accumulated depreciation-equipment 61,200 4,500 19,880 3,500 Building B. Hachey, capital B. Hachey, drawings 175,000 634,700 104,480 Purchase discounts 6,300 12,000 Purchase returns and allowances 13,315 Cash 8,500 Rent revenue 2,800 Depreciation expense Equipment Freight in Freight out Insurance expense 14,000 Salaries expense 122,000 57,000 Salaries payable 8,500 5,060 Sales 872,000 8,200 Sales discounts 8,250 9,000 Sales returns and allowances 9,845 Interest expense 5,300 Unearned revenue 3,000 Land 85,000 Utilities expense 19,800 Additional facts: 1. Bud's Bakery uses a periodic inventory system. 2. Of the mortgage payable, $8,500 is due on March 31, 2022. 3. A physical count determined that merchandise inventory on hand st November 30, 2021, was $37,350. 4. The owner made no capital contributions during the year. Instructions a. Prepare a multiple-step income statement, statement of owner's equity, and classified balance sheet for the November 30, 2021, year end. b. Prepare the closing journal entries. c. Post closing entries to the Merchandise Inventory and capital accounts. Check that the balances in

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 9RE: Refer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for...

Related questions

Question

prepare the multi step income statement

Transcribed Image Text:Search

nd

*P5.13A (LO 7) AP The following is an alphabetical list of Bud's Bakery's adjusted account balances at

the end of the company's fiscal year on November 30, 2021:

and

Accounts payable

$ 32,310

Merchandise inventory

$ 34,360

Accounts receivable

13,770

Mortgage payable

Prepaid insurance

Property tax expense

106,000

Accumulated depreciation-building

Accumulated depreciation-equipment

Building

B. Hachey, capital

B. Hachey, drawings

61,200

4,500

19,880

3,500

175,000

Purchases

634,700

104,480

Purchase discounts

6,300

12,000

Purchase returns and allowances

13,315

Cash

8,500

Rent revenue

2,800

Depreciation expense

Equipment

Freight in

Freight out

Insurance expense

14,000

Salaries expense

122,000

57,000

Salaries payable

8,500

5,060

Sales

872,000

8,200

Sales discounts

8,250

9,000

Sales returns and allowances

9,845

Interest expense

5,300

Unearned revenue

3,000

Land

85,000

Utilities expense

19,800

Additional facts:

1. Bud's Bakery uses a periodic inventory system.

2. Of the mortgage payable, $8,500 is due on March 31, 2022.

3. A physical count determined that merchandise inventory on hand at November 30, 2021, was $37,350.

4. The owner made no capital contributions during the year.

Instructions

a. Prepare a multiple-step income statement, statement of owner's equity, and classified balance sheet

for the November 30, 2021, year end.

b. Prepare the closing journal entries.

c. Post closing entries to the Merchandise Inventory and capital accounts. Check that the balances in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning