The following information was extracted from the records of Rampage Company as of December 31, 2021: Carrying amount Other receivables (NRV) 150,000 Prepaid rent 30,000 Motor vehicles 165,000 Accumulated depreciation 61,875 Provisions for warranty 12,000 Deposits received in advance 15,000 The depreciation rates for accounting and taxation are 15% and 20% respectively. Deposits are taxable when received while rentals and warranty costs are deductible when paid. An allowance for doubtful debts of P25,000 has been raised against other receivables for accounting purposes, but such debts are deductible only when written off as uncollectible. The rate applicable was 30%. Round off answers into whole number a) What is the Deferred Tax Asset of Rampage Company as of December 31, 20217 Answer: a) What is the Deferred Tax Liability of Rampage Company as of December 31, 20217 Answer:

The following information was extracted from the records of Rampage Company as of December 31, 2021: Carrying amount Other receivables (NRV) 150,000 Prepaid rent 30,000 Motor vehicles 165,000 Accumulated depreciation 61,875 Provisions for warranty 12,000 Deposits received in advance 15,000 The depreciation rates for accounting and taxation are 15% and 20% respectively. Deposits are taxable when received while rentals and warranty costs are deductible when paid. An allowance for doubtful debts of P25,000 has been raised against other receivables for accounting purposes, but such debts are deductible only when written off as uncollectible. The rate applicable was 30%. Round off answers into whole number a) What is the Deferred Tax Asset of Rampage Company as of December 31, 20217 Answer: a) What is the Deferred Tax Liability of Rampage Company as of December 31, 20217 Answer:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 23P: Notes Receivable On January 1, 2019, Lisa Company sold machinery with a book value of 118,000 to...

Related questions

Question

Transcribed Image Text:Print item

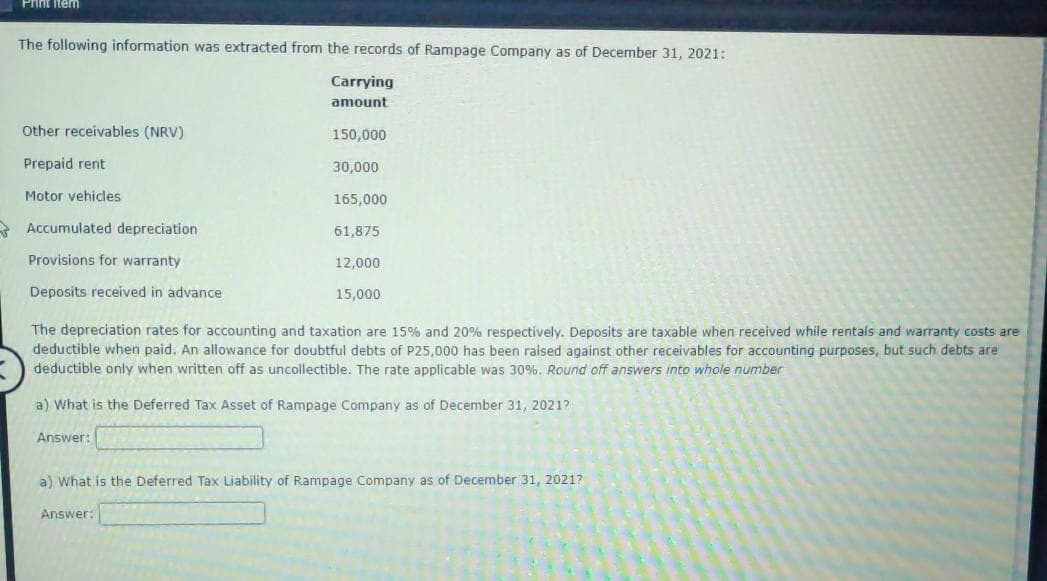

The following information was extracted from the records of Rampage Company as of December 31, 2021:

Carrying

amount

Other receivables (NRV)

150,000

Prepaid rent

30,000

Motor vehicles

165,000

* Accumulated depreciation

61,875

Provisions for warranty

12,000

Deposits received in advance

15,000

The depreciation rates for accounting and taxation are 15% and 20% respectively. Deposits are taxable when received while rentals and warranty costs are

deductible when paid. An allowance for doubtful debts of P25,000 has been raised against other receivables for accounting purposes, but such debts are

deductible only when written off as uncollectible. The rate applicable was 30%. Round off answers into whole number

a) What is the Deferred Tax Asset of Rampage Company as of December 31, 20217

Answer:

a) What is the Deferred Tax Liability of Rampage Company as of December 31, 20217

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College