PA4. 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG) Number of Units Unit Cost Beginning inventory Mar. 1 Purchased Mar. 8 110 $87 140 89 Sold Mar. 11 for $120 per unit 95

PA4. 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG) Number of Units Unit Cost Beginning inventory Mar. 1 Purchased Mar. 8 110 $87 140 89 Sold Mar. 11 for $120 per unit 95

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 17GI

Related questions

Topic Video

Question

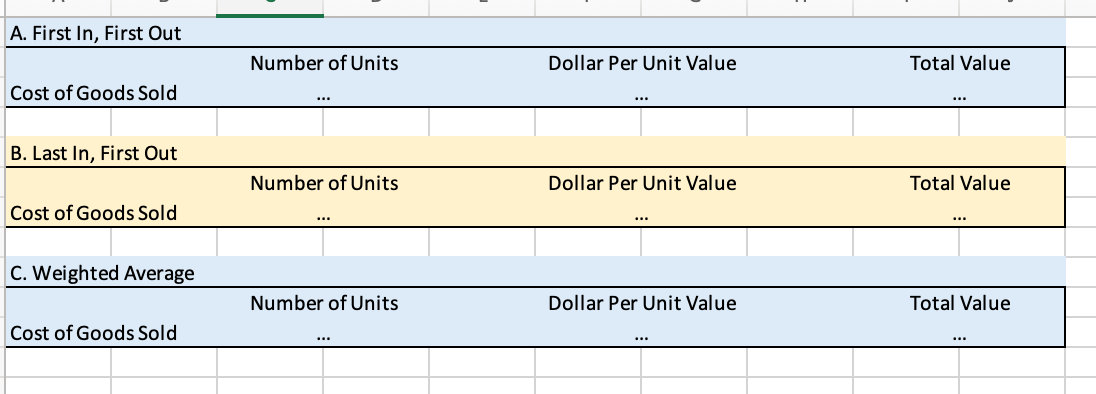

Transcribed Image Text:A. First In, First Out

Number of Units

Dollar Per Unit Value

Total Value

Cost of Goods Sold

..

...

B. Last In, First Out

Number of Units

Dollar Per Unit Value

Total Value

Cost of Goods Sold

...

...

C. Weighted Average

Number of Units

Dollar Per Unit Value

Total Value

Cost of Goods Sold

...

...

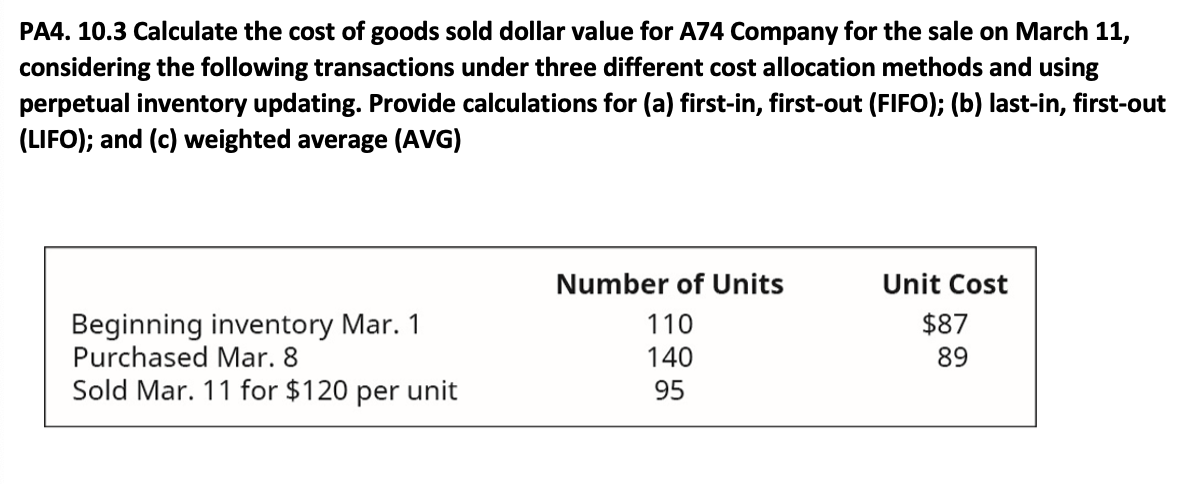

Transcribed Image Text:PA4. 10.3 Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11,

considering the following transactions under three different cost allocation methods and using

perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out

(LIFO); and (c) weighted average (AVG)

Number of Units

Unit Cost

Beginning inventory Mar. 1

Purchased Mar. 8

110

$87

140

89

Sold Mar. 11 for $120 per unit

95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning